Alternative data report for Q1 2024 - Ad Sector, Cloud, AI, Semiconductors

Welcome to UncoverAlpha newsletter. The newsletter is primarily focused on deep dives and insights into great companies/subindustries in the technology sector.

This article is sponsored by Revealera.

Revealera is a New York based company that provides data and insights on hiring trends and trending products and skills across the globe.

Analyze the hiring trends for 4,000+ companies and usage trends for 500+ SaaS products

If you are interested in sponsoring the next article, you can DM and reach me on Twitter @RihardJarc

Hi everyone,

From now on UncoverAlpha will also be posting »alternative data« monthly reports on some of the most interesting technology names and what the different data sources are saying. During my investment process, I find alternative data and a deep understanding of a company to be very helpful in forming an investment thesis.

This report is for Q1 2024, but going forward, I will publish it more regularly, monthly.

GenAI in general

Job openings looking for skills related to generative AI continue to rise with companies:

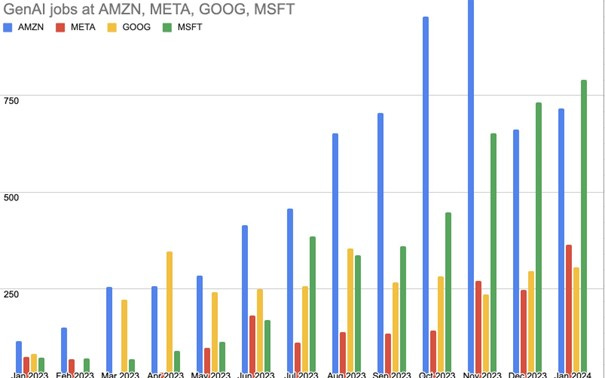

I also analyzed jobs at Big Tech companies in relation to GenAI with an interesting dynamic going on between the companies:

Surprisingly, Amazon has been leading most months with GenAI job openings, which tells you a lot about how seriously Amazon takes this. The thesis of Amazon "being behind" in GenAI might soon be false.

Meta, despite having 3x fewer total employees, now has more GenAI job openings than Google.

The data shows that Microsoft is constantly looking for more GenAI employees and currently has the most GenAI job openings of all the companies.

This data show any open job at any point in time, but they are unique.

Ad Tech

In general, I see a few prevailing themes in alt data for Q1, that I will summarize:

Meta's Advantage+ and Google's Performance Max continue to drive outstanding results for advertisers

Many experts note Meta is »back« from the setback of the iOS signal loss with the new AI target. On top of it, WhatsApp is starting to gain traction with click-to-message ads.

Social shopping could become the next big growth driver for the industry as TikTok Shops have been pushing hard.

Amazon's Prime Video ads could be very attractive for advertisers because of 1st party data on the shopping behavior of subscribers.

Even before the recent re-ignition of the TikTok ban possibility, Meta was already starting to win market share again with Reels. Already before the recent TikTok drama, TikTok had trouble getting advertisers as many did not want to focus too much resources on a platform that could potentially get banned.

Here are some of the highlighted data:

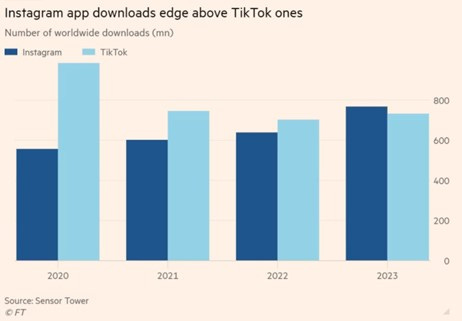

FT and SensorTower reported that for the first time since COVID-19, Instagram's number of downloads edged higher than TikTok. In my view, much of that also has to do with the fact that TikTok is banned in India, but nonetheless, the trend is clear.

A similar pattern has emerged when looking at data from advertisers.

I analyzed the number of job openings mentioning Instagram or TikTok as a needed skill, and the results are the following:

We can see that Instagram is still the dominant platform for advertisers. While that was expected, the more interesting thing is that since last year, the gap between Instagram and TikTok has stabilized. This aligns with other data showing that TikTok is no longer catching up to Instagram, but rather, the current market positions are holding steady.

AI targeting tools from Meta (Advantage+) and Google (Performance Max) are a significant driver of current growth for both companies as advertisers are still adopting them. The data shows clear benefits for advertisers adopting these new AI targeting tools:

Some recent expert interviews also highlight this:

A Former Director at Snapchat mentioned the importance of Advantage+ to Meta and the advantage of their multiple touchpoints with different apps and both desktop & mobile usage:

He also noted that he believes Meta is 100% back from the iOS setback, while smaller platforms with fewer data and resources are still struggling. This view was also shared with other experts, such as the CEO of a large digital ad agency with Fortune 500 companies as clients, highlighting that Meta is in the best position to gain in the next year and that smaller platforms are the losers. The belief that Meta is in a prime position in the ad industry, especially with genAI, was also shared with a former unit head working in marketing at Amazon.

