Amazon the company that is taking over the world with economies of scale

Welcome to UncoverAlpha newsletter. The newsletter is primarily focused on deep dives and insights on great companies in the tech and growth sector. The newsletter is free, so if you haven’t, you can Subscribe on the following link.

This article is sponsored by Olive.

Invest smarter with Olive. Improve performance by reducing volatility with option strategies that the pros have historically kept to themselves. Build a sandbox portfolio with a $100,000 virtual trading account or link your brokerage* to start executing protective options strategies with ease.

*TD Ameritrade accounts are currently fully integrated with more brokerage support coming soon.

If you are interested in sponsoring the next article, you can DM and reach me on Twitter @RihardJarc

Hey everyone,

In this article, I am doing a deep dive into a very important company in my portfolio. The company is Amazon. While almost everyone knows Amazon as the e-commerce giant and maybe also as the software cloud computing giant Amazon Web Service (AWS), many of their other big and growing segments are less known. Furthermore, most investors have a problem valuing the company by looking purely on a P/E basis; the company has always been expensive but has rewarded shareholders with high gains over the years. In this article, I will describe and break down Amazon’s most interesting and material segments of the company and, at the end of the article, value the company based on the findings.

Overall Amazon strategy

Before we dive into each of the company’s segments, there is fundamentally important to understand something about Amazon. Their whole strategy relies on economies of scale, and this can be seen in all of their business segment. The company also continues to reinvest profits from its profitable segments towards making new business segments that rely on economies of scale. And they can do that because of their financial positions and, more importantly, their size and previous business segments.

I always like to go back and read Amazon’s shareholder letter in 1997.

“We believe that a fundamental measure of our success will be the shareholder value we create over the long term. This value will be a direct result of our ability to extend and solidify our current market leadership position. The stronger our market leadership, the more powerful our economic model. Market leadership can translate directly to higher revenue, higher profitability, greater capital velocity, and correspondingly stronger returns on invested capital.

Our decisions have consistently reflected this focus. We first measure ourselves in terms of the metrics most indicative of our market leadership: customer and revenue growth, the degree to which our customers continue to purchase from us on a repeat basis, and the strength of our brand. We have invested and will continue to invest aggressively to expand and leverage our customer base, brand, and infrastructure as we move to establish an enduring franchise.”

And this section right here shows Amazon’s strategy from more than 25 years ago to this day. The company is constantly pursuing revenue and customer growth and later focusing on profitability. And they are continually reinvesting their earnings into new business segments that bring them dominant roles because of their market position. As Statechery said it well, they are the first and best customer of their new service/product. It happened with fulfillment centers & ads; it has happened with AWS, and it’s now happening with logistics.

Business segments breakdown

For a better understanding, I draw up this diagram representing Amazon, and its most important business lines/segments.

AWS

The start of AWS

Let’s start with the crown jewel: Amazon's cloud software business, AWS.

Amazon started its AWS business from a need of its own. In the early 2000s, Amazon software engineers complained that they spent too much time maintaining and creating software infrastructure. In an interview In 2018 from New York Magazine, Andy Jassy (current CEO of Amazon) recalled engineers saying to him:

“Look, you guys think these projects should take two to three months total, but we’re spending two to three months just on the storage solution or the database solution or the computing solution,”

It felt like every time they were on a project; they would have to reinvent the whole thing. To address this problem, Amazon centralized the process of building and offering database management software for their own teams so that they could focus on other things.

Later on, Jassy proposed that Amazon starts a 57-person division selling digital infrastructure. In 2004 the division released the first test versions, and by 2006 AWS officially opened for business. They first started with one of the most used and famous services (to this date) called S3. S3 is a storage service. Later, they developed EC2 or elastic computing, allowing software developers to access on-demand computing power. The goal of it was clear, build the Lego of the IT world so that developers can save time and resources and scale quickly.

