Google the Golden Goose of the Internet

Welcome to UncoverAlpha newsletter. The newsletter is primarily focused on deep dives and insights into great companies in the tech and growth sector. The newsletter is free, so if you haven’t, you can Subscribe on the following link.

This article is sponsored by Stream.

Today I am extremely happy that Stream from AlphaSense is sponsoring this post! :)

I use their platform regularly and it is one of my main tools for analyzing a company also from a qualitative standpoint. The insights shared by ex-employees, big customers, and competitors about a company are very valuable in addressing the industry trends and path of where a company is going. You will see many of them in this article as well.

If you want to try the platform out you can sign up using this link and get a 14-day trial

No credit card is needed. Also, you can download as many expert interviews as you want and save them for later.

Stream by AlphaSense helps investment research teams access unique, high-quality expert insights faster and more cost-effectively than most traditional expert networks.

With Stream, you’ll have instant access to:

20,000+ on-demand transcripts of interviews between experienced buy-side analysts and company experts provide first-hand perspectives on the companies and sectors that matter to you.

The fastest-growing library in the industry, you're bound to find what you need, when you need it!

Insight from experts with 500+ hours of industry interview experience.

If you are interested in sponsoring the next article, you can DM and reach me on Twitter @RihardJarc

Hey everyone,

In this article, I am diving deep into a company everyone knows because they probably encounter its products on a daily basis. We are talking about Alphabet the parent company of Google. But since it’s easier and makes more sense for me in this article I will address Alphabet as Google. While most people know Google as a verb for internet search the company has developed & grown a lot in recent years, especially after the pandemic. But even though we might think of the company as being an unpenetrated monopoly the risks it faces right now, as I will break down in this article are noteworthy. Nonetheless, the company is still one of my core portfolio holdings.

Now let’s dive into it.

Breakdown of Google’s businesses segments

Google is a full fledges conglomerate. Like with every big Tech the company has multiple business lines and segments not to mention investments. This is a breakdown I made as I believe these are the segments most relevant for investors.

And because I want to dive deep into the things that matter the most for investors the focus of this article will be on these key areas:

- Search

- Network

- Cloud

- YouTube

Google Search and Network

The two business segments that account for most of Google’s revenue are search and Google network. Google is most known for its Search. It is the most dominant search platform in the world and commands an approx. search engine market share of 90%. Revenues under the Google Search category include revenues generated on Google search properties - including revenues from traffic generated by search distribution partners who use Google.com as their default search in browsers, toolbars, etc.

Google Network on the other hand includes revenues generated from Google Network properties participating in products like AdSense, AdMob, and Google Ad Manager. They are basically third-party sites or mobile apps that put Google ads on them and let Google take care of the ad part of their properties.

And Google is not only dominant in the US and Europe, but also very dominant in emerging markets (ex-China).

In fact, when looking at the future of Google Search, most growth will probably come out of emerging markets like India and Brazil.

The real reason why advertisers are paying for Google Search ads is very simple: you want to be on top of the ranking of your page when somebody is searching for a keyword you find could be interesting for your business. Because the results speak for themselves. The position ranking on Google’s search engine is the single most important factor when determining how many clicks you get to your site:

Click rate results according to position standings:

Position one: 30.2%

Position two: 12.33%

Position three: 7.77%

Position Four: 4.23%

Position Five: 2.78%

So even the difference between being number one when people google a keyword and being number two is a 144% difference in clicks.

An interesting aspect is if we look at what people google in search the most. The top 5 things people search for on Google:

The number one thing is YouTube which is again owned by Google. In the top 5 searches also comes Gmail again a property owned by Google.

All this success has also been translated into financials. Even though Google search was already dominant in 2017 revenues from that segment have grown from $69.81B in 2017 to $148.95B last year.

But what has happened in this time period that the growth was so strong when it comes to a mature product like search?

Google’s reaccelerated rise in search in the last 2 years

The rise can be factored in two main reasons:

First, it was the macro environment, especially the pandemic which pushed even more businesses and consumers to start their exploration and e-commerce journeys online, and with it, advertisers shifted even more massively from offline to online channels if they had any hope of reaching customers.

