How Snap Holds the Keys to Its Own Future

Hi everyone,

In this article, I am breaking down my thesis on the company I have accumulated over the last few months, and has now become a substantial position of mine. The company is Snap. Let's dive in.

Introduction

I won't spend much time introducing the company as most of you already know it. Snap is a social media company operating the Snapchat app. Its users are mostly young adults and teens, and it is a competitor to TikTok as well as Meta. The company was founded in 2011. Snapchat has 443M daily active users. They generate $5.17B in revenue (LTM). The company makes revenue mostly from ads, but increasingly also from B2C subscription Snapchat+. They also have their own AR business segment.

The company has IPOed in March 2017 and has since had a very volatile ride. The IPO was priced at $28.3B, and the company made $825M in revenue that year. Today, the company trades at a $20B market cap and is expected to end the year with around $5.3B in revenue.

These are the key things for me when analyzing this company:

User base

If you have read my work before, especially my articles on Meta, Pinterest, and others, you know that one of the key figures I focus on when analyzing a social media company is the user base. In a company like Snap, the user base is the key indicator of the soundness of the company's base fundamentals. A social media company's health is measured by its active user metric. If the users are there, the advertisers will follow. This was also one of my main arguments for Meta back in 2021-2022 when Meta lost the tracking signal because of the iOS privacy change, and it remains one of my key arguments when analyzing Snap.

