Earnings analysis of PINS, ABNB and SOFI

Welcome to UncoverAlpha newsletter. The newsletter is primarily focused on sharing my analysis and insights on great companies in the tech and growth sector. The newsletter is free so if you haven’t you can Subscribe on the following link.

This article is sponsored by Commonstock

Commonstock is all about transparency. Follow your favorite investors and see their trades in real time. Link your favorite brokerage and add a memo as to why you bought or sold a security for your followers to see! See my trades and decision making process @rihardjarc on Commonstock

If you are interested in sponsoring the next article you can DM and reach me on Twitter @RihardJarc

Hey all,

I decided that I am going to do earnings results and quarter recap analysis of the companies I follow on top of the company analysis I do. Now I won’t do an analysis of all the earnings but the ones that are the most interesting ones.

The earnings that were chosen for this article were earnings from Pinterest, Sofi, and Airbnb. Now all three are portfolio positions of mine.

Let’s start with the one that had the biggest “bang” - Pinterest (PINS).

Pinterest earnings

The numbers:

Q2 revenue grew 125% YoY to $613 million

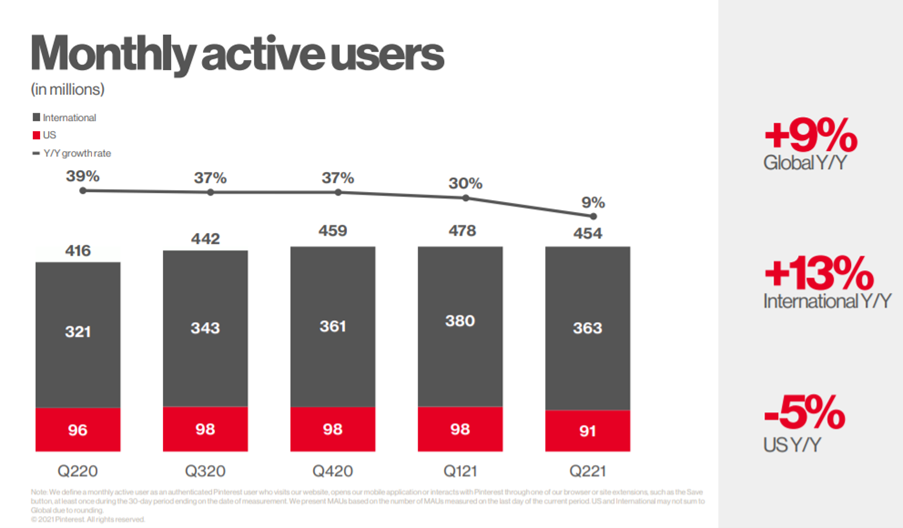

Global Monthly Active Users (MAU) grew 9% YoY to 454 million

GAAP net income was $69 million and adjusted EBITDA was $178 million for Q2

Now the thing that disappointed most investors is MAU. So let’s look at it first in more detail.

There are several things that stand out.

US MAU grew negative -5% YoY and negative -7.1% from the last quarter.

International MAU growth was up only 13% on a YoY basis and negative -4.5% from the last quarter.

The growth targets didn’t even meet management’s lowered guidance from last quarter which projected mid-teen global MAU growth instead the global MAU growth was 9%.

What was not encouraging either is that the July numbers for the Q3 quarters were down also.

Let’s not sprinkle flowers here, the MAU results were bad. But the earnings call shed some light on why these numbers were such a miss.

The main reason: The users that left were users that came during the lockdowns to Pinterest primarily through search and were on desktop. So, the latest engaged users of all.

Management note:

“Well, most of the difference between what we guided and what we reported are people who came to Pinterest from the web versus from mobile apps. These users tended to be, on average, less engaged and generated less revenue than people who came directly to Pinterest.”

In fact the most engaged users and the ones that bring most of the revenue the mobile users grew by more than 20% YoY in this quarter. Also, Gen-Z audience grew double digits YoY.

So what we can take from the MAU results is that Pinterest lost some of the users that came because of the pandemic, but these users were low quality, to begin with. The only thing I was sad not to see is that management would give this low-quality users data last year when it was affecting PINS in a positive way so that investors would not be shocked when we see these users unwind.

