Meta’s challenges - the narrative vs reality

Welcome to UncoverAlpha newsletter. The newsletter is primarily focused on sharing my analysis and insights on great companies in the tech and growth sector. The newsletter is free, so if you haven’t, you can Subscribe on the following link.

Hey everyone,

In this article, I will dissect the top three issues investors have with the company. Disclaimer Meta is one of the largest positions in my portfolio.

The main concerns investors have about Meta and why the valuation of the company is so depressed are the following:

The rise of TikTok and the risks that it brings to Meta’s core product portfolio (Blue app, Instagram)

Apple iOS privacy changes and the challenges with monetization

The sci-fi vision of the so-called Metaverse & the cash burn that it brings in the following years for Meta

The rise of TikTok

I think all of you reading this article know TikTok. In the last few years, it has grown very quickly. Some people call it a social media company, but in reality, it is an entertainment platform (the company itself acknowledges that). It provides a stream of addictive short video formats that keeps its users spending a lot of time on the platform. But before we dive into it and what it means for Meta, let’s first look at the landscape of social media and entertainment platforms.

Here is an overview I made for a better understanding. The brands and the companies shown in the diagram are just some of which, in my opinion, represent the most important ones.

In this overview, we first have to distinguish three segments:

1. Friend and Family interactions (which is what social media is known for)

2. Content from 3rd party

3. Intent-focused platforms

Within Family and friends’ interactions, you have the content platforms and the chat or messaging apps. The main ones, as shown here, are Meta’s apps (Facebook blue, Instagram, and WhatsApp) and the companies such as Snapchat, iMessage (from Apple), Viber, etc. This part of social media is where you spend time interacting with your friends and family, and you consume what they are producing as content (such as weddings, traveling, etc.)

Then we have the rising category of Content from 3rd parties. It represents content that you view and consume as a user of the platform but is produced by people you are unfamiliar with. Within this segment, we have Originally created content represented mainly by the streaming companies like Netflix, Disney+, HBO Max, etc. So especially studios that produce movies and series. Then we have the so-called “user-produced content” category. This is a rising category that was much smaller a few years ago. It represents content you consume from people you do not know but are smaller contributors on a platform. The most used use case is influencers, e.g., people with large followings and social presence. It can be famous influencers like celebrities or sports icons, or it can also be micro-influencers, so people with a few thousand followers or even random people with no following. Platforms that fall in this category are YouTube, TikTok, and Instagram; you could also put Snapchat in here with its Spotlight feature. Some platforms fall into multiple categories, such as Instagram, Snapchat, etc., because they have different platform features that target different segments and fit multiple use-cases. The last content segment from the 3rd party category is the chat or discussion platforms. The most dominant here are Discord and Telegram, although Facebook with its Groups feature, could also easily fall into it. So again, these are chat platforms but are used mostly for chatting with people you do not know personally or chatting in bigger groups with some shared interest/goal.

The last breakdown of the space falls into a category I called Intent focused platforms. These are platforms that most people visit with a clear intent of doing something. A widespread use case for this intent is shopping. For example, Amazon and Pinterest. Of course, we can’t get by the biggest and most used “intent” platform, which is Google with its Google Search. Users, in this case, know exactly what they came on the platform for as they are researching or looking for a specific thing.

Knowing this breakdown is essential to understanding the dynamics between Meta’s products and TikTok. Meta and TikTok are direct competitors in the 3rd party-produced user content, mainly with Meta’s Instagram platform (although Facebook is now also moving into the 3rd party category).

TikTok, as already stated, falls into the 3rd party content platform, specifically the user-produced content portion. The real appeal TikTok has is that it has become known as a platform where everybody can become an influencer. The reason for this is in their discovery ranking algorithm. It is still very unknown and makes it so that videos posted by users with no follower base can suddenly go viral and be seen by millions of people. So, it appeals to the very young generation (Gen-Z) as a survey in the US was conducted in 2019 and said that 86% of young Americans said they want to become a social media influencer. It also appeals to the young generation with its user interface, which after registering an account, gives you an endless feed of short videos of more or less attractive-looking young people, jokes, memes, or stunts of people for the sole purpose of entertainment. It has also taken a different approach to the standard in social media so far because after registering, you don’t need to follow anyone to start receiving the stream of content.

