Google's Sum-of-Parts Analysis: Why a Breakup Shouldn't Alarm Shareholders

Hi all,

Given the pressure big tech is getting lately from antitrust regulators, I decided to share my sum-of-parts analysis on the example of Google and what shareholders could expect in the event of a Google business breakup.

Google's break-up chances

The motivation to break up Big Tech has been growing in the last few years, especially since 2021, when FTC Commissioner Lina Khan started her term. While the new upcoming administration doesn't have the same motivation for breaking Big Tech as the current one, it is still interesting to view what that would mean from a shareholder perspective.

Given that Google's case seems to be the further along I decided to focus on Google. A few days ago, the U.S. Department of Justice (DOJ) proposed breaking up Google as a remedy for its monopolistic practices in search and advertising. Specifically, the DOJ is asking a federal judge to force Google to sell its Chrome web browser, arguing that its integration with search has solidified Google's dominance. Additionally, restrictions on Google's control of the Android operating system and its AI technologies have been proposed to prevent the company from favoring its services unfairly.

As expected, Google plans to fight this proposal. In a recent interview with an antitrust legal expert, the expert thinks that Google will likely argue on appeal that the court's decision is inconsistent, as it acknowledged that Google's dominant position in Search resulted from innovation—a factor that, under U.S. antitrust law, would make its monopoly lawful.

However, he also acknowledges that the court might look at the Microsoft 2001 case and feel that the remedy back in 2001 was insufficient for Microsoft. That might result in the possibility of selling Chrome or selling off or doing a mandatory, taking Android out of control or Android away from Google (full interview found on Alphasense).

Even if the chances of this are small, let's look at the value of Google if it were broken down into different business units:

Google's main business segments

This is a good chart showing the breakdown of Google's business units and their contribution to revenue.

The main units of Google and the ones which we are going to be estimating the value from are: Google Search & network, which is the largest revenue source with over 65% of total revenue; YouTube ads + subscriptions; Google other subscriptions and services (like Gmail, Chrome, Android and Google Maps), Google Cloud (GCP and Google workplace) and Other bets (from which I will focus only on the most mature two, because I think the value is the biggest there which is their AV unit Waymo and DeepMind).

Search & network

I have written thoroughly about Google and Google Search over the last few years. My last article on Google, Google: The Innovator’s Dilemma is real, extensively covered my thoughts on Google Search, and my view has stayed the same since that article at the start of this year. I still believe Search is facing the classic innovator dilemma where it must cannibalize and morph into an AI Search engine. It might come out of it as the leader in AI Search, but so far, it doesn't look that way, with ChatGPT becoming a verb similar to Google. On top of that, the alternatives to Search are growing, like mushrooms, with LLMs enabling different features and new products. That doesn't mean that Google Search has no value as a standalone business.

Before I estimate its value, let's look at some new data about Search.

Google's position regarding monetizable searches in the e-commerce segment remains stable. Still, contrary to many's belief, there are other ways shoppers start their online journey, with Amazon being a strong competitor here, together with the growing trend of social and now ChatGPT (LLMs).

That said, Morgan Stanley also noted that they see younger cohorts' behavior on social media (Meta and TikTok) together with GPT more prevalently at the top of the e-commerce search funnel. If we add the fact that most younger adults in the U.S. prefer the iOS ecosystem vs the Android, Google's grip on this audience is even smaller.