On the user side, I am concerned if I see users that are actually using a platform like Pinterest go away. This shows either that the product itself is not good enough to fulfill the need of the users or that the competition has a better alternative. But in this case, the users that left the Pinterest platform were users that weren’t really using the platform but just happen to stumble upon it while surfing through the internet. I will keep a close eye on this trend in the next quarters, but as long as the “real” users aren’t leaving the platform I am not that concerned.

Revenue and monetization

Now the bright spot of these earnings report were the monetization efforts. Revenue grew 125% which was higher than expected and ARPU was particularly good.

Global ARPU up 89% while international ARPU up 163% YoY.

These numbers show a higher than expected pace of monetization for Pinterest and at the same time show, Pinterest is really the platform where monetization is easy. I believe in my thesis that the more Pinterest is monetized or shall we say the more shoppable it is the more useful the platform will be and the more users will join it. It is one of the rare platforms where monetization is welcomed by the users.

Management also noted on the call that many new advertisers are joining the platform including big advertisers and that we can expect that the average ad price will rise because of more bidding for ad space etc.

Now honestly I had no doubt that Pinterest can monetize its a platform well and that advertisers, especially from specific sectors (retail, home décor, etc.), will love it but it is still good to see actual results confirming this thesis.

Pinterest evolving?

Now the last important thing I want to address on the earnings call is a new shift in which management said PINS wants to go. That is into the creator economy and being a more engaging platform for user-to-user interactions. Now PINS was always a platform that lacked the user to user engagement in my view but, I didn’t see the need for them to have it as their primary use-case of being the go-to place to find stuff that you want to buy is good enough for me. But now with this shift to a more user-to-user engagement, I find this could provide some positive upside surprise. If they get this right and onboard creators and get the users to engage they have a great chance to evolve into a platform similar to Pinduoduo or WeChat in China. With the right partners to fill in the gaps like Payment etc., it could work out for them. I also think Pinterest could provide an interesting value proposition for creators as their content can be more evergreen (example. How to perfectly grill a steak?) – similar to YouTube and with that their content monetization value rises as opposed to short videos that disappear. As a creator, you don’t have to make new and new content constantly.

For me going in the direction of trying to make the platform more engaged for user-to-user interaction is a good attempt. If they make it - great it brings another level of value. If they don’t it is also not a big deal. The only thing we have to take into account is that this “test” will cost them something. They explained and guided for Q3 revenue in the mid-40s because of this shift to the creator focus platform as they will be giving up on some ad space for creators instead of advertisers. But still, I feel like with every platform going to video and user engagement it is a well-balanced risk/reward experiment for them.

Conclusion

The user number is the one that totally affected and overshadowed the whole earnings results. One of the reasons in my view is also the fact that PINS is not a traditional social media company but more of a social commerce platform. The measurement of MAU and DAU is probably not so much important with PINS because even if you go to the platform one time, it is the time when you want to buy something specific and are looking for ideas on this item, so you are logged on the platform at the prime moment to get monetized. It’s like you logged on to your Amazon account when you already have an intention to buy something which makes the one-time you log in a lot more valuable than if you would logging in multiple times without any intention to buy but just to be there because you are bored. Let’s look at things realistically, if somebody is selling to you a $5k couch and you are surfing through TikTok, Instagram, or Snapchat doing your stuff an ad won’t be much effective. While if you log in to Pinterest and search for couches you are much likely to be monetized for this case. Quality overtrumps quantity. And that is why we are seeing increased interest from advertisers on the Pinterest platform.

The stock price dropped like a rock and fell more than 25% after the earnings. The market cap of the company is now $36B which is very low in my view. The company is trading at around 12-14 times this year’s revenue with great prospects of having 30%-40%+ revenue growth for the coming years. At these levels, the company is also a prime candidate for a takeover. If you are an e-commerce player and are looking at the social commerce space which is set to grow for years the price drop in PINS probably gives you one of the best chances to own a vital asset in the social commerce space at a great price. I do not wish for a candidate to buy PINS as I believe the company can compound at a high rate for years without a takeover but the chance for M&A in my view is high right now also because of macro reasons (low-interest rates, FED tapper cycle not yet starting…).