Because of this design and the demographic, it has become reputable for having a big user time spend metric on the platform.

We can see that the average time spend in minutes for US Adult users who use TikTok is 45.8 minutes per day which is only matched by YouTube. But remember that many people use and open YouTube for longer videos or to listen to music.

The most significant rise TikTok achieved was during the pandemic. That is when TikTok received its biggest push, as this Google search data shows for the US:

The reason is apparent. Because of lockdowns and the pandemic, everyday lives came to a stop. There was not much going on with you or your friends. Your Family or Friends didn’t get married, didn’t go on any trips, parties, etc. People started to look for entertainment and content. Because they quickly viewed the whole content library of streaming service platforms like Netflix, they began to look for other content, content from people they don’t know, and that is where TikTok filled the need.

Now TikTok, while it has gone through the period of being the “cool” product and expanding fast, it is now facing challenges: content moderation (it is one of the most hostile platforms regarding comments and trolls), monetization (viral videos vs. ads), ownership, getting big influencers to produce constant content. Big influencers with follower bases on TikTok do not count as much as on other platforms (for example, Instagram). That is because of TikTok’s discovery algorithm. The algorithm is appealing to “normal” people who want their 5 minutes of “fame.” Still, it makes it more difficult for bigger influencers to build audiences and keep them engaged with their content constantly, as even though you have a big following, it doesn’t count that much in the discovery engine. This means that some videos you make won’t go viral and will have poor impression results even though you might have millions of followers. That means the platform is very unpredictable.

Why does Meta need to worry about TikTok?

So, where does Meta fit, and why does Meta need to compete with TikTok even though it is in a different category segment than Meta (mostly family and Friends content)?

The real answer is that TikTok is a direct competitor for users’ time. In a world where the time span of people is getting shorter and shorter, and many apps/products and services are competing for our time, a competitor that drains a lot of time from users must be taken seriously. Especially because of TikTok’s rapid growth and scale that has been achieved in a very short period. Not to mention once you have a powerful platform in the social media/entertainment space, it is not that hard to add new features that could be more social and could get more into Meta’s “business lines.”

But facing significant challenges is nothing new to Meta. Back in the days, they had quite a lot of them. First, they had to transition from a web app to mobile. Then it was a transition from news to photos, later on to video with Stories (a feature first introduced by Meta’s competitor Snapchat), and now it’s the transition of user attention to short video format.

Once Meta realized that TikTok was a real threat (back in 2020), they launched their answer, and it’s called Reels. It does the same thing as TikTok, providing you with a feed of short videos. Meta first launched Reels on Instagram in August 2020, and then a year later, in September 2021, also introduced Reels on Facebook. And on their last earnings call, Meta didn’t just say Reels was one of their many features. They stated a clear focus on pushing Reels as their number one priority to drive growth for the platform.

From the data that got disclosed so far, Reels is doing very well. On their last earnings call at the end of April, Mark disclosed the following:

“Short-form video is the latest iteration of this, and it's growing very quickly. Reels already makes up more than 20% of the time that people spend on Instagram. Video overall makes up 50% of the time that people spend on Facebook, and Reels is growing quickly there as well.”

And also:

“We're focused on growing Reels as a major part of the Discovery Engine vision, and we expect that this expansion in engagement to shift from a short-term headwind to a tailwind at some point.”

So right now, Meta is pushing Reels more and more to users, and it is a headwind to their short-term revenue because Reels doesn’t show the amount of ads as their other features do, like Stories and News feed. But the way Meta always worked is that they pushed the thing driving higher engagement to add gasoline to the fire and have growth. Once that growth stabilizes to some more normal levels, they push the monetization.