Apple’s privacy change resulted in third-party signal loss for many of Google’s competitors like Meta, Snapchat, and many smaller companies.

Google was together with Microsoft one of the biggest benefactors of the pandemic, the shift to remote work and the shift to business and consumers pushing online.

According to Statista the share of digital advertising in terms of revenue worldwide in % of total advertising jumped from 53.4% in 2019 to 61.6% in 2020 and then another big jump in 2021 to 65.2%. The projections for the coming years are now on a less steep growth curve with projections for 2022 and 2023 being at 67% and 68.3%.

Another big dynamic resulting in big success for Google is the iOS privacy change that Apple rolled out in 2021. This change completely changed the landscape for many ad and platform companies. The results of the change meant that advertising platforms can no longer get third-party data and tracking data of users and what they do outside of their apps. This has resulted in a drop in effectiveness and performance of many ad platforms like Meta’s Facebook and Instagram as well as Snapchat and other smaller players. But Google was less affected by the change as it is more of an intent platform where users come with a clear purpose and their need to get third-party data outside of their ecosystem is less relevant, since they know the intent of the user and since their ecosystem of 1st party data is one of the biggest out there.

This shift resulted in many advertisers increasing their budgets on Google versus other platforms, especially on their Search segment as they could get similar and measurable ROI on their ad dollars than before the iOS change. We can see the effects also in the financial results of these companies after the iOS change rollout (keep in mind both META and especially SNAP have smaller basses where the YoY growth is calculated).

But the iOS privacy change is not the only action taken by Apple that has helped Google.

The big Google & Apple deal

Apple and Google signed a very important deal for both companies. The deal means that Google pays Apple billions for Google being the default search engine for Apple’s Safari and Siri. The deal has a long history. It was first inked back in 2005 when Google and Apple signed a deal for Safari on Mac to use Google as the default search engine. Later on, that expanded to the iPhone as well as Siri. But the deal that was once minor in terms of size is now one of the biggest deals in the world. In 2014 it was believed that Google paid $1 billion for the deal to Apple in 2017 that number went up to $3 billion and now in 2021 analyst estimate that Google paid Apple $15 billion and will pay between $18 billion and $20 billion to Apple in 2022.

As you can see from the numbers the deal has become huge and very significant for both companies. On one hand, we can see from Google’s financial filings that a lot of the growth in recent years in Search comes from “mobile devices” as a lot of traffic now is mobile. So being the default search engine of iPhone’s Safari is very important to Google as it probably drives a lot of that growth. But the deal is also very important now for Apple. The $15 billion in 2021 means that almost 16% of Apple’s net income comes from the deal.

I can’t shake off the feeling that the deal given the size is now actually more important to Apple than Google. Because in reality if Apple would have changed the default search engine to something else than Google it would probably face quite a backlash from most of its users since Google Search is from a user perspective when it comes to results still the best search engine out there. At the same time, Google paying $20 billion in TAC (Traffic acquisition costs) probably means that this is not their most profitable business deal. So, I wonder if Google should use this moment and negotiate a better outcome for them and with it lift its bottom line.

There is also the case that regulators will limit the deal as it is recently getting the focus of regulators as being a monopolistic practice. Rumors are that Apple is also working on their own search engine, but I think this would be only the case when regulators would stop the deal and Google would pay 0 to Apple because right now getting $20 billion per year is probably much higher than what Apple would get if they would launch their own search engine. I think even if users would have a question before using Safari the first time in which they could decide which search engine they want as the default the big majority would choose Google.

Nonetheless, it is a risk to Google that investors need to keep in mind because it is important in terms of size and reach.