Cloud industry to date

Public cloud computing is one of the highest growing industries, and given its size and growth rate, it’s set to be one of the biggest industries in the world. According to Fortune Business Insights Global, the cloud computing market stood at $405 billion in 2021 and is set to become a $1.7 trillion market by 2029 with a 19.9% CAGR.

And what confirms the trends and the growth path of the industry is the recent comments of Adam Selipsky (current head of AWS). He noted that only roughly 10% of the world’s IT has migrated to the cloud, which means that AWS is still operating as thought is “Day 1” for this segment and that most of its growth is yet to come.

Even when we think about where the internet and the world is going, we can understand that as the internet is moving more into video from text (with apps like Instagram, TikTok, and streaming providers Netflix, Disney, etc.), there is a bigger and bigger need for consumption of computing than what was ever before. With concepts like Autonomous vehicles, Metaverse, and IoT, that will only increase even more rapidly. Cloud computing and public cloud companies will become even more important as they will serve as a critical infrastructure backbone, similar to the Telecom industry providing access to the internet.

So how big is AWS?

Well, it’s the biggest of the public cloud providers, and this chart summarizes just how fast AWS has been growing over the years and how big it has become. Last year AWS alone made $62.2B in revenue, and it’s not stopping. According to Amazon’s last earnings report (Q2 2022), AWS’s latest 12-month trailing revenue run rate is $72B. And it’s also very profitable. In 2021 the unit brought in $18.5B in operating income at an almost 30% operating income margin.

When it comes to their clients, they range from the big reputable corporation and government institutions of the world to newly formed startups.

Here are some names that are on record publicly as using AWS:

Aon, Adobe, Airbnb, Alcatel-Lucent, AOL, Acquia, AdRoll, AEG, Alert Logic, Autodesk, Bitdefender, BMW, British Gas, Baidu, Bristol-Myers Squibb, Canon, Capital One, Channel 4, Chef, Citrix, Coinbase, Comcast, Coursera, Disney, Docker, Dow Jones, European Space Agency, ESPN, Expedia, Financial Times, FINRA, General Electric, GoSquared, Guardian News & Media, Harvard Medical School, Hearst Corporation, Hitachi, HTC, IMDb, International Centre for Radio Astronomy Research, International Civil Aviation Organization, ITV, iZettle, Johnson & Johnson, JustGiving, JWT, Kaplan, Kellogg’s, Lamborghini, Lonely Planet, Lyft, Made.com, McDonalds, NASA, NASDAQ OMX, National Rail Enquiries, National Trust, Netflix, News International, News UK, Nokia, Nordstrom, Novartis, Pfizer, Philips, Pinterest, Quantas, Reddit, Sage, Samsung, SAP, Schneider Electric, Scribd, Securitas Direct, Siemens, Slack, Sony, SoundCloud, Spotify, Square Enix, Tata Motors, The Weather Company, Twitch, Turner Broadcasting,Ticketmaster, Time Inc., Trainline, Ubisoft, UCAS, Unilever, US Department of State, USDA Food and Nutrition Service, UK Ministry of Justice, Vodafone Italy, WeTransfer, WIX, Xiaomi, Yelp, Zynga and Zillow.

Netflix was supposed to be one of the key clients of AWS back in the day. It was constantly pushing their capacity to the limit because of the influx of new users and content and helped AWS grow a lot in the early days.

When looking at the market share of AWS in the cloud industry and their position vs. peers, estimates range quite significantly, but all acknowledge that AWS is the market leader with around a 30% market share. However, with Azure, Microsoft has been growing very fast and catching up to AWS in recent years. Gcloud from Google is in the number 3 spot, but AWS and Azure are far ahead of everybody else.