Google Search still dominates advertising verticals like online travel, healthcare, autos, and finance, but I also see challenges there. One of Google's biggest clients in the travel sphere is Booking Holdings. A comment that struck me in one of their latest earnings calls was praising social media for becoming much more effective for their use case:

"we are really excited about this social media because we are now seeing that the effectiveness of social media platforms in terms of performance marketing spend has suddenly seen kind of a leapfrog change. Why? Because we see that the effectiveness of spend on those platforms suddenly leads to much higher ROIs. It has probably to do with their investments in AI and being able to target customers in a much more effective way. So we are expanding our relationship with them. And we have been working with them for many years and it was difficult to really make it effective and the returns were too low«

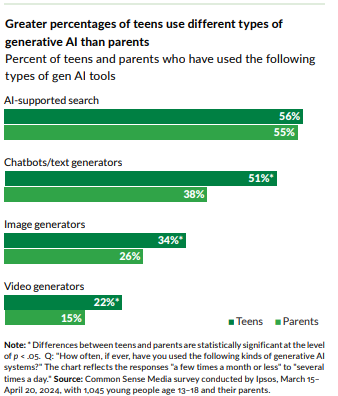

Also, the topic of teen usage of GenAI products from a recent teen survey is fascinating. We can see that teens are using chatbots and AI-supported search in equal matter (compared with their parents).

Also, looking at the data on what teenagers and their parents use GenAI search, it is clear that primarily nonmonetizable Google queries dominate it.

My point here is that to understand the search disruption theme, we have to look at unmonetizable queries first as they show the behavior changing and new habits start to form with it. Later, those habits will transition to monetizable search queries like shopping. At the same time, AI search and chatbot providers are just starting to roll out their shopping AI agents and shopping features (like Perplexity did 2 weeks ago with Perplexity Shopping). So, the data on how shopping intent search is changing will be more relevant a year from now than what it is today.

Nonetheless, both Google Search and Network generated $222B in revenue TTM. While network revenue was flat recently, Search continued to grow at 12% YoY in the recent quarter. Google, as a company, has a net income margin of 27.7% (TTM). Given that the GCP and some other units are not profitable or have a low-profit margin, it is a fair assumption that Search net income is at least 27.7%, if not higher. If we apply that multiple, we get a net income of $61.5B on both Search and Network.

There are two main risks to Search right now. One is the danger of being disrupted or cannibalized, as again, the consumer behavior shift first starts slow but then fast, and it can severely affect the profits. On top of that, it seems increasingly likely that Google will lose the default Safari deal with Apple. While this might not have been a problem before 2022, when I think most consumers would voluntarily choose Google to be set as a Safari default on their iPhones, now with LLM alternatives like ChatGPT, Perplexity, and others, this doesn't seem like a total slam dunk case for Google. The chances of those profits sliced in half in a not-so-distant time frame are not crazy. With that in mind, my fair value multiple for Search as an independent business now would be a 13x P/E. With that, the Search would be valued at $800B.

Before we continue with the article, I invite you to join a webinar on the topic of the future of AI in the investment and investment research industry.

The webinar will be hosted by Patrick O’Shaughnessy host of Invest Like The Best. He will have guests like Divya Narendra, the CEO of SumZero and co-founder of ConnectU (predecessor to Facebook).

now back to the article…

YouTube & services (Chrome, Android, Maps…)

YouTube is one of Google's biggest assets. Despite being already one of the world's most used daily digital assets, everything looks like this will remain the same in the future, with most young adults and teenagers using YouTube daily.

It generates $34.8B of ad revenue in the last 12 months. It also generates a significant portion of the $39.5B (TTM) service & subscription revenue with its ad-free tier, YouTube Premium. Given that YouTube announced at the start of this year that it had surpassed 100M subscribers globally, we can assume that the average price is somewhere around $10 (the basic price is $14, but there are discounts on Family, student, and other packages + different pricings given your geolocation). It is fair to assume that YouTube Premium brings in $12-$15B annually for Google. If we take a $13B estimate with YouTube Premium revenue and add YouTube ad revenue, we get to a total revenue (TTM) of around $48B.

If we look at peer valuation from Meta or Netflix, they trade in the 9-10x P/S ratio. But for YouTube, it is fair to assume that their net income margin is much lower because YouTube's ad revenue takes 45% of the revenue, and the remaining 55% goes to the content creators. In comparison, Meta's gross profit margin is over 80%. Netflix's margin profile seems more similar, with a 45% gross profit margin. Netflix also has a net income margin of 15-20%, which could be similar to YouTube's. If we take the midpoint, YouTube's net income would be around $8B. Meta and Netflix trade at a 27x and 50x P/E mutliple. In current market conditions, YouTube getting a 35x P/E ratio would be something expected. With that, the estimated value of YouTube as a stand-alone business would be $280B.