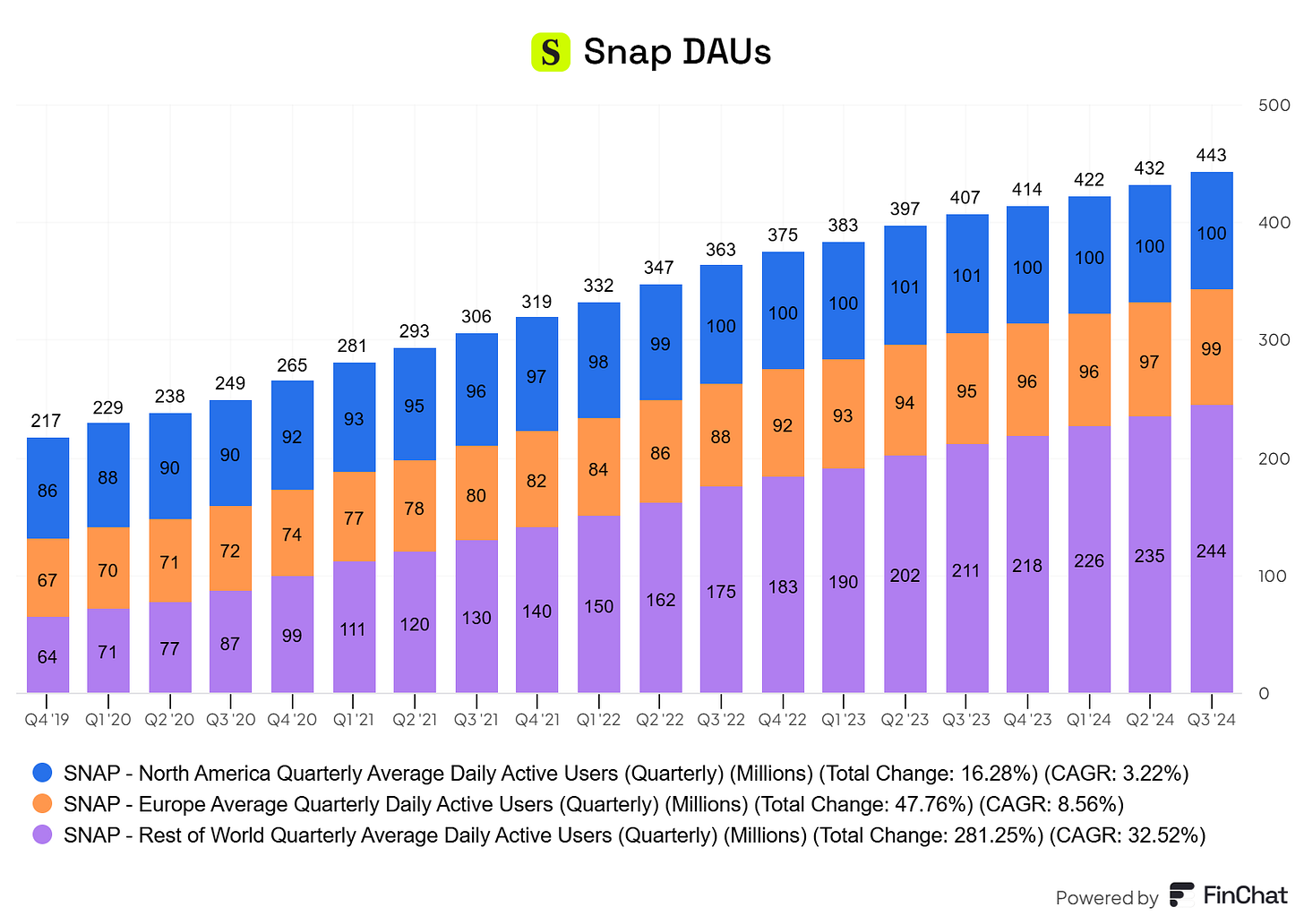

Despite all the hurdles that the stock price has had over the years, the trend in terms of the user base remains clear. Snap continues to grow in terms of Daily active users every quarter (DAUs). And yes, while the DAUs have remained stable in the U.S., it shouldn't be a surprise, given there are 100M Snap DAUs in the U.S., the app has its specifics, making it more attractive to the younger demographic. Today, Snap DAUs' growth mostly comes from ex-Europe and U.S. regions. Based on the total DAUs at 443M, Snapchat is also one of the most used apps in the world.