Airbnb is coming out of the pandemic as a whole new beast

Airbnb reported strong numbers for the second quarter:

Nights and Experiences Booked 83.1M up 197% YoY and -1% from 2019

Gross Booking Value $13.4B up 320% YoY and up 37% from 2019

Revenue $1.3B up 299% YoY and up 10% from 2019

Net loss -$68M

Adjusted EBITDA $217M

Now while we expected big numbers compared to the year-ago quarter when covid hit it is nice to see numbers comparing the quarter to the 2019 quarter. The quarter, in general, showed just how much Airbnb is ready to capture the reopening of the economy and the travel industry.

But the things that stood out to me in the quarter were the following:

1. The TAM is expanding and Airbnb is evolving

The pandemic fueled a new trend in Airbnb’s business and that is long-term stays. So in reality Airbnb does not only service the travel industry but also the living industry. This is particularly interesting for Airbnb as it is now less dependent on top cities and long-distance travel. The two segments were one of the pillars of their business before the pandemic. Now long term stays and none top city locations are one of their highest growing categories diversifying and with that de-risking the business to some extend.

Long-term stays (defined as stays of at least 28 nights) remained one of their faster-growing category by trip length.

Management note on the call:

“And long-term stays (defined as stays of at least 28 nights) remained our fastest-growing category by trip length. Airbnb survey data indicates that people plan to continue to travel and live this way, with 81% of our long-term stay guests in Q2 2021 saying they plan to book another long-term stay in the coming year.”

“And one of the elements is that we're seeing the trends of long-term stays which we highlighted as a key strength in Q1, stays of 28 days or longer, remain being one of the largest and strongest growing parts of our business. So that was 19% of our nights booked in Q2 following the 24% in Q1 just as the mix of short-term stays kind of rebounded strongly in Q2”

With that their already massive travel TAM is expanding:

“In terms of TAM for alternative versus hotels. If you really think about Airbnb, it's not just a travel company. It is all about travel and living. And really any kind of stay, any kind of accommodation really short of kind of a full-year lease can be accommodated with Airbnb. And that's what we're seeing with the fact that we're seeing such strong growth in stays of 28 days or longer. And that that was 19% of nights in Q2. And we highlighted in the letter the fact that even the nights of seven days or longer were 50% of our nights. And so that is not hotels. Hotel average much lower, maybe one to two nights on average. We're going to be four-plus. And 50% of our nights were of seven days or longer.”

2. Covid has strengthened its business

There are two main things that I see that have happened because of Covid and that has strengthen Airbnb. They noted that because of the pandemic the company put a lot of effort in the year 2020 into effectiveness and flexibility. This means the company has become more effective in allocating its resources and capital because the pandemic forced it to be. In other word cost optimization and with it profitability. The other thing I am seeing is that the platform has become even more sticky for their hosts as host churn was lower both in 2020 and so far in 2021:

“And then, actually, what we've seen with our host churn has actually decreased from what we saw pre-COVID. So it was lower in 2020 than it was in 2019 and it's lower in 2021 than it was in 2020. So the overall churn rate continued to actually decline right now.”

3. Bullish Outlook and the opportunity

On the call, we could see that management is very bullish on the upcoming Q3 quarter stating that it will be their biggest quarter in terms of revenue and EBITDA in their history.

“While the COVID-19 pandemic creates ongoing uncertainty for our future results, we expect Q3 2021 revenue to be our strongest quarterly revenue on record and to deliver the highest Adjusted EBITDA dollars and margin ever.”

On the other hand, the company still has a big opportunity as so far strength in Q2 was mainly driven by North America and Europe. So other parts of the world are still not where they used to be as the vaccinations and re-openings are having a longer timeline. Another important revenue contributor that hasn’t returned fully is long-distance travel which before the pandemic contributed to nearly 50% of their revenue. These are two factors that will further strengthen is revenue pipe in the following months.