We also got more hints on how Reels are performing from an internal letter sent to Meta employees just a few days ago about staffing changes and goals.

“Reels + Discovery Engine: A bright point in our last-half results, we have made great strides across the family and have continued momentum in short-form video. We are growing quickly: time spent on Reels overall has more than doubled year over year both in the US and globally, with 80% of the growth since March coming from Facebook. These are early days, but with good momentum.”

Also, looking at search results for Instagram Reels, it is apparent that the feature is growing in popularity:

The biggest problem TikTok has and benefits for Meta

A big driver of the growth in Reels, specifically on Instagram, comes from India. India banned TikTok on the 29th of June 2020 for national security reasons. That is because TikTok’s owner is a company called Bytedance which is a Chinese company. India is worried about the effects and influences the Chinese can have over its people by having data from an app like TikTok. And India is not alone. In September 2020, Donald Trump wanted to ban TikTok from the US (or at least make it so that the parent company Bytedance would have to sell its US business to a US company). Since Biden became president, this ban didn’t go into effect, but the problem is still here. Social media companies have large amounts of data on their users and the power of influence with it. We have seen over the years how much pressure Meta received from operating the biggest social media platform in the world from regulators, Congress, etc. TikTok has an even bigger problem with its connection to China, and it’s demographic, which are mostly kids and young adults. This user base is the one that Congress was most upset and protective of when it came to Meta (for example, when they wanted to launch Instagram for Kids etc.). And the pressure has started to build more on TikTok. Just a few weeks ago, a Buzzfeed news article revealed that the data on US users that TikTok stated is located on US servers can be accessed by Chinese employees of the parent company. It has now gotten the attention of the US FCC. Specifically, commissioner Mr. Brendan Carr views TikTok as a way for China to access and use information from US citizens.

He urged Apple and Google to remove TikTok from their app stores. It has since gone even further as Bipartisan Senate Intel Cmte leaders are now seeking a federal investigation into TikTok.

TikTok is already banned on multiple U.S. military branches from government-issued devices due to national security risks, including Navy, Army, Air Force, Coast Guard, and Marine Corp. U.S. government officials have also urged troops to erase the app from their personal phones. Similar banns are also in the U.S national security agencies. The ban has also been placed in some private U.S businesses like Wells Fargo. It is hard to imagine that as TikTok gets bigger that it will avoid even more regulators pressure.

I think the chances of even a ban are very high for TikTok. We have seen how social media companies, in general, are under review by lawmakers, and now to have a social media platform Chinese-owned that targets kids and young adults to be the dominant one in the US is hard to believe. Especially in a period when it seems the world is going into less globalization than we had in the previous years. If a ban were to occur, a similar playbook that happened in India is expected to occur. TikTok was very popular in India before the ban, and after it, most creators and users switched to Instagram Reels. I did a poll recently on Twitter asking the question of which app people would use more if TikTok got banned in the US, and the answer is obvious. It’s with a landslide more than 76% answer Instagram Reels.

TikTok didn’t just bring problems for Meta

But there is also some good news for Meta from TikTok becoming their competitor. TikTok tested the market for Meta and proved that people want short video formats. On top of it, it looks like the new format is even more engaging for platforms than any other product (news, stories, long video format), which means a more engaged user base that is spending even more time on the platform. That all transform into more ads. Meta also acknowledged this on their last earnings call. The transformation to more short video content is necessary for Meta’s Facebook, as even in my experience, there is a lack of content on the platform. Users are mostly consuming content from groups they are in or Stories. The news feed has become clogged with ads or links to media articles which is not the content that most people want to see. A fresh wind of entertaining short-term video content would be welcomed. On the other hand, even without short-term video content, Instagram was doing very well, so here Meta has to do more of a balancing act between photo/video content and content from friends’ family/3rd parties.

If, in the end, it comes down to Reels catching up to TikTok and Meta having an even more engaging platform on which people spend more time than before because of short video content, that is a big win for Meta and its advertising business.