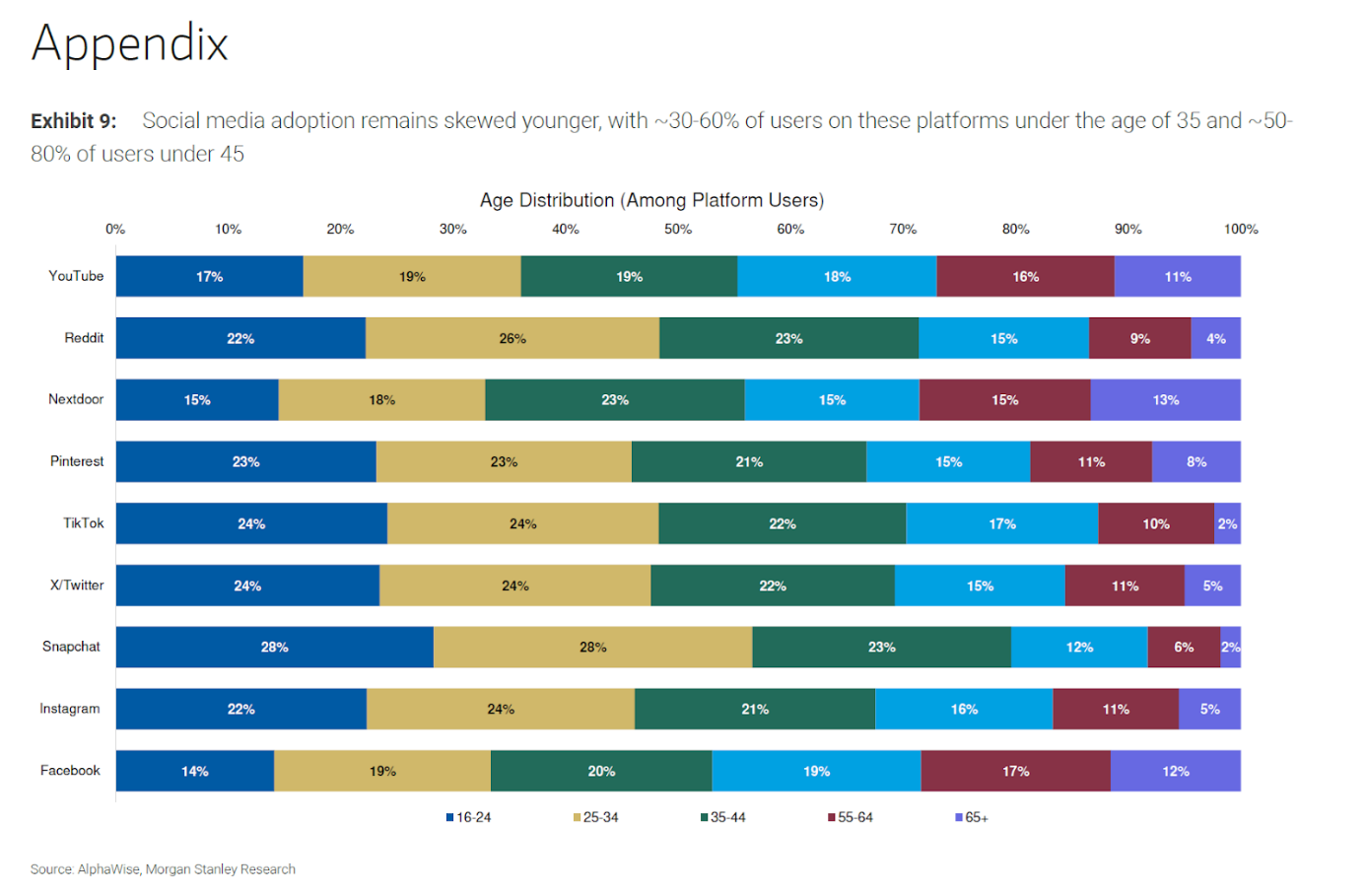

What is more impressive to me is that from the end of 2019 to today, Snap managed to grow DAUs despite this period being the period of the emergence and insane growth of TikTok. TikTok is a bigger rival to Snap than Meta because TikTok's key demographic, at least at the start of this period, is the same as Snapchat – teens and young adults. This trend also shows that while young adults and teenagers use TikTok, they still use Snapchat, and TikTok hasn't become a complete replacement for Snapchat. The usage trend that has emerged in the last years is that users mainly use TikTok to consume entertaining content from people they don't know, while Snapchat is used to connect, talk, and interact with friends you know. The lines here are getting blurry as both companies try to cover both usage fields (Snap with Spotlight and TikTok now with Lemon8 and other features on TikTok). While TikTok has gained traction also among older demographics, it is becoming increasingly similar to Meta's Instagram, as shown in this table:

But for Snap, it is not just about DAUs but also about time spent. TikTok has taken a big chunk of time spent from Snap and its potential, as TikTok's doomscroll short videos are very addictive, and the feed highlights it. Snap appears to finally have a response with a simplified user interface that is expected to roll out more widely in Q1 2025, currently being used by approximately 10 million users. The new interface will simplify the app and emphasize Spotlight, Snapchat's short video format. Snap believes it will deepen engagement and increase time spent.

This is an essential moment for Snap as emphasizing more short videos can result in more time spent and more monetizable ad surfaces, and possibly even a shift in users towards Snap as uncertainty around TikTok's future in the U.S. is in the air.

The culture at Snap has often hindered Snap from going via this viral short video route:

»The company doesn't focus on virality because by part of their nature, they're still trying to maintain privacy and authentic expression as a core element of the business. It's a juggle between values and being able to capitalize on the industry trend. So far, they're balancing the both of them, but the values have prevented for new product evolution to push for virality of content.«

(Former High ranking Snap employee- reported to C-suite)

source: Alphasense (get a 14 day free trial and acess the full interview)

But with the new app revamp, it seems they finally understand that they don't need to be the ones bringing every new format/surface to the market but can take a step back and copy what the big guys are doing.

However, the fact that Snap is still growing in terms of users is hardly a secret, as any analyst on Wall Street follows the user metrics. So why is the company »in the dog house« valued at only $20B?

Snap's challenges and Wall Street's current focus

The problem for Snap is not its user base; the issues, in essence, derive from two places:

Snapchat is bad at ads (monetization)

Snapchat is acting like it is a bigger company than it is

Let's first look at their ad problems. The problem derives from a few places. Firstly, the demographic of younger adults and teenagers is very specific. The problem is that teenagers don't have the purchasing power that advertisers are looking for; because of this, campaigns on Snap from advertisers are often more focused on brand than performance. Brand advertising is more susceptible to macro conditions, and when there is macro uncertainty, advertisers tend to cut those budgets and focus on performance until they become more comfortable with the macro. This is the period we had in the last 2 years, where we had a lot of macro uncertainty because of high inflation, interest rates, and wars. On the flip side, there are also positives to having such a young demographic, which, unfortunately, Snap hasn't taken advantage of yet. The positives are that young adults spend a lot more time on these platforms, and their shopping habits tend to be very e-commerce friendly, making them a perfect audience for things like social commerce.