In this segment, we still have around $26.5B in other service revenue from Chrome, Android, Maps, and other services that Google offers. It is hard to break down these services as, in some cases, they are very dependent on each other. For example, Chrome benefits immensely from being a default browser for Android devices. Services like Maps, Chrome, and others also benefit significantly from being pre-installed on Android devices, so keeping these pieces together seems critical to maximizing value. If these were broken down into their own products with the current data that we have, it would be almost impossible to value them.

If we take them as a group, a more appropriate net income margin than that of YouTube is, in my view, that of Search, as these products have fewer costs associated with their usage than YouTube. If a 25% net income margin is applied to this segment, we reach around $6.6B in profits. Given that the growth rate of this segment is in the 10-20% range and that inside of the whole segment that was reported, YouTube Premium was the highest grower, my estimate for the growth of these services (ex YT Premium) is more in the 10% range. This is in line with app revenue data saying that mobile ad spending in 2023 grew 7.7% YoY, which is where Android makes most of its cash. Given current conditions, applying a 20x P/E ratio on a 10% YoY grower seems reasonable. According to that, the estimated value of this segment is $132B.

Google Cloud

I already wrote about the cloud space in great detail in my previous articles, so the thing that I want to go over here is the latest data that we have:

The first thing we have to note is that when we talk about »pure cloud« revenue, the only pure data point is the one from Amazon's AWS, where they report AWS revenue. In their cloud revenue figures, Google and Microsoft include other cloud services, like Google Workspace, making direct comparisons less straightforward.