Google’s worst enemy when it comes to search

But the Safari deal is not the only thing that Google should be worried about and keep a close eye on. In the last 3 years, there is a rising player with enough resources to attack Google on an important vertical for search – the e-commerce vertical. The competitor is Amazon. Amazon has become a strong competitor to search because customers are starting to use Amazon search more and more instead of Google when it comes to buying things. Amazon Advertising has been on a big growth path in recent years:

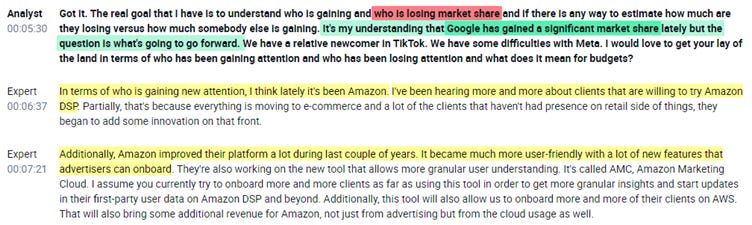

Its ad business generated more than $30 billion in revenue last year and is still growing also in recent quarters in 2020 higher than other industry peers including Google. Also looking at various expert interviews from the last few months with former employees, customers industry insiders the theme is more than clear. Amazon is taking market share and Google’s search is one of the targets in terms of taking share.

These are just some of the recent expert calls from the last 2 months from Stream with industry insiders and they show a clear pattern:

Director at MightyHive a big digital consultant agency:

Expert 15 years in digital media marketing, current Vice President of Client delivery at Kepler (global digital marketing service company):

“We haven't talked about Pinterest, but I do think that Pinterest specifically for retail clients, branding, is a really beautiful visual place to create community and is really interesting as well. I think they will continue to be around. Who will they steal share from? I'm not sure. Amazon is just steamrolling everybody. I only anticipate that the Amazon value opportunity to continue to grow.”

Former Head of Professional Services for India and Southeast Asia at Google:

“Amazon as a platform is obviously picking up, which means that consumers have started to go with an Amazon to search for a product rather than searching on Google Search. I know that there are some users in Search who [already] they're moving to the big platforms. I don't think that will make a big dent on Google Search business the next one to three years for sure. A longer horizon five to 10 years I would say it would become a big question”

Sales lead at InMobil:

“If you're asking my personal opinion as far as respect goes, I think Amazon is where my respect is a little bit skewed towards. Though it's not completely integrated, but that's one player that's probably causing a serious competition or building up serious competition for Google.

If you see, Amazon not only has a shopping app on the mobile, they understand what their shopper purchases, what are his spending patterns, how much of Amazon Pay Wallet that he is using. Now, they're also getting into consumer durables. For example, they also invest in consumer durables. One of their recent acquisitions have been the robo vacuum. That probably wherein you need to feed in a consumer.”

Former Global Head of Ad ROI/Measurement at Google:

I can go on, but I think you get the picture.

These insights show what also the financials show. Amazon is gaining market share when it comes to e-commerce because of its ecosystem and convenience with Prime and its vast data points they have on customers’ shopping behavior also based on their Prime offering. A lot of customers are shifting search to Amazon and Google will have to answer to retain the important e-commerce vertical of Search.

Another threat is also the rise of short-term videos specially TikTok and Reels. Recent data showed that many Gen-Z’s are starting to use TikTok and Instagram’s Discovery engine for search. At a technology conference in July Google senior vice president, Prabhakar Raghavan acknowledge that:

“In our studies, something like almost 40 percent of young people, when they’re looking for a place for lunch, they don’t go to Google Maps or Search. They go to TikTok or Instagram,”

While I think the 40% number seems a bit excessive and could be a strategy for Google to show that they are not a monopoly with the regulator's eye there is some truth here. Also, in another recent expert interview with a former Google employee, the ex-employee got this question and answered with clear affirmation that “It is a huge threat” as the younger generation is using social media as the starting point of their research and often even converting there.

Before moving on all of the insights from the expert interviews above are found on Stream. You can use this link to get a free trial and check it out. For an even better understanding, I highly recommend reading the whole interviews of the above-mentioned people.

YouTube

The second pillar of Google’s conglomerate is YouTube. Google bought YouTube in 2006 for $1.65 billion. It has since become one of the biggest internet assets out there.

Some fascinating stats:

There are 2.1 billion Monthly Active YouTube users worldwide.