Conclusion

While I do expect Airbnb to have a tougher environment in the second half of this year with the Delta Variant spreading at the same time they have shown how resilient their business is and how quickly they can adapt to a changing environment with things like flexible search, long term stays and rural era stays. I also see a company that will be a much stronger company after the end of the pandemic with an even bigger TAM. At the same time, I see Airbnb in a perfect position if a higher inflation environment would present itself. The higher price in bookings and ease of scalability makes it perfect to absorb the whole inflation environment and shield its shareholders.

Sofi on a steady path

Sofi earnings numbers:

GAAP net revenue $231.3 million up 101% YoY. Adjusted net revenue $237.2 million up 74% YoY.

Net loss of $165.3 million vs net income of $7.8 million last year.

Other highlights:

Main takeaways from each business line:

Loan business steady as she goes

The loan business had good results growing 73% YoY to $166 million. What is very important for me is seeing that loans processes are being more and more automated:

“In Q2 more than 50% of personal loans process were 100% automated. That compares with less than 30% one year ago, which drove lower cost per loan and shortened time to fund to two days from four days last year and nearly a week a few years ago.”

With more automation comes more profit. The loan business main goal in my view is to help the company be more profitable at the moment and we need profit from this business segment to fuel growth in the technology and financial service segment of the business.

The guidance for Q3 was not what investors were expecting but they still upped the guidance even though they will have some headwinds in the second part of the year because of the extension of the CARES Act on the loan business segment.

Technology platform – Galileo

The technology segment drove strong results. The number of accounts at Galileo more than doubled in the past year growing 119%. Going from 36 million to 79 million this year. Revenue for the business segment was up 138% YoY (although you have to factor in that last year was not a full quarter because Sofi acquired Galileo in May last year).

Galileo is also doing an important shift from on-premise to cloud. This is very important as it will drive costs significantly down in the future and provide Galileo with bigger flexibility and scalability. It looks like we might see the transition to cloud finishing soon.

Management on the call:

“At Galileo, we near completion on a 15 month project to build out a new cloud computing environment to replace the on premises environment, and are now in Q3 focused on the migration of existing clients to the cloud, which we filed by onboarding new clients straight to the cloud.”

They are also putting a lot of resources to expand Galileo in terms of the team size and new product offerings. I like this move as Galileo is one of the best assets Sofi has with a great market and potential. Taking profits from the loaning business and putting it into Galileo seems like a wise move.

Financial service is the clear standout

The financial service segment with the super app is as expected starting to gain some serious traction:

“As we mentioned on the call, the business really saw a key inflection point in the quarter with revenue up 2.5x Q2 versus Q1. As we're now starting to monetize all that activity”

Net revenues for the segment were $17 million vs 2.4$ million a year ago, the largest driver of that revenue was Sofi Invest.

The number for Sofi products is also an important metric showing the adoption and usage of the products Sofi offers. Sofi products are the numbers of products a Sofi member has selected on their platform in the reported period. The numbers show adoption is growing fast:

While the segment in terms of revenue is still small the Sofi product count shows it is growing fast and that revenues will soon follow the product count in the coming quarters.

Conclusion

The flywheel effect that Sofi has placed because of their product portfolio and loan know-how is on the right path. The most interesting and important segments for me as a shareholder are the financial service segment and the technology platform segment. While I do acknowledge the value that Sofi’s lending business is making I am not a big fan of the loan market. While the quarter didn’t produce any blowout surprise in terms of numbers it showed that they are executing as planned and my conviction in the stock remains as it was before the results. The stock fell 15% after earnings and is now trading at an $11 billion market cap.

An important step for them will also be getting a Bank charter. They already applied for it and are working now with regulators on finalizing the process. Management didn’t give us a deadline on when they expect to finalize the process but as it seems the process is running normally and as a shareholder, I expect they can have it finalized in a few quarters.

Disclaimer:

I own PINS, ABNB and SOFI in my portfolio.

Nothing contained in this website and newsletter should be understood as investment or financial advice. All investment strategies and investments involve the risk of loss. Past performance does not guarantee future results. Everything written and expressed in this newsletter is only the writer's opinion and should not be considered investment advice. Before investing in anything, know your risk profile and if needed, consult a professional. Nothing on this site should ever be considered advice, research, or an invitation to buy or sell any securities.