But Meta should not and is not downplaying the threat that TikTok is for them. This is the first time Meta has a really big competitor growing fast knocking on their door. The reaction of Meta’s management in the recent quarter to put great focus on Reels is the right one as a platform like TikTok sucks up a lot of user attention and has the potential to add more social features and with it go into direct competition with Meta’s portfolio of platforms. At the same time, Meta’s real challenge is the balancing act on Instagram and Facebook regarding the UX of the apps and the balance between family and friends’ content and 3rd party content from Reels. Meta can use this situation and make the product like Reels better than TikTok by using data that they have on users to make the discovery algorithm give you more content that fits your interest and not just content that has gone viral for most people. At the same time, good content from friends and family should be at the center of both apps since the use case of keeping in touch with friends and family will always exist. The next stage for short video format seems to be more user-fitted content which TikTok might have a challenge with because of its lack of data on users. With the shift, it could also lose some of the main appeal that it has had so far, which is that everybody can become an “influencer” overnight. With more content coming on TikTok and the trend going into user-fitted content, the best days for big viral content from random small content creators on TikTok seem to be over.

An essential part of the puzzle Meta must keep at all costs is India. Because TikTok is banned there, Meta is benefiting enormously. They must maintain good relationships with India and defend their strong position, also from local competitors.

Another important advantage Meta has over TikTok is its relationship with advertisers and its monetization track record. The monetization and effectiveness of a platform that’s business model is around advertisement are very important. We can see that some companies haven’t been able to figure it out for years successfully, Twitter the prime example. Meta’s experience, algorithms, and relationships in this department give them the edge.

There are some interesting findings from the commentary of the head of Vodafone’s Media & Sponsorship arm about TikTok and Meta. Brands and advertisers have problems with TikTok as it is not well at managing content like Google and Meta, so the reputation risk is higher there. Advertisers also view TikTok more as a brand platform, not a performance platform. He also noted that it is harder to identify an in-market customer through TikTok than it is on platforms from Meta. All this shows that TikTok has a lot to do on the monetization part and, in doing so, will probably risk the platform becoming less “cool.”