62% of internet users in the US access YouTube Daily, 92% on a weekly basis, and 98% monthly.

It is a very sticky platform for all age groups including Gen-Zs.

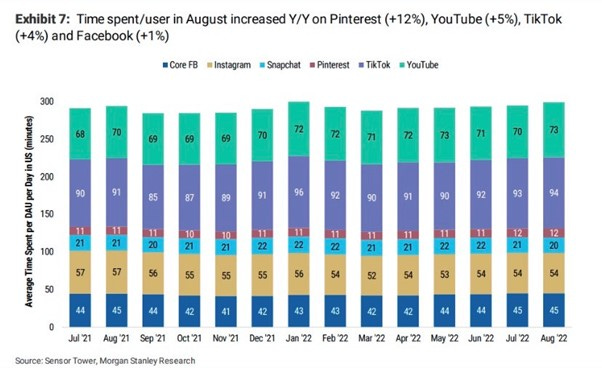

When it comes to time spent it lags only TikTok based on average minutes per user:

There are two ways in which Google monetizes YouTube. The first one is via advertisement and the second one is via YouTube premium subscription, which is a monthly subscription you pay to not receive any ads. The two segments are not reported together in Google’s financials but here are the numbers:

When it comes to YouTube ads the business has been growing fast in the last 5 years with almost $30 billion in ad revenue in 2021 up from $8 billion in 2017.

As for YouTube premium in 2019, CEO Sundar Pichai disclosed that YouTube Premium & Music had roughly 20 million subscribers. YouTube reported on September 2021 that that number is now around 50 million. At $11.99 per month and if we take into account that would mean around $600 million in monthly revenue or $7.2 billion annually (we have to take into account free trials and family packages so the real number is probably around 70% or around $5 billion ).

For what Google once paid $1.6 billion the asset is now bringing in $34 billion in revenue every year and still growing.

YouTube also has a business model where creators receive 55% of the ad revenue YouTube gets and an undisclosed % of the revenue from users who have YouTube Premium (based on the time they spend watching a creator’s content).

In September 2020 they also launched YouTube Shorts. A short video format meant to tackle TikTok and Instagram Reels. A few months ago, YouTube reported that 1.5 billion people are watching Shorts each month. But what should really be interesting to watch and could appeal to a wider range of creators on YouTube Shorts is the announcement Google just did a few days ago that YouTube is launching a revenue share deal with creators also for Shorts. The revenue will be shared with creators that have at least 1,000 subscribers and 10 million Shorts views over 90 days. The revenue share will be 45% instead of the 55% that is on normal YouTube videos. This in my view is a big change in the industry, because so far TikTok, Meta, Snapchat, and even Google attracted the creators with “Creators Funds” that pay creators a fixed amount based on the success of the videos, but those numbers are normally much lower than what a creator would earn via a revenue share agreement. For comparison, TikTok is set to raise its US Creator Fund to $1 billion over the next three years and $2 billion internationally, but YouTube paid creators over $30 billion in ad revenue over the last three years. Having creators make videos on your platform instead of the competition could prove to be a key turning point for short video platforms. In fact, if Meta follows with a similar approach this could mean big pressure for TikTok, as out of all three TikTok has the least developed monetization platform and would probably result in less advertising revenue for the same amount of views a creator would get on a video compared to what they would get on Meta’s and Google’s platforms.

And while Google doesn’t share any specific information on how YouTube Shorts are performing here are some estimates. The most successful market for YouTube Shorts is India where TikTok is banned (YouTube launched Shorts in India in September 2020). But it seems they are gaining in popularity also in the US. YouTube launched Shorts in the US in March 2021. A recent survey from a data research platform called Inmar Intelligence showed that 25% of respondents said YouTube Shorts are their preferred short-form video service in September 2021. That number has grown in June of this year to 29%. The answer TikTok also fell in the same period from 49% in September 2021 to 44% in June of this year. It seems Google is starting to gain some market share, primarily at the expense of TikTok which seems that its rapid growth days are behind them.