Breakdown of the services that AWS makes revenue on

AWS product offerings can be broken down into the following categories:

- Storage

- Computing

- Networking

- Software as a Service

So, we can say that AWS offers two categories of products; infrastructure as a service (IaaS) and platform as a service. Amazon doesn’t give a breakdown of AWS’s revenue in terms of how much each segment brings to the total revenue. However, according to many industry experts, the main products in terms of AWS are still S3 and EBS, which are both Storage products, and EC2, which is AWS’s core computing product. Coreq Quinn, a chief cloud economist at Duckbill Group, estimates that more than 50% of AWS revenue comes from EC2 computing. Computing means that customers of AWS rent virtual slices of physical servers in AWS data centers. The same analyst says that when you add all the storage products and data transfer fees, you get another 20%. So, estimates are that 70% of AWS revenue comes from computing and Storage.

While EC2 and S3 & EBS are meaningful when it comes to AWS’s total operating profit, they are lower margin businesses than the so-called “platform as a service” parts of AWS. For S3 and EC2, analysts believe the gross profit margin is in the 50% range, while some believe S3 can go as high as 70%. A more recent computing product called Lambda is more profitable than EC2 in their computing segment. Lambda is a computing job that runs in response to certain events like when someone uploads a new photo to social media etc. Customers also call this tool serverless because AWS takes the full job of running the servers for the service. It is believed that AWS can charge up to twice as much for Lambda services than for EC2 computing services.

Regarding Storage, we mentioned the famous S3, but a well-known product is also the EBS service or Elastic Block Store. It is a product that is typically attached to an EC2 instance and holds data for it. AWS offers the EBS service on hard disk drivers. The EBS gross margin is speculated to be between 60-70%.

While the IaaS category is AWS's biggest segment in terms of % of the revenue, the platform as a service part is even more interesting regarding gross profit. It is also the segment that has a significant potential to expand further as more and more use cases emerge and more partner companies start to offer different products for cloud customers. When more and more of these services take a bigger % of AWS's total revenue, we expect the operating margin to improve further.

Services in this category are different types of SaaS services that either AWS offers as their own or partner software providers offer through AWS’s marketplace. Services such as Elastic Search, Twilio, different AI and text/image recognition software, etc. If AWS provides this service as their own, their gross margins are more in the +70% range, but even if the services are offered by their partner software providers via their AWS marketplace, AWS takes an approx. 5% listing fee. Last year it was estimated that the AWS marketplace generated around $1 billion - $2 billion in annual revenue. For comparison, Microsoft also took a fee on their Azure marketplace but reduced it last year in July from 20% to 3%.

Many of these kinds of services will be developed in the future. A report was published just a few days ago in The Information that AWS is preparing to unveil a cloud service called Bastion for Advertisers. The move comes as advertisers try to recover from, and get ahead of, Apple’s and Google’s restrictions on their ability to track consumers online. Bastion is a data-clean room. It lets multiple companies pool data they have on existing or potential customers without any of them being able to view the entire pool. The idea: protect privacy and address competitive concerns. More on the service AWS Preps ‘Bastion’ Cloud Service for Advertisers — The Information

But it just shows how this field will develop more and more applications and features, and AWS will be able to upsell the new features/products to their existing client base.

Moving data can be very expensive and presents a Moat

Another less talked about topic about public cloud providers is moving data out of the public cloud or switching to other cloud providers. This can be a very expensive task. This is also the case with AWS. And the charges for moving this data can be very unpredictable, so the companies that think about it are quickly turned off. Because of the high data moving fees in 2018, Cloudflare announced a Bandwidth Alliance to lower or eliminate the data-transfer costs. Amazon decided not to participate. The CEO of Cloudflare said recently that the markup for bandwidth at AWS is exceptionally high and even said he guessed that the gross margin is 99%.