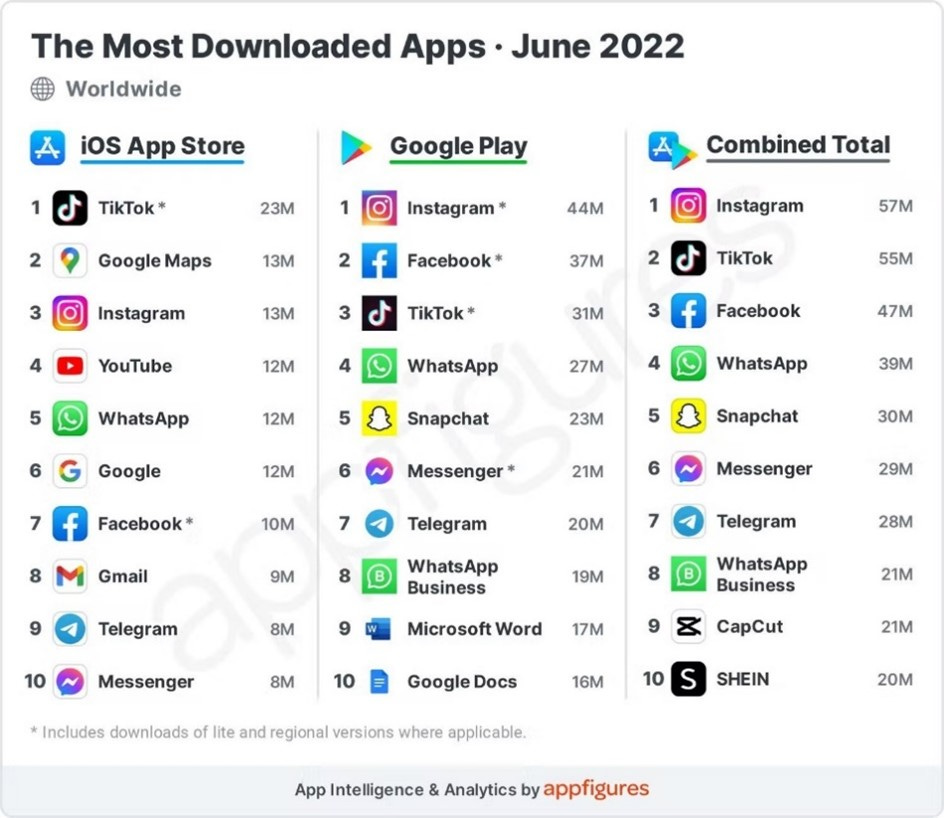

The last thing I want to address in the TikTok vs. Meta topic is the notion that TikTok is taking Meta’s users. While it is true that TikTok is growing rapidly, it is not true that Meta is losing users (no matter what people say). The data doesn’t back that up. In the last quarter, Meta’s family of apps added 50 million MAU, which now has a record 3.64 billion MAU. Even the most recent report of app downloads for June 2022 by appfigures shows three of Meta’s apps are still in the top 5 most downloaded apps (iOS and Android).

A significant difference can also be seen between downloads of iOS, where TikTok leads, and downloads of Android, where Instagram leads. The main thing here is again India, which is Android dominant, whereas TikTok is banned, so Instagram takes the lead. But even if we look at the app downloads for multiple months since December 2020, we can see the rise of TikTok. Still, at the same time, Meta’s apps are not in decline (data for Whatsapp Business is sometimes 0 because there are not always data available).

What we can take away from this is that users that use TikTok do not stop using Meta’s apps like Instagram or Whatsapp but rather use it for different purposes. So the fight between these companies is more about attention and engagement than the users base itself.

Apple iOS privacy changes a blow to ad tech.

Another big topic on the minds of Meta investors is the topic of the Apple iOS privacy change, and the change Meta was forced to make because of it. In April of 2021, Apple made a big change to its privacy controls, limiting the tracing capabilities of digital advertisers. This resulted in ad platforms becoming less effective for advertisers in targeting users off-site. The platforms most affected by this are ad platforms that are more known for performance marketing (not so much brand awareness). The change affected the whole industry, but Meta, known for being the biggest performance platform out there, has been hurt the most. In Meta’s Q4 2021 earnings call, they quantify how much of an impact the iOS change is:

“And we believe the impact of iOS overall as a headwind on our business in 2022 is on the order of $10 billion, so it's a pretty significant headwind for our business.”

Since Meta made almost $120B in revenue in 2021, that impact is nearly 10% of their revenue. Now faced with this challenge and the upcoming challenge of Google doing the same privacy change in the next 2-3 years, Meta has no choice but to adapt. It’s doing this in two ways. The first one focuses more on different ad products that don’t rely on tracking. These are called onsite data conversion products. Products such as Click-to- Messaging ads where they lean more on their chat products like Messenger Whatsapp and Instagram Direct. Meta mentioned that the Click-to-messaging part of their business is already a multibillion-dollar business with healthy double-digit year-over-year growth rates in Q1 2022. The other onsite conversion ads Meta is pushing are more e-commerce type of ads - Lead ads and Shop ads which direct users to the advertiser’s storefront on Facebook and Instagram. With this push, we can expect Meta to make and become more of a social commerce platform in the next months and years.

Meta, to some extent, has been too slow to react to the iOS challenge so far. Still, the latest commentary from management shows they are close to figuring out how to take this headwind in getting less data for tracking and turn it into a competitive advantage. And the answer is AI. AI models that rely on small data instead of big data, which is the predominant way of learning AI models to date.