Google Cloud

The next pillar of Google's business is its public cloud business called GCP (Google Cloud Platform). By market share, it is the third largest cloud provider lagging behind Amazon’s AWS and Microsoft’s Azure. It is from a strategic perspective a very important business segment as cloud computing will probably be the biggest software industry in the next 10 years. For more details on the cloud industry in general and the market shares you can view one of my previous articles when I talked about AWS:

The thing that investors should focus on when it comes to GCP is that it keeps the rate of growth at least in line with AWS and Azure, although a slightly higher growth rate would be more optimal also given the lower base that it has compared to the other two.

In terms of past revenue growth, we can see a similar story in both Search and YouTube. The Cloud business has grown from $4 billion in annual revenue in 2017 to over $19 billion in 2021. In their recent Q2 2022 results they also reported a very healthy revenue backlog. As of June 30, 2022, they had $51.2 billion of remaining revenue backlog and expect to recognize approximately half of that amount in the next 25 months. Revenue backlogs are commitments in customer contracts for future service that have not yet been recognized as revenues.

A former Sales Director for EMEA at Google Cloud explained well where Google’s advantages and disadvantages are compared to AWS and Azure:

Disadvantages: less extensive range of infrastructure applications, less spread of data centers (although they are working fast to open many new areas, including Europe), smaller array of offerings, less strong sales team and partner channels than the other two.

Advantages: flexibility, easier to manage if you have hybrid clouds, advantages in use cases like big data, machine learning, artificial intelligence, and analytics; better connectivity and flexibility when it comes to open-source software

The use case where many industry experts agree is that for AI Google has the most advanced developments and setups and as the percentage of spend on cloud shifts more towards SaaS products and AI and less towards infrastructure Google might have an edge here. So even though GCP is smaller than AWS and Azure it’s growing at similar rates as the other two and it seems it has solidified itself as the number three public cloud provider. The perception of GCP in the developer community has also improved a lot from what it was just a few years ago when nobody would even think to compare it to AWS or Azure. Google’s benefit is also that Google and YouTube are GCP’s best and biggest clients. Also, with the transition into more video content, GCP should benefit from Search and YouTube needing more computing power but at the same time having a strong cloud infrastructure can also be an advantage for YouTube and Google Search as the discovery engines are using more AI algorithms for recommendations for content as well as for ad monetization.

Future plans

When we look at the future for Google it’s clear that they are betting big on their Cloud business and on the ad side they want to increase the amount of first-party data they get on users. They want to have as many “points of contact” with their users are possible, because they know the advertising landscape is strongly shifting towards first-party data. Those points of contact can be from people using their Workspace suits, apps like Maps, or even Smart home gadgets like Nest. But they also want a strong presence when it comes to the new trend of short-term video and moving their asset up on the e-commerce discovery funnel (similar to TikTok and Instagram). They are betting big with YouTube Shorts, but it’s far more than that. It was interesting what a month ago a former employee of Google told while doing an expert interview:

So Google is thinking about video specially short-video in a broader sense than just YouTube. The feature that this ex-employee means is that Google’s classic Search wants to move more into video search and provide results with videos instead of text. It is similar in a way to TikTok and Instagram stories but regarding the intent part, it’s more like what Pinterest is doing with Idea Pins, where you get short videos with explanations and inspirations.

Is Google ready to make a big move with M&A?

One way Google might be thinking to tackle Amazon and the e-commerce vertical is with Pinterest. Recently at the CodeCon Conference Sundar Pichai was asked what he thought about Twitter and all the M&A around it and quite clearly said that they are not interested in it, but then the reporter out of the blue asked him what about Pinterest? And Sundar had real problems answering this question in the end and said he can’t comment on any potential M&A deal.

Here is the video of the event and Sundar’s response, judge it by yourself (go to 42:19 to see the conversation about Twitter and Pinterest):

But looking from a strategic perspective Pinterest makes perfect sense for Google. The main reason is that it is higher in the e-commerce funnel than Amazon. People come on Pinterest to find inspiration and ideas about a product and the characteristics of the product that they want to buy. On Amazon, they normally come with an already defined idea. With Google owning Pinterest they could be higher in the e-commerce conversion cycle and redirect those users to Google assets. At the same time, Pinterest can boost its efforts and content library when it comes to educational search content and picture content.