The point of Meta gaining after the iOS change is also shared by a former Meta, Twitter, and LinkedIn employee who says that Meta is the winner of Apple's IDFA change. As they got a little better with new signals and AI enhancements, while competitors now, because of IDFA, got worse. So, there is no alternative out there.

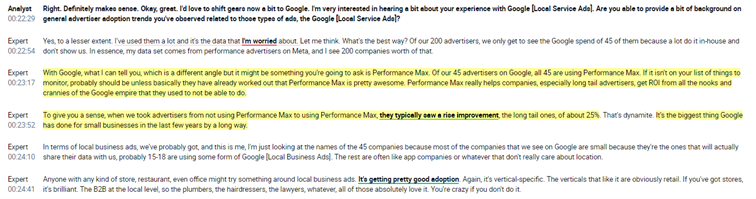

A digital industry expert who has over 200 advertisers also highlighted Google's Performance Max as the biggest thing Google has done for small businesses in the last few years. In his experience, Performance Max typically increases long-tail ROI by about 25%:

This expert also gives big importance to click-to-message ads, especially WhatsApp Business, as click-to-messenger ads report the best ROI of anything they are doing with Meta:

While WhatsApp has been highlighted as a growth driver, many still view it as a significant untapped opportunity as more advertisers discover it via other Meta platforms like Facebook or Instagram. A Former Director at Meta also noted this:

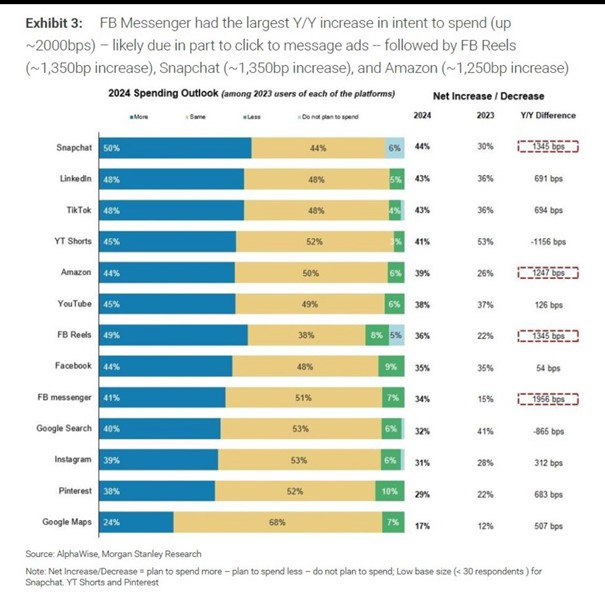

Data from AlphaWise and Morgan Stanley Research show that click-to-message ads are becoming more interesting for advertisers. The survey shows significant spending increases for this year compared to last year.

The cloud providers

In general, I see a few prevailing themes through this data that I will summarize:

Cloud jobs are on the rise again as companies are starting to test out new GenAI workloads

Right now, data doesn't show companies switching cloud providers because of AI workloads.

Given that most enterprises are multi-cloud, AI workloads might go to one provider for now. Azure OpenAI seems to be picking up.

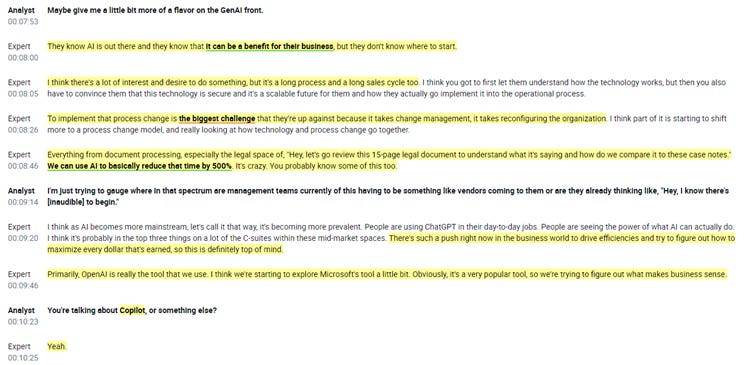

Companies are still testing out AI as most still don't know what or how to use them.

Azure continues to win at companies with a big Microsoft footprint (SQL, Office 365, Active Directory, Teams, Windows Servers, etc.)