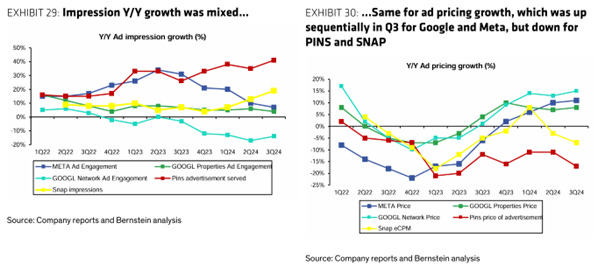

The fact that smaller ad platforms like Snap didn't have the resources and didn't invest heavily in AI ad targeting solutions like Meta and Google did (with Advantage+ and Performance Max) is taking its toll in the recent quarters:

We can see that only the big players like Meta and Google rebounded successfully from the 2022-2023 period after the Apple iOS signal loss, and that is because of AI. With the help of these AI targeting tools, Meta and Google are growing their ad pricing as they become more efficient, and advertisers are willing to pay a higher price for their ads. For Snap, this is still a path they need to take.

The other problem that relates to low ad monetization is the fact that Snap doesn't have the same scale now as TikTok or Meta; because of it, advertisers often do not want to invest in a platform where they can only reach Gen-Z and Millenials, but prefer a platform where the scale is more significant in terms of users and demographic cohorts. Snap won't be able to resolve this problem in the short term. Nonetheless, focusing on their strengths with a younger, more engaged demographic should be something they should lean on as an advantage, given their size. At $5B of revenue, many low-hanging fruits remain for you to grow successfully before the scale problems become the biggest obstacle.

Snap has an ego problem

The second problem that I see for Snap is their ego. More specifically, the company/management is acting like they are a much bigger company with much bigger resources than they actually are. Snap is investing in AR, AR smartglasses, their own OS, and all these technologies, which do and can affect their core but in a very limited matter. Snap's LTM revenue is $5.16B, and they spend $1.7B on R&D, which is 33% of their revenue. It used to be even worse in 2022 and 2023. Snap spend $2B each year on R&D, or 43.5% of their revenue. Meta spends $40.8B on R&D (and they are investing heavily in AI and the metaverse), but it still accounts for 26% of their revenue. The problem for Snap is that most of that $1.7B goes into areas where it doesn't improve the core business. A big problem is investing $1.7B in »innovation« in AR, filters, and Smart glasses, but you missed the boat on AI targeting, which is your core product. Yes, Meta and Zuckerberg also invested in the Metaverse, AR and AI. Still, their core products are on fire and executing on all cylinders because Meta also invested first in Advantage+ and all these other tools. While many leaders like to think their company is a technology company and will be a conglomerate, Snap needs to understand they are, first and foremost, a social media chat company. When you develop that side of the business into a cash cow, you can start planning on spending on these moon-shot areas. But Snap is not that company yet, and the sooner they figure that out and refocus on the core, the faster they will have a shot at once becoming that technology conglomerate. This former high-ranking Snap employee reporting to management explains it well:

»My concern with Snap is that Snap loves to innovate as a culture. Therefore, there's a lot of innovation that happens without understanding how it is monetized. What usually happens is they're going to innovate. They're going to come up with something great like Stories and Spectacles, and their competitor, Facebook, Meta, is going to chase that innovation and monetize it.

A good example would be Spectacles. Spectacles came out, I forgot what the original year was, but definitely at least two to three years before the Ray-Ban glasses that are out now, Ray-Ban Stories, that's out. Facebook has learned to monetize that technology, and Snap has not yet been able to do that. That's the concern that I have. The competition isn't in the innovation. The competition is in the monetization of their ideas, and in that, they're falling behind.«

(Former High ranking Snap employee- reported to C-suite)

source: Alphasense (get a 14 day free trial and acess the full interview)

Many projects haven't even seen the day of light but still managed to burn money:

»Snap had, it was called ARES. It was an [AR enterprise solution], where it was a whole business that they were investing and that they really wanted to believe in and so they went big and invested heavily. Ultimately, that business didn't work out and there were some product market fit issues, but they still went for it.«

(Former high ranking $SNAP employee – 1 level from C suite)

source: Alphasense (get a 14 day free trial and acess the full interview)

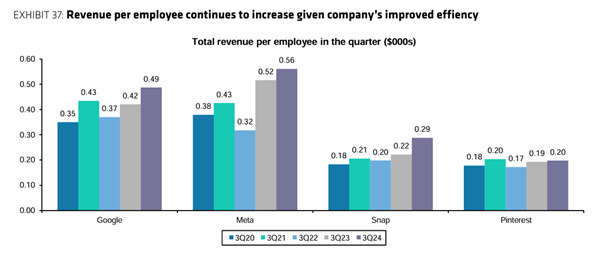

And the problem of thinking you are bigger than you are is not limited only to R&D costs. The whole company's cost structure needs a revamp. They are spending $1.1B on SBC, over 21% of your revenue. Again, for comparison, Meta's SBC/revenue is around 10%, and they pay their employees very handsomely. The revenue per employee figure also shows us that while Snap has started to improve in this realm, it is still vastly over-bloated compared to bigger competitors like Meta and Google:

Snap needs to face the music. It is no longer a $94B market cap company as it was in September 2021, but it is a $20B market cap company with limited resources that can't make big bets in 3 different areas but should and can focus on one. That focus should be on AI and improving its monetization and core business. It is that simple.