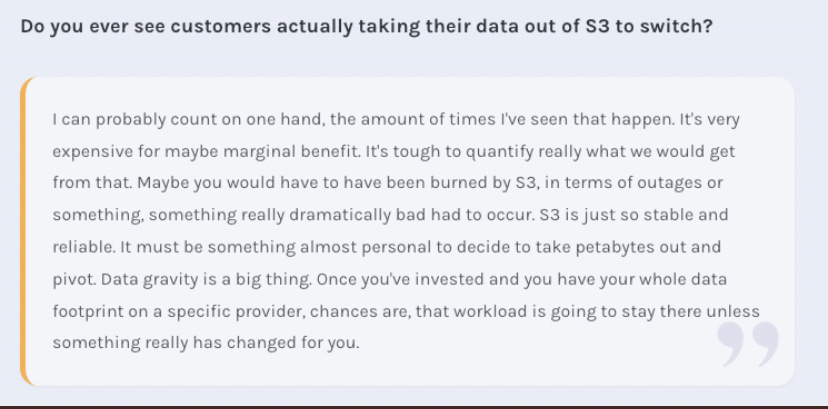

What is also telling is a recent answer on this topic from a former AWS director:

One of the reasons why fees for data transfer are that high is because with it, the cloud provider “locks you in” as a customer. From an investor standpoint, this is good as it means barriers to entry and stealing clients for new companies are higher, and it is somewhat harder to take clients away from AWS unless something significant upsets them.

In summary, AWS is a growing and profitable machine. And its future looks as bright as ever. With the world moving more IT into the cloud and consuming video content each year, the need for services like Storage and Computing is growing rapidly. On top of that, AWS is still in the early days when it comes to profitability, as a lot of their higher profit business segments are still in early days, and the platform is not yet at full scale when it comes to the ecosystem of software partners that can sell their software solutions to AWS clients. In my view, AWS will continue to grow in high numbers for the years to come. When comparing it to competition, the only true real competitors are Microsoft and Google. And even with Google, they can keep up with AWS and Azure because they are spending a lot on making the product work & price competitive even though it is not small now, it is still unprofitable as Google has to spend to keep up with the other two. So far, Microsoft’s Azure is the real threat as Microsoft is well in leveraging its existing B2B relationships because of its portfolio of other B2B products. But in my view, the cloud market is big enough for both AWS and Azure to continue to grow, and it’s not a one company takes the whole market kind of industry.

E-commerce from 1P to 3P

E-commerce is the bread and butter on which Amazon started its business. Back in the years, Amazon was known to be the company that both from suppliers (wholesale) and then sold to clients. But in recent times, that has also evolved in a way that Amazon also offers Third-Party sellers (3P) to sell directly to clients, and Amazon only serves as the platform on which a seller can list their offering. They also take care of fulfillment, packaging, and shipping to the client process.

Amazon realized that it might be better to allow 3P sellers to list on their platform and not have to worry about inventory, branding of items, quality, etc.

Now while Amazon still sells items themselves via the 1P system, the 3P system has been growing and taking more and more share of their total e-commerce revenues. I made a chart to show how things have evolved since 2015.

We can see that while both 1P and 3P have been growing in the last six years, 3P is growing fast and is 32% of total revenue from e-commerce in 2021, up from 17% in 2015.

This is, in my view, a good sign for Amazon shareholders as I prefer the 3P model because it means that Amazon can focus on what it is good at and that is being the dominant platform for people to shop. At the same time, the 3P model has higher margins, and more predictability than the 1P model, as Amazon doesn’t have to worry about inventories and what products are “trending” right now and what aren’t. It also opens Amazon up to new revenue streams like Ads which we will discuss in the Ad section.

If Amazon was not investing significant amounts of its profits from e-commerce in fulfillment & logistics, I believe the 3P model would already show very healthy net margins in the e-commerce section.

Financially the 3P model means that Amazon takes an 8%-15% referral fee from the sellers on top of the other fulfillment fees they charge them for sending out the goods.