Here are some of the highlighted data:

There is an interesting data trend with the cloud names—the ramp-up in cloud jobs is starting to happen, as it seems we have reached the bottom regarding cloud jobs. The main reason, as I see it, is the genAI workloads that are starting to be tested and carried out by companies.

AWS and Azure are very close together, as Azure has managed to narrow the gap between them in the last four years. On the other hand, looking at GCP data, it doesn't seem like the gap between GCP/Azure and GCP/AWS has changed a lot since then.

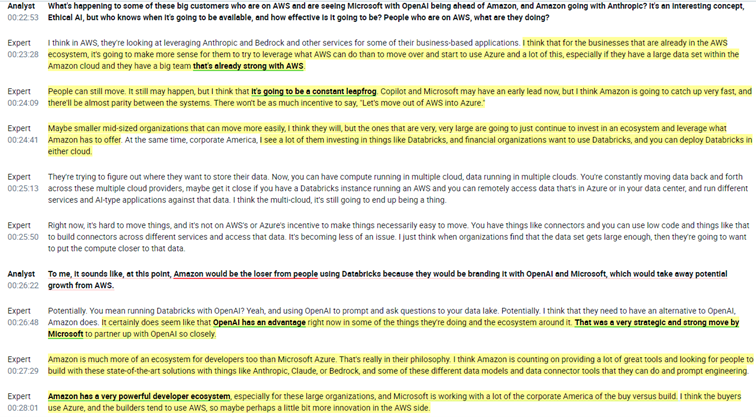

It seems that the reason to migrate from one cloud to another won't be AI. While specific AI workloads might get migrated between cloud providers, it's not a big enough reason to migrate entirely from one provider to another. A cloud Industry expert recently highlighted this:

Azure OpenAI is starting to pick up some momentum, as this Former Group Lead at Microsoft explains, which bodes well for Azure:

This is also highlighted in this interview with a Partner and Cloud consultant. From what they use with their clients it's OpenAI tools mostly:

But the data so far still points to companies still being in the early testing stages and to adoption really starting to pick up in the next 12-24 months.

Semiconductors and Nvidia

In general, I see a few prevailing themes through this data that I will summarize:

Inference is becoming more and more important

Demand for GPUs will remain high for the next few years before it starts to normalize, as many Big Tech companies start using their own silicon.

The costs of GPUs will go down, but not yet

Right now, it is even hard to get GPUs on cloud providers as demand is much higher than supply

NVDA's leading edge is CUDA

Here are some of the highlighted data:

The first thing is that Inference is becoming increasingly important as many experts highlight that inference will be able to run locally on your phone/laptop or on specialized ASICs. The main thing driving the focus with Inference is costs. A Former Architect, Nvidia also highlights this:

Many industry experts also agree that demand will slow down, but not for a few years. The main reason for the slowdown in GPU demand is hyperscallers with their custom silicon offerings.

The demand at cloud providers is high right now. A former AMD employee shares that renting a GPU at AWS for a week right now is hard, as AWS might prioritize those who rent it out for a month or two.

The same viewpoint is shared by a Former Senior Engineer at Nvidia, who says the best option to get access to GPUs right now is to get approval from someone at the cloud provider or get access via other companies that already have access.

Nvidia's CUDA advantage is something that a lot of investors already know, but here is one of the best explanations from a Former Nvidia Researcher of what the CUDA edge is:

If you are using AMD GPU, an alternative to Nvidia's CUDA is a tool called hipify-perl. This is basically an open-source converter of CUDA code into a version compatible with AMD's ROCm. However, the converter doesn't guarantee 100% CUDA performance. Also, developers still need to customize the converter to fully leverage the performance benefits of AMD GPUs. In his opinion, about 50% of the work on the AMD GPU is done by the converter, and the remaining 50% needs to be done by the developer doing the customizations. Because of the customizations needed, he thinks that from a cost perspective, even though the GPU itself is more expensive with Nvidia, it still makes more sense to go with Nvidia as it is a one-time cost/investment instead of converting it every time. In his view, the price of the AMD GPU and the work that needs to be done with the customization is almost double that of the Nvidia GPU price. The use case for using an AMD GPU with the converter is not when you want lower costs but when no Nvidia GPUs are available:

Until next time, take care.

As always, If you liked the article and found it informative, I would really appreciate sharing it.

Disclaimer:

I own Amazon (AMZN), Meta (META), Microsoft (MSFT) stock.

Nothing contained in this website and newsletter should be understood as investment or financial advice. All investment strategies and investments involve the risk of loss. Past performance does not guarantee future results. Everything written and expressed in this newsletter is only the writer's opinion and should not be considered investment advice. Before investing in anything, know your risk profile and if needed, consult a professional. Nothing on this site should ever be considered advice, research, or an invitation to buy or sell any securities.