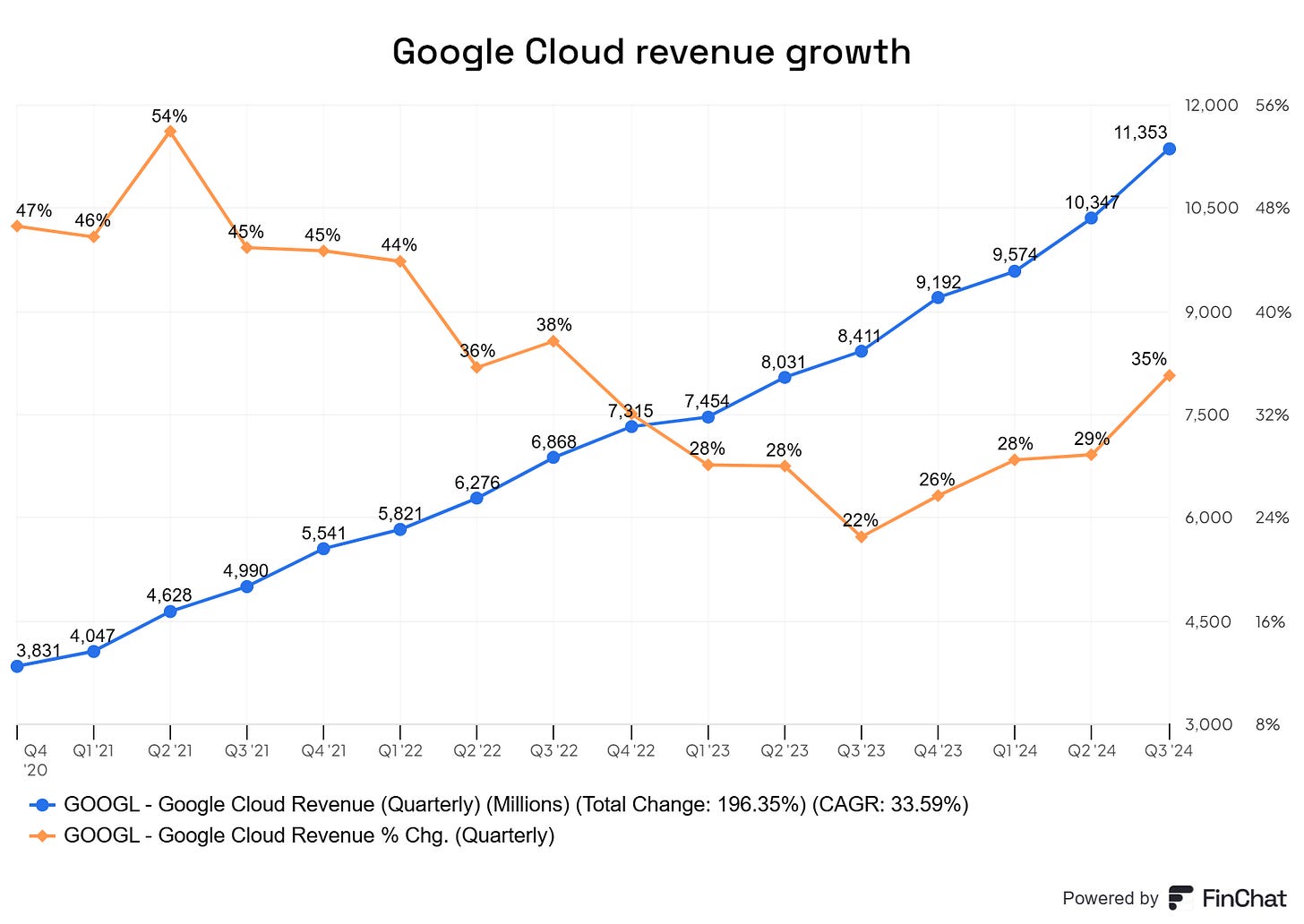

Looking at Google Cloud as a whole segment, it is now at over $40B in TTM revenue. It has also accelerated recently, as all cloud providers have because of new AI workloads. Google Cloud reported revenue growth of 35% YoY in the last quarter.

We can see that the 2022-2023 period, when clients were optimizing their cloud spending, has passed, and growth is reaccelerating while at a much bigger revenue run rate.

What is also important is that, as I mentioned in my articles quite often, the fight between the cloud providers has now shifted to providing LLM models and cost-effective chip infrastructure as the market is shifting from training to inference AI workloads. Within this topic, an integral piece for the cloud providers is their custom ASICs. Google has a significant advantage regarding its TPUs, which are already in the 6th generation. As a Former Google Unit Head stated on the AlphaSense platform, TPUs are approximately 66% or less expensive to operate compared to GPUs for the latest generation, with previous generations being around 40-45% lower in cost.

Both Amazon and especially Microsoft need to catch up when it comes to their custom chip development. TPUs are something that Google is already using heavily internally for their LLMs and other AI workloads, but now they are beginning to offer services run on TPUs and even TPUs to outside clients. Apple Intelligence is supposed to be trained on TPUs.

With the fact that Google Cloud is currently the fastest growing out of both Azure and AWS and the fact that they have the best and most mature custom ASIC offering, they, in my view, deserve a slight premium compared to AWS and Azure and would get that if they were an independent company. The multiple that a Google Cloud would get in today's market is around 15x P/S, if not higher. If we apply the multiple to the $40.5B revenue run rate, we get to a Google Cloud value of $607B.

Other bets

The two other business segments I want to include here are Google's AI DeepMind unit, which recently merged with Google's Brain business unit, and Waymo.