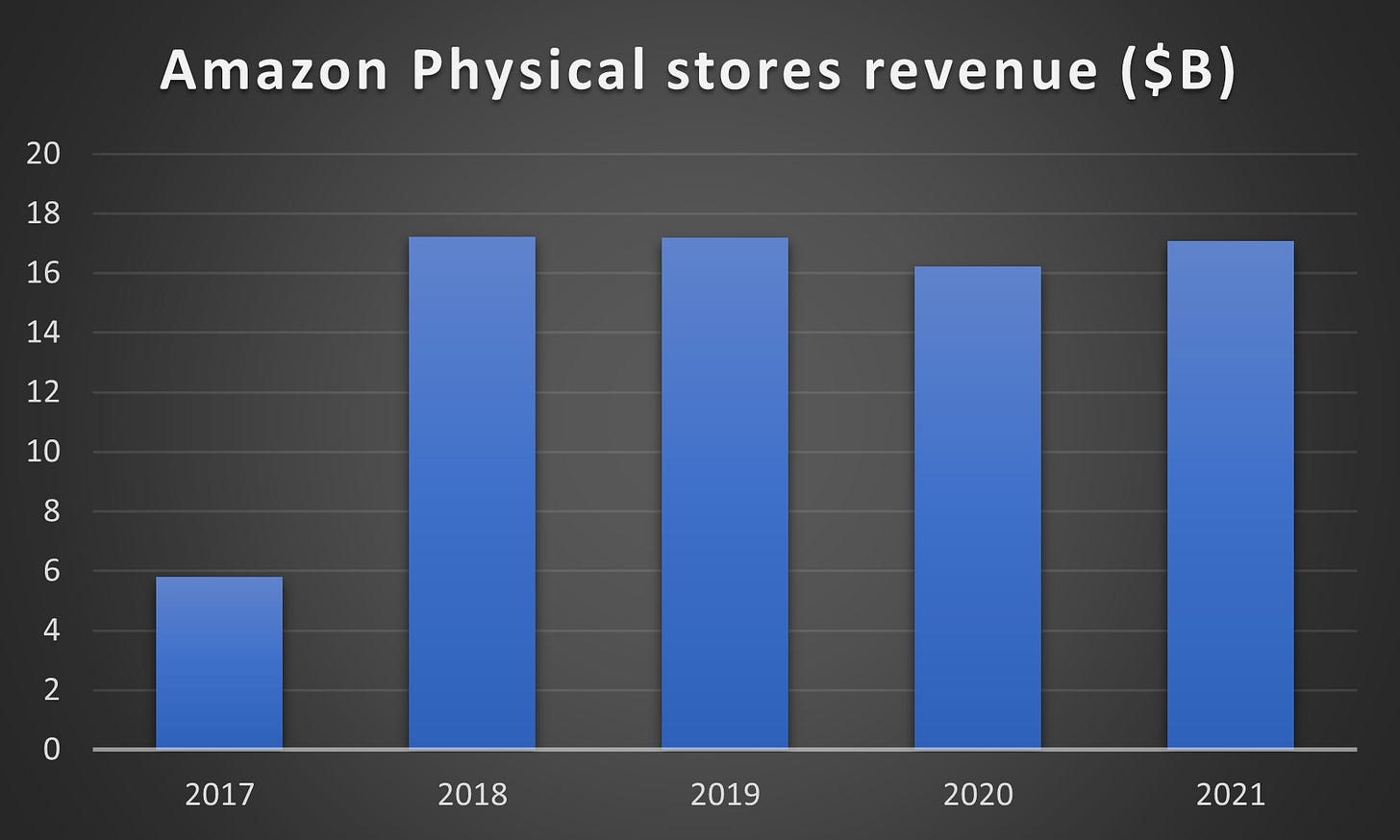

In 2017 Amazon also entered the Physical store business when it Bought Whole Foods. I won’t lose much time on this segment because I don’t find it that interesting and given the size of the whole company. The segment is much or less flat from the year Amazon bought Whole Foods, which is 2017 (the revenue in 2017 is much lower because Amazon didn’t own Whole Foods for the whole year yet) to date at around $17 billion in revenue.

Advertising

Amazon launched its Amazon advertising platform in 2012, but it wasn’t until 2018 that Amazon really focused on this business segment. Amazon advertising consists of many sellers advertising their products on their marketplace, and it is an upsell feature of their 3P offering. Besides the Amazon marketplace ads, they also have assets like Twitch TV and IMDB, and Amazon Prime Video offerings.