Recession what can we expect?

Since there are big signs that we are already in a recession or at least going in that direction what can we expect from Google in this environment? While it’s more or less known that the advertising sector is affected by a recession in terms of ad spending let’s look at how Google performed in severe economic downturns in the last 20 years. First looking at 2008 when Google was a smaller company than it is today the stock dropped from a high of $17.9 in 2007 to a low of $6.72 in 2008. That’s a 62.4% drawdown from highs to lows, but keep in mind that time Google’s market cap hovered around the $200 billion to $150 billion market cap. Nearly 10x smaller than today.

Another severe downturn happened in 2020 when the pandemic hit. Google’s stock went from $76.53 to $51.85 – a +32% drawdown from its highs.

So where are we today? At the time of writing Google’s stock is worth $99.28 down 34.5% from its highs of $151.55.

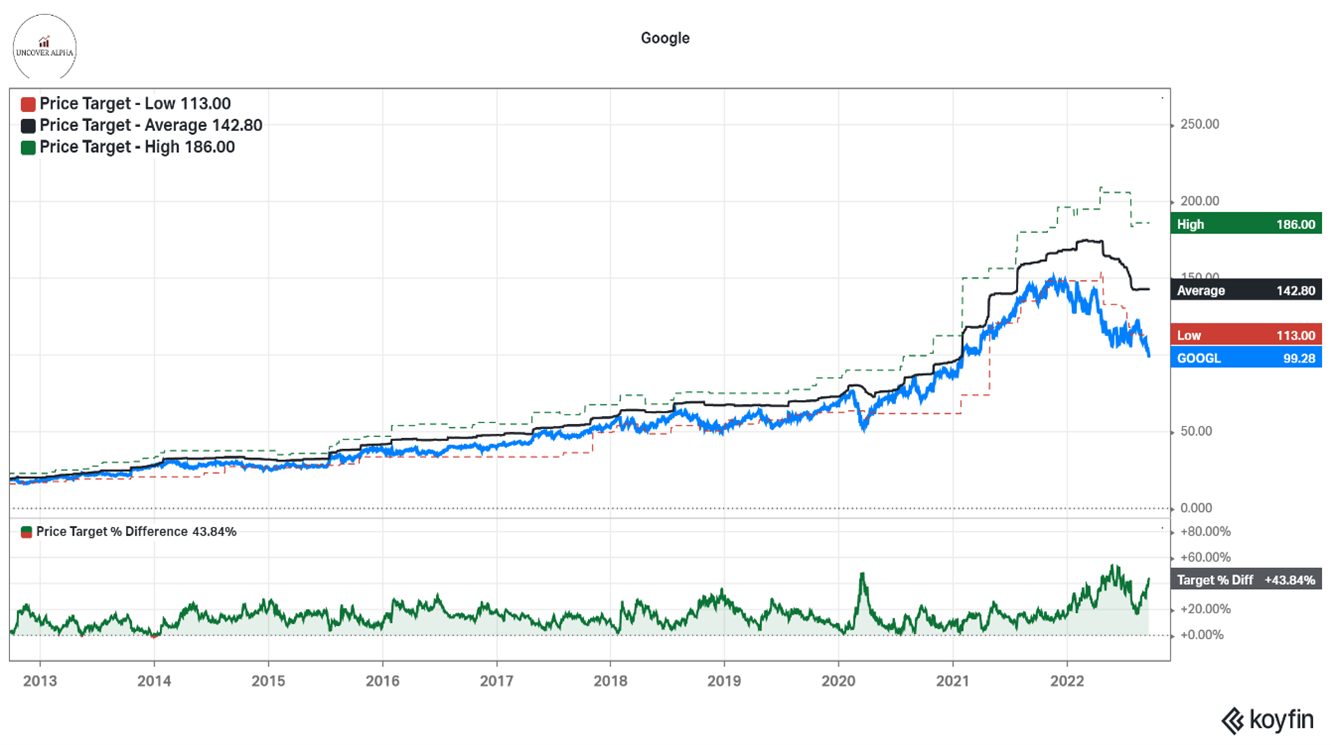

It’s also interesting to look at the Analyst Price Target graph for the last 10 years. As you can probably note the stock price tends to be near the Analyst's low price targets and the average ones. In the last 10 years, we are now at one of the highest differences between actual stock price and the low estimate for analyst’s price target.