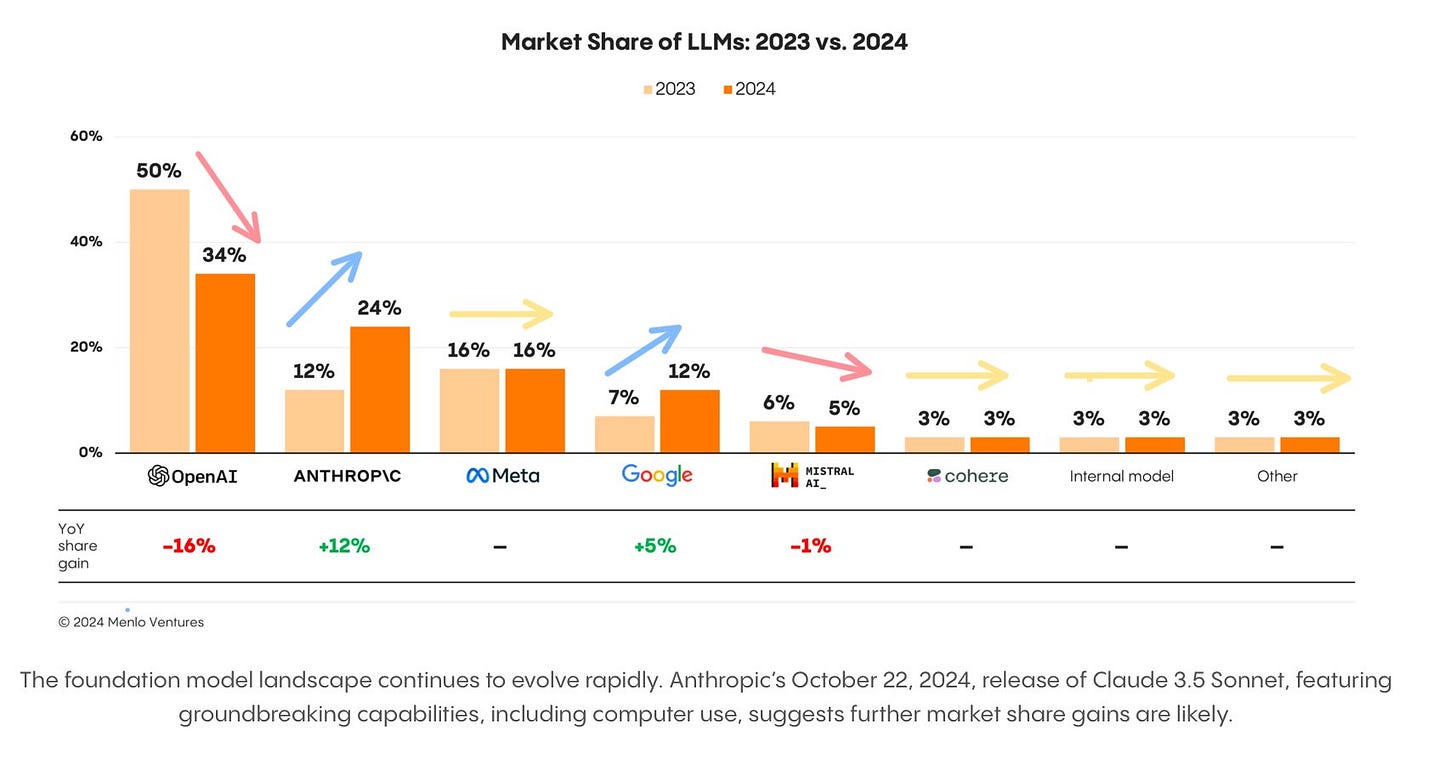

For DeepMind, I wanted to separate this unit and include it because, as I said in this article, I believe Google will have to cannibalize its Search unit over the coming years, and DeepMind, with its LLMs products, will take over. In assigning value to Google's DeepMind unit as a separate entity, I would again look at their peers. The two peers that matter are OpenAI and Anthropic. OpenAI just recently completed its new investment round valued at $157B. Rumors have it that Anthropic has floated a $40B valuation (details of Amazon's recent $4B investment have yet to be disclosed). Trying to value this unit as a separate unit is hard as a lot of the value derives from DeepMind having access to GCP, cheap TPUs, and the vast Google array of data. To try to nail down the estimate of it, we can look at the recent market share estimates for LLMs from Menlo Ventures:

Based on these estimates, Google DeepMind LLMs now have a 12% market share, up from 7% last year but still smaller compared to 24% for Anthropic and 34% for OpenAI. Based on this, the unit's estimates should be closer to Anthropic's valuation than OpenAI's. With that in mind, my current DeepMind value estimate is $40B.