A real benefit when it comes to Amazon ads is that they control the whole ecosystem, so they are one of the biggest beneficiaries of the privacy change that Apple implemented, which limited how many ad tech companies were able to track people. Even more so, if you are a seller of Amazon, it feels like a “must-have” to use Amazon advertising to have successful sales on the platform as competition is fierce and crowded.

Because of their reach and effectiveness, without being affected by the iOS change, Amazon is now one of the biggest advertising players in the world, with revenue from advertising being over $31 billion in 2021.

But it’s not just the size of their business that is impressive; it’s the growth rate at which Amazon advertising grew, with 57% and 58% YoY growth in 2020 and 2021. The strongest growth came both in the periods when Apple disrupted the whole ad industry. Even in the first half of 2022, where we have a macro headwind in the entire ad industry and where most ad companies are reporting low single-digit to flat revenue growth rates, Amazon's ad business grew revenue by 25% in Q1 2022 and 21% in Q2 2022, showing much more robust results than both ad juggernauts Google and Meta.

With the advertising segment, it’s also worth mentioning the gaming streaming platform Twitch has become a significant asset for Amazon and its ad business. It is estimated that Twitch revenue for 2021 was $2.6 billion, up 41% YoY.

With the recent trend in streaming companies starting to ramp up their ad offerings like Netflix and Disney, this should also benefit Amazon. As streaming customers get used to ads popping up on competitive platforms, it opens up the ability for Amazon to start providing ads on their Amazon Prime Video platform.

The ad business has become a significant business segment for the company as it will probably come close to $40 billion in annual revenue in 2022. And it is another example of how Amazon leveraged its existing business, like e-commerce, to upsell a new product and make a multi-billion dollar business on top of another one. While Amazon doesn’t break down the profitability of the segment, it is expected that Amazon’s ad business is as profitable as Google's or even higher since it controls the whole ecosystem and doesn’t need to carry the CAC alone (the costs are spread around the e-commerce ecosystem).

Prime

Another important driver of Amazon is Amazon Prime. Amazon Prime is a paid subscription that gives Prime subscribers access to additional services that the company offers. Services such as one or two-day delivery of goods, streaming services for music, video, e-books, gaming, and grocery shopping. It also gives its members access to an exclusive Amazon Prime Day event in which sellers provide discounts on goods to all Prime members. It has become as big, if not even bigger, as Black Friday. Amazon first started Prime in 2005, and in 2021 Amazon shared that Prime members have surpassed 200 million. I believe Amazon Prime is Amazon’s 2nd most crucial asset behind AWS.

81% of Americans aged 18 to 34 are Prime members. This is a mind-blowing stat and shows that in the years to come, when younger people mature, Prime will continue to grow even more as the demographic ages & young people love using the service. Currently, 59% of American households have at least one Prime membership.

It still has significant potential outside of the US to capture a big audience. Out of the 200M, it is estimated that 153M of 200M are US customers, so only 47M are customers outside the US. Prime is not even available in all the EU countries, so the potential for international growth is big.

Prime builds a loyal user base as it becomes more convenient for Prime members to shop most of the items on Amazon if they are available, which increases the dominance of Amazon’s 3P and 1P offering even more

Prime members tend to spend more on Amazon. 30% of Prime members spend between $50-$100 a month on Amazon. They are also highly engaged on the platform, as 40% of Prime members visit one of Amazon’s platforms daily.

Almost nobody unsubscribes to the service after year 1. The 30-day retention rate is 69%, rising to 93% in the first year and then to 98% after the first year.

It is no surprise that these numbers also translate into Amazon’s financials. Amazon subscription services which are mainly Prime subscriptions show the whole story:

It is hard to produce revenue growth rate numbers like this, especially when you make almost $32B in the year 2021.