But in this economic downturn, Google has a lever to pull that I didn’t use yet. Not only did revenues and profits balloon after the pandemic headcount also grew substantially. It has grown to 156.500 people in 2021 from 118.900 people in 2019.

It has gotten to a point where even ex-Google employees acknowledge this. Here are the words of a former Global Head of Ad/ROI Measurement at Google:

“I think from what I understand, again, anecdotal, my own perception, that they've hired so many people that there's too many people to do the work that needs to be done. They could probably cut people and nothing would change in the business. People just aren't that busy is a sense that I've been told. That hasn't always been the case. Again, anecdotal, but from what I've heard, a general sense that it's such a big organization now that there's just not enough work for all these people. You end up being 70% busy or something like that.”

At the same time this has also changed the culture of the company in a more comfortable way for employees but not necessarily a good one for the company and its shareholders:

“On the other hand, not everyone's hungry at Google. There's sometimes a sense that Google, particularly in my last couple of years and I know that this has continued, that there's not enough work to do. I would say you're almost not hungry. You're not worried about getting fired, but you're also not hungry to do crazy things, partly because it's gotten so big. You're like, "Well, it's as big as it's going to get. Whatever I do is going to be a small drop in the bucket." It doesn't feel as results-oriented. It's become a little bit more of a lifestyle company.”

Recently even the CEO Sundar Pichai said the company needs to be 20% more efficient.

Without the optics, this basically means fewer employees, and those who are working to work harder.

In my view, Google has quite some room when it comes to employee efficiency and in a severe downturn may pull those levers to reduce costs and stabilize profitability. But when you are as big of a tech company as Google you don’t want to be the first one calling for layoffs. That is why everyone is waiting for the first big tech company to start with layoffs whether that is Meta, Google, Amazon, or any other. They are all trying to save their reputation as being a strong place for talent because at the same time they know that when the market and economic conditions change, they are going to need new talents and be a place where people want to come and work.

Just to get an idea of how much the “buffer” is in dollar terms. Let’s look at Google’s Selling, General, and Admin expenses and & R&D expenses for the current (LTM) period.

Selling General & Admin expenses are now $40 billion up from $28 billion in 2019

R&D expenses are now $35.36 billion up from $26 billion in 2019.

While I am not saying that the difference between these costs which stand at over $21 billion in the 2022-2019 period is everything that Google can cut, I am saying that this number gives Google enough room to become more efficient and stabilize its profit at least to some degree in an event of a downturn in profit.

While a recession is never a good thing it can also bring some positive outcomes to Google as the company once again becomes more efficient and can focus on the things that need to be priorities instead of spending all over the place. With competition in the online ad space heating up Google needs to retain its strong position and efficient model to continue executing and retaining/growing its market share. Especially because the online ad market is not fully grown to its potential yet with the share of the online ad market in the total advertising market still standing at 62.5% far from what I believe will be a world where more than 80% of advertising will be done online. The reason is that online ad formats are much more effective for advertisers and more and more of our time spent is moving online every year.

Also looking at the biggest economic recession in 2008 Google managed to grow its top line by over 30% from 2007 to 2008 and keep net income stable with a growth of 5% in the same period. While Google was much smaller at that time it still had $20 billion in revenues and $4 billion in profits.

Valuation

Now let’s move to the valuation part. When valuing Google an appropriate assessment is to split the business into two categories. One is the GCP Cloud business and the other is the Google ad business.