Another business segment I wanted to add to the conversation is Google's autonomous vehicle unit, Waymo. The math is easy here, as Waymo raised outside money at a $45B valuation last month. Given that Google now owns about 90% of it, the value assigned here is $40B.

Summary

To wrap it up, my projections for Google's business, if broken down into individual segments, are as follows:

Search & network: $800B

YouTube: $280B

Other services (Chrome, Android, Maps, etc.): $132B

Google Cloud: $607B

DeepMind: $40B

Waymo: $40B

Net Cash: $41.5B

Total: $1940.5B

The estimated valuation of $1.94 T is close to Google's current market cap of $2.08 T.

Interestingly enough, Barron's put out their own Sum-of-parts analysis for Google just a few days ago:

Based on these numbers, they estimate the valuation of Search at $1700B, YouTube at $764B, Cloud at $300B, and Waymo at $300B for a total of $3T.

As I read through their estimates to me, it shows that they do not expect Search to be disrupted (that is why they assigned a much bigger multiple to it - 2x my multiple); when it comes to YouTube, my guess is they probably included Other services like Chrome, Android, Maps, etc. in that pie. They valued Google Cloud much lower than what I have, and they also valued Waymo the same as Google Cloud with a $300B market value, which I think is way off since Waymo just recently raised outside funds at a $40B valuation (nowhere close to $300B). Even if you add a control share premium, the gap to $300B is huge.

In general the chances of a Google breakup are still very low as the administration is changing. So far, President Trump has commented that he doesn't want to break up Google, as he believes it would weaken U.S. companies competing on the global stage.

At the same time, my sum-of-parts analysis also showed that even if that happened, Google shareholders wouldn't get much less value than they have today. Of course, again, these are my estimates based on my assumptions and the risks that I am seeing. The more significant focus when it comes to Google and its investor base shouldn't be on the risk of breaking the company up but rather on their fight in their primary business unit, Search, and how well Google can position itself in the new AI Search era. With LLMs and AI, the market has opened in a way that not only are smaller companies competing with Big Tech, but also Big Tech is competing with each other in almost every field they are in, and to me, not everyone will come out as a winner.

As always, I hope you found this article valuable, and I kindly invite you to become a paid subscriber as this week I am publishing a deep dive piece into the Small modular reactor (SMR) industry and, with it, Sam Altman's SMR investment in the company Oklo. Since I just launched this service, I decided to give a special offer to my early subscribers. Subscribers who sign up for the plan until the end of this year will get a 20% discount on their subscription forever.

If you found this article insightful, I would appreciate it if you could share it with people you know who might find it interesting. Thank you!

Disclaimer:

I own Amazon (AMZN) and Meta (META) stock.

Nothing contained in this website and newsletter should be understood as investment or financial advice. All investment strategies and investments involve the risk of loss. Past performance does not guarantee future results. Everything written and expressed in this newsletter is only the writer's opinion and should not be considered investment advice. Before investing in anything, know your risk profile and if needed, consult a professional. Nothing on this site should ever be considered advice, research, or an invitation to buy or sell any securities.

Very interesting content, Richard! I didn’t know DeepMind in such depth before.

Great take on Google Search facing the innovator's dilemma.

So far, the e-commerce search segment remains stable, but there are also clouds on the horizon.

The rise of AI agents that make transactions and buy for us could jeopardize this segment as well.

Google had everything lined up to lead the charge in LLMs (researchers, compute, capital, Transformer paper, data, etc.)

Nevertheless, they were slow to react.

Will the rigidity and bureaucracy of large organizations hinder one of the most value-creating companies in history?

I'm happy to watch.