Prime is another example of the economies of scale business that Amazon is building. The more members Prime has, the lower the costs are for Amazon and the more entrenched the subscribers get in the whole Amazon ecosystem, feeding other business segments of Amazon. Not to mention with Prime, Amazon has data on the spending habits and entertainment habits of more than 200M users. Which is probably the holy grail of e-commerce and ad networks.

Logistics

Amazon Logistics is a business segment that has, similar to others, been developed by Amazon’s own needs. In the early days, Amazon relied much on UPS, the Postal Service, and FedEx to deliver their packages to customers. But it soon realized that the third-party providers could not deliver the full extent of their products, and so Amazon’s growth could be hamstrung by a third party provider. So Amazon took this problem into its own hands and, in 2014, started its Logistics unit from scratch. They pour billions of dollars into building their logistics network in the coming years. In 2021 they now had 400k drivers, 40k semi trucks, 30k vans, and 70+ planes in their logistic unit. They understood that if they built out the best logistic network, they could develop another strong business that helps their existing businesses and makes a new big moat around the company. So again, following the rule, they are the biggest and best customer for their new business segment.

And the results are here:

In 2019, Amazon delivered 46% of its own packages. In 2021 that number is now at 72%.

In 2018, 51% of the US population lived within an hour of an Amazon warehouse, and in 2021 that grew to 77%.

And to be honest, Amazon didn’t really have a big choice here. Since we know this company is fierce when it comes to customer satisfaction. If they wanted to meet customers’ demands for delivery, especially one-day delivery, they knew the UPSes and the FedExes of the world would not place that many resources in developing that network, and so Amazon had to do it by themselves. But this is a significant long-term advantage of Amazon and trouble for the package carriers and other e-commerce players like Shopify. As Amazon is launching these high standards of one-day free delivery, customers are getting used to that standard. So online sellers that do not sell through Amazon, like Shopify sellers, now have the pressure to either match that or risk that clients could shift because of the better user experience regarding delivery. And here is the grand catch.

Amazon already launched Logistics as a Service in the UK in 2020, offering their logistics network for package delivery for sellers who are not selling on Amazon. I believe they will soon expand this to other countries and open up another vast billion-dollar business line. At first, you might think this is bad for Amazon as sellers will be less inclined to sell on Amazon as they can now get the delivery of Amazon even if they don’t sell on their platform, but in the long run, this is not the case. In the long run, this means that Amazon understands that they cannot and will not be the only company selling goods online and for them getting those other sellers to use their logistic networks means that they can lower the costs of their logistics network, even more, invest more into expanding it and make a world dominant logistic network for e-commerce which nobody can compete with. Amazon also figured out that they receive a lot of trucks daily that deliver goods to their warehouses. Still, the trucks then leave the warehouse empty or partly empty when they could be filled with goods that Amazon delivers for other customers and make use of that capacity. It is again similar to what they are doing in other parts, an economies of scale business and infrastructure play. Once Amazon builds out this mega logistics business, nobody will be able to compete with it or recreate it since it would require hundreds of billions of dollars to build it out.

Valuation

Now that we can understand the main business lines of Amazon, let’s move to the valuation part. Amazon is currently trading at a $1.33 trillion market capitalization. For this article, we will use a sum of parts analysis to understand what each of their business lines is worth. We will look at the most recent numbers from Q2 2022 to Q3 2021.