If we first look at the Cloud business. The cloud business is not yet profitable but generated $19 billion in sales in 2021, it’s also on pace to deliver at least $24.7 billion in revenue in 2022. If we look at other cloud businesses and their valuation. I recently did an article on Amazon where I broke down AWS and gave it a 12.5x sales multiple given its dominant position and growth rate. Similarly, the market is valuing Azure inside Microsoft according to my observations around 12.5-15x sales given that it has been growing a bit faster than AWS in the last few quarters and it also has a large dominant position as AWS. What we do know is that a publicly traded company called Digital Ocean which is a small cloud provider currently trades at an 8x P/S (LTM) ratio. Given that GCP is the third largest cloud provider and has a much more dominant position than Digital Ocean but still lags AWS and Azure, I would give it a fair multiple of 10x P/S.

If we take that multiple the value of GCP is $247 billion.

Google also has $172 billion in current assets or cash and $99.7 billion in total liabilities. That adds to $72.3B of net cash.

Now if we look at the market cap of Google, it is trading at $1.311T. Striping out net cash and GCP we get to $991.7B.

Even in a severe economic recession like we had in 2008 Google fundamentally performed really well.

Revenue in 2007 was $16.6 billion and actually grew to $21.8 billion in 2008. Net income in 2007 was $4.203 billion in 2007 and went to $4.226 billion in 2008. So even though we had a severe economic shock revenue still grew but at the same time, net income stayed stable.

Now given that we had a big digital boom in 2020 and 2021 I still expect in the event of a recession that Google’s both revenue and net income will drift lower, at the same time I don’t expect net income to drop more than 15% versus 2021 levels, given that Google is one of the main platforms for advertisers to spend ad dollars (versus some other smaller experimental platforms where I expect a bigger ad pull), they have substantial room to cut costs given the fast pace of cost growth in the last 2 years and overcapacity they have internally.

Google earned $76 billion in net income in 2021. If we estimate net income to drop 15%, we get to a net income of $64.6 billion. That would mean that Google’s ad business currently valued at $991.7B is trading now at a 15.35x Price to earnings multiple (even when considering the possible effects of a recession).

I find this valuation compelling given Google’s strong position and the current S&P 500 multiple of 19. Even more, looking back in 2008 at the low point Google’s P/E ratio was 16.5x.

What we also didn’t mention when it comes to the net income is that a year ago 1-year Treasuries yielded 0% now they yield over 4%. This means Google can place its $172 billion cash pile in 1-year treasuries and earn over $7 billion in profits with it (that is almost 10% of Google’s current net income). Although honestly, I would like to see them use that cash to increase their already big $70 billion buyback program (since they make almost $70 billion a year in FCF).

Summary

Google is embedded in almost every aspect of the modern internet we know today. They have the biggest number of users using one of their products but at the same time, other Big Tech and emerging players are starting to emerge as serious competitors. The valuation given its current levels is at historic lows and in my view includes a lot of risks including macro risks from higher interest rates and high inflation rates. I find Google to be one of my core portfolio holdings as it owns some key digital assets, has executed on a high level over the past years, and has built up a war chest of cash.

In this article, we didn’t touch Google's other business segments like Android, Play Store, or Other bets like Waymo, because I wanted to focus on the things that I find most impactful right now for investors to understand. But given how many of those other segments Google also has I will leave them for part 2 of the article.

The graphs in this article were made using Koyfin. UncoverAlpha subscribers can get a 10% discount for Koyfin using this LINK.

If you haven’t yet, feel free to subscribe to this free newsletter & share. If you feel so, I would really appreciate it if you shared the link to the article on social media, as this is the best way to find new subscribers to UncoverAlpha and keep the newsletter free for everyone. Thank you very much all!

Disclaimer:

I own GOOG stock.

Nothing contained in this website and newsletter should be understood as investment or financial advice. All investment strategies and investments involve the risk of loss. Past performance does not guarantee future results. Everything written and expressed in this newsletter is only the writer's opinion and should not be considered investment advice. Before investing in anything, know your risk profile and if needed, consult a professional. Nothing on this site should ever be considered advice, research, or an invitation to buy or sell any securities.

Excellent info and analisis. Quiet impressive.

Great DD into the main revenue generator of Google