Before we continue with the article a section for our partner Alphasense:

Alphasense just released a new GenAI Search feature that analyzes and reviews its vast library of over 300M documents. I can now use GenAI to review company filings and expert interviews and it has vastly increased my research process. Using the button below, you can try it out yourself with a 14-day Free Trial.

now back to the article…

Snapchat+

Snapchat+ is a subscription service offered by Snap that provides users with access to exclusive features and enhancements not available to regular users. Features include the ability to customize the app's icon, see who replays their snaps, and utilize special filters and effects. Snapchat+ users also get priority customer support and early access to new features that are being tested.

It is priced at $3.99 monthly and launched in June 2022. It was one of the first B2C products in social media, now being followed by X (former Twitter)'s Premium subscription and Meta Verified.

Snapchat+ is one of the highest-growing B2C products out there as the timeline of its growth is very staggering:

June 22 – Launch

Aug 22 – 1M subscribers

Q1 23 – 3M subscribers

Q4 23 – 7M subscribers

Q2 24 – 11M subscribers

Q3 24 – 12M subscribers

Based on these figures, Snapchat+ is bringing in around $47M in monthly revenue and is on a +$500M annual run rate. Even if we look at the growth of the last quarters (which was the slowest) and extract it to a yearly figure, it is still growing at a +33% growth rate. Today, it is already more than 10% of Snap's revenue.

Snapchat+ is an excellent product because it helps Snap weather the storm with its problems when it comes to ad monetization; at the same time, I think it is a path that will become increasingly important for social media in the future as we will have an abundance of AI content and with it AI bots. At some point, I think every social media company will have a »human« content feed, and the only way to differentiate it from AI bots will be through a Subscription program similar to the ones companies are already running today. From a user perspective, it will have multiple phases. The first phase is the one we are at right now, mostly used by »influencers« and content creators on these platforms for better reach, visibility, and features. Later, it will trickle down to ordinary users who look up to these creators and find it a status symbol. In the last phase, it will become table stakes, where any individual not having a verification badge and with it subscription will be viewed as an AI bot and not a human.

With its young demographic, Snapchat is well positioned here, as the results of the fast-wide adoption of Snapchat+ already show. Both X and Meta have slower growth in their subscription programs in the same period as a % of their user base. This is something that we already talked about in this article: the fact that a younger demographic is more tech-savvy, inclined to try new things and spend more of their lives online, which is a positive for a company like Snapchat if they know how to take advantage of it with products like Snapchat+.

So why now, will the narrative around Snap change on Wall Street?

There are solutions to Snap's problems on almost every level:

1. Embrace the fact that your niche focus is young adults. Mold the platform more socially commerce-friendly as your demographic is ready for it. Social commerce and e-commerce gamification are rising in the West because of TikTok Shops and Temu de facto subsidizing and trying to make it a habit. A significant upside is that Shoppable ad formats have much higher CPMs than regular ads, especially when compared to brand campaigns, which are currently dominated on Snap.

2. Snapchat+. We already talked about Snapchat+, but B2C social media revenue streams are in their early innings. Look at X Verified, Meta Verified. X will pioneer here because Elon likes to test things out even if they don't work out. There is another tailwind coming: more and more pressure from regulators on companies like Apple and Google in relation to their App Store fees. Not to forget, a big portion of Snapchat+ revenue (30%) is taken by Apple or Google when users sign up for these features via mobile. As regulators have become more focused on App Stores and as companies like Epic Games are fighting legal battles over these App Store practices, this benefits companies like Snap and Snapchat+ features as the chances of these fees becoming lower in the future increase. As Snapchat+ becomes a bigger product and now breaches that 10% total revenue mark, it will also get more attention from the investor community, where the stock might get a re-rate based on B2C well diversified and less business cycle risk revenue.