E-commerce

Their online 1P store’s revenue and physical stores revenue for the last trailing twelve months (TTM) were $218 billion. Now given that this is a category that is currently more or less flat in growth, together with the fact that Amazon will want to keep margins low here so it can leverage this network for other things, we can value this segment conservatively and apply a 0.7x P/S multiple which is similar to where for example a box retailer Target is valued right now. By applying that multiple, we get to a value of = $152.6B

The second part of the e-commerce segment is 3P seller service revenue. TTM 3P revenue is $107.3B. This segment is harder to value as it is more profitable than the 3P and Physical stores segment, but it’s harder to compare with peers as there are not a lot of similar business lines. The Etsy and Shopify multiple ratios would skew the picture too much as they are very high. Still, a quick comparison to big Chinese e-commerce players such as Alibaba shows that a valuation of 2x P/S might be appropriate for this segment. That would put the value of this segment at $214.6B

Advertising

Now moving to advertisement. TTM Advertising revenue is just shy of $34 billion. Given that Amazon controls the whole ecosystem and doesn’t need to pay anyone for content (at least on the marketplace side), we can assume that as a standalone company, a similar Net profit margin could be achieved, as for example, Google. Keep in mind that Amazon’s ad business in the last quarter grew by 21%, which is higher than the latest growth of Google. Google's latest net margin is around 26%, so that would equal $8.84 billion in profit for Amazon from its ad business. Applying a similar P/E as Google at 20x, the Amazon ad business value is $176.8B

AWS

AWS’s TTM is $72 billion. The business is still growing over 30% YoY, and it’s the most dominant player in the space. If this were a standalone company, given its position, growth rate, and profitability, the market would probably value it in the 10x-15x Sales range. Even if we compare it to the smaller public cloud provider Digital Ocean, we can see that Digital ocean trades at around 9x P/S with a less dominant market position. If we take the middle valuation multiple of 12.5x P/S, we get to a value of $900B for AWS.

Subscriptions & Prime

TTM revenue for subscriptions stands at $33.4 billion. Given that this segment is probably highly profitable as it consists primarily of Prime memberships, we can assume the net margin would be somewhere between 15-25%. If for our calculation, we take a 20% net income margin, we get to a net income of $6.68 billion. Subscription revenues grew 14% in the last quarter, so applying a 20x P/E ratio seems appropriate. The value of this ratio makes it a $133.6B business.

Summary

When combining all the values from the segments, we get to a valuation of $1.577 trillion. Again this is only hypothetical and educational but the calculation and it’s assumptions are in detail above. We also didn’t assign any value to the logistics unit yet as we have no data to properly assess it, but it’s definitely not a 0-value business.

Conclusion

We have not touched other parts of Amazon’s business, such as the Home units like Alexa and Roomba or their online health business, or even Amazon Pay. Still, given the size of Amazon, in my view, the key areas to focus on with Amazon should be the ones that were mention in this article. At the same time given the nature of this company, new emerging business lines are constantly being built by Amazon as they are putting the money they earn into new segments to enhance old moats and create new ones.

Amazon is a clear example of a company using its size and market position to develop moats based on economies of scale. They are creating both physical as well as digital moats. Investors are also getting a company that is tied to both B2C and B2B trends. Even though it is a mega-cap company already, I find it to be one of the most exciting companies that will, in my view, will continue to dominate and develop monopolistic type business segments where it is hard for anyone else to compete with them.

If you haven’t yet, feel free to subscribe to this free newsletter & share. If you feel so, I would really appreciate it if you shared the link to the article on social media, as this is the best way to find new subscribers to UncoverAlpha and keep the newsletter free for everyone. Thank you very much all!

Other sources for this article:

How Amazon Web Services makes money: Estimated margins by service (cnbc.com)

https://www.seattletimes.com/business/amazon/in-the-15-years-since-its-launch-amazon-web-services-has-transformed-how-companies-do-business/

https://techjury.net/blog/amazon-prime-statistics/#gref

https://www.cnbc.com/2022/08/16/amazon-to-raise-seller-fulfillment-fees-for-the-holidays.html

Disclaimer:

I own AMZN stock.

Nothing contained in this website and newsletter should be understood as investment or financial advice. All investment strategies and investments involve the risk of loss. Past performance does not guarantee future results. Everything written and expressed in this newsletter is only the writer's opinion and should not be considered investment advice. Before investing in anything, know your risk profile and if needed, consult a professional. Nothing on this site should ever be considered advice, research, or an invitation to buy or sell any securities.