3. AI & GenAI ad enhancements. Lean into it. In the last 2 years, we have seen a massive improvement in conversions on ads from Meta and Google with their AI targeting tools Advantage+ and Performance Max. Snap so far, hasn’t built such strong tools internally, but with the development of the AI field in general, they can lean internally with the help of external partners or open-source software to fill those gaps. Even if they are always 2 years behind, that is not a bad position. Right now, they can improve their ad products with similar tools to Advantage+, and in 2 years, when Meta & Google will »show them the way« of improving ads with GenAI (hyper-personalized creative generation, GenAI agents, and chatbots monetization), they have additional tailwinds for the next 4 years. They just need to follow and observe.

4. GenAI agents and chat platforms are a marriage made in heaven. Again, here, don't invest a ton, don't innovate too much, follow and look at what bigger peers like Meta are doing with WhatsApp, and be fast to copy. Standing on a high ground and being the first to bring a feature to market is not always rewarded. Just look at Zuckerberg; he has been copying features (including Snap Stories) for a long time and making them better and integrated into his ecosystem, and it has given excellent returns to Meta shareholders as not much R&D and testing the market budgets had to be burned. Others did that. This time, it is time for Snap to take a back seat, especially considering they do not have their own data centers and are renters of cloud infrastructure from the hyperscalers. GenAI will be a big unlock to social media, especially to chat like social media assets like WhatsApp and Snapchat, which can harness the AI agents to make businesses and creators use them for communicating and selling products to potential clients. GenAI on social media will disrupt the call center industry and open new budgets for these companies, not ad budgets but sales and human labor replacement budgets.

5. TikTok ban call option. Another important event for Snap is the potential ban or divestiture of TikTok. The law that Congress passed states that by 19 Jan 2025, TikTok will either divest from ByteDance or face a ban (Apple and Google need to remove it from the App Store). However, the Supreme Court will hear TikTok's case this Friday, 10 Jan. The upcoming Trump administration issued a letter to the Supreme Court urging them to postpone the ban deadline so that the new administration has the time to make a deal with/for TikTok. I believe the Supreme Court will likely listen to the new administration and postpone the effective ban. If that doesn't happen and the 19 Jan ban deadline stays, Snap would be up for a significant upside as they and Meta's Instagram are one of the leading networks that would benefit from a ban both from a user and advertiser migration. In the end, if Trump gets the postponement, I believe he won't ban TikTok but will make a deal where TikTok is sold to a U.S. buyer. Again, depending on the buyer, but if the buyer is not a big tech company and is instead a consortium of private investors, private equity, or a non-tech company (Walmart or another), I think this is also a positive for Snap, as managing a social network is not easy especially if you are not a tech company. The fact that the Chinese would probably not allow the new entity to keep the recommendation and content TikTok algorithm in the U.S. entity would be another big hurdle for whoever ends up buying the U.S.-based business of TikTok as the addictive algorithm is one of the key pieces of the network. ByteDance keeping TikTok would be the worst outcome for competitors like Snap and Meta as they have the know-how and deep pockets to fund and fuel continued growth, but I think that scenario has a very low chance. So, a potential ban or divestiture of TikTok is a call option on Snap.

6. Pressure from stakeholders on the company because of the current valuation. This is actually good for investors because the longer Snap stays at these levels, the more the pressure on Snap's management builds. Issues like inflated costs, SBC, cash burn on AR, and the complexity of being a bigger company than you are are all issues that Snap can resolve internally. Even with Spiegel having super-voting shares and controlling the company, he is not immune to these pressures as employees who are paid in stock are motivated by a rising stock price, not a falling one. We have already witnessed that in 2022, the stock price of Meta fell, and with it, external pressure did, to some extent, make Mark speed up and make some significant cost changes at Meta despite him also controlling Meta with super-voting shares.

7. I believe smart glasses and AR are facing an actual mainstream moment in 2025. You have two scenarios. Number one, Snap can finally stop the unit from burning cash as it folds to Meta and sells it to another company. Number two, if the market gets excited about any company building AR, then Snap can expect to get a bump in its market cap because the value of its AR unit becomes positive (as today, it is valued at zero or even negative value).

Valuation

I am moving to the valuation part, a key piece of my investment thesis.

With any user-based network, I like to value them based on a metric I call market cap per user. The reason for that is that looking at the core fundamentals of a social network, the thing that matters is how many users it has and how much value it brings its users (can be measured in time spent or other metrics).

Looking at the results and comparing them to some of the peers, here they are:

The results show that the market currently gives $45 of value to Snapchat on a user basis, which