“We're making major AI investments to build the most advanced models and infrastructure in the industry. Over the next year or two, we hope that this drives better recommendations for people, higher returns for advertisers, and increases our revenue growth even in the face of signal loss. Over the longer term, I think that these large technology investments can provide a sustainable competitive advantage over others in the industry.”

Meta figuring out successful targeting of users via AI models with fewer data would really be a competitive advantage, as they are a company with enough resources both in terms of financial and the talent side (besides Google) that can make that happen. The shift to onsite is also better for the company long-term as they can control the inner part of their ecosystem, which means fewer surprises in the future.

And the last thing when it comes to monetization: they are finally “opening the chest” and pushing monetization on WhatsApp. Last month Meta announced WhatsApp Cloud API. Contrary to most beliefs, Meta already made revenue directly from WhatsApp when it launched WhatsApp Business API in 2018. It charges businesses if they want to respond to users after the first 24 hours of when a user asks a question or sends a message. It’s an intelligent way to improve the experience for users, as the enterprises that do not want to pay for the service have a motivation to reply within 24 hours, making the experience better. If they don’t, Meta charges them a fee. But the API was so far only on-premise. Now they launched the cloud version, which opens the gates for many smaller companies that can use it easier and build things on top of it. It’s probably the first step of what is rumored to be a paid-tier version for its Business App. The cloud move, while it doesn’t sound like a big deal, is very important and allows many other companies to build on top of the API other services and products and make it a platform also from the Business perspective.

In general, when it comes to the topic of iOS privacy change and the headwinds ad companies are facing, my belief is that while in the short-term it has been a big hit for almost everyone (especially the performance-driven platforms), in the medium term it will make the big players even stronger as already mentioned they have enough resources & first-party data on users to make better onsite conversion product, but for smaller ad platforms that could be a problem that drags for years.

Advertisers must understand that Meta is evolving, and they will have to use new ad features like click-to-message, shop ads, and Reels to take advantage and achieve the levels of efficiencies that they were used to in the last few years. But it’s always good to remember that in social media if users stay, advertisers stay.

The Metaverse

Ok, so let’s talk about the Metaverse. Since Mark revealed the Metaverse concept in October last year, it has become a controversial topic. The skeptics believe that people will not want to live in a virtual reality world and that Meta is trying to swing the narrative away from their core business which, in their mind, will go out of favor. On the other hand, the believers believe that in the coming years, we will spend billions in the metaverse on digital assets and most of our time in it. But we also have the third group that are the “rationalists” they are focused on two things how much it will cost and in the coming years to build it and what revenue and WHEN can we expect it. Now the market itself has gone more in the skeptical path given the recent valuation cut, but I am more in the believer/rationalist camp.

But let’s be clear: Meta is not the only company seeing the future of tech in the metaverse and the next computing platform in AR and VR. Many other big tech companies and their leader see it similarly. Companies like Nvidia, Microsoft, and Disney all believe AR/VR is the next computing platform, even Apple, as it is ready to launch its version of a VR headset. So, to entirely doubt the concept, given that many tech leaders are leaning toward it and making significant investments, is maybe not the right approach. Who are we to say that all these executives at the largest and most innovative company in this decade are wrong?

In my view, it’s more of a timing and form question. So, what shape will the “mainstream” metaverse look like, and when will it achieve the levels that make it so it takes off and becomes a multibillion-dollar business.

What is the concept?

I am not going to spend too much time explaining in this article what the basic concept is, but you can read about it in one of my previous articles.

For this article, it is important to understand the benefits and future revenue streams for Meta in this so-called Metaverse. We can divide the following into three main categories:

- Hardware revenue from VR & AR

- Platform revenue from service take rate

- Other competitive advantage benefits (moat protection from Apple – for main apps IG, WhatsApp, Messenger)

Hardware revenue

Meta is already a prominent market leader in the VR hardware market. In 2014, Meta bought the VR hardware maker Oculus for $2B. Since then, the VR hardware market has grown substantially, and Meta, with its Oculus unit, is the clear market leader. Their leadership position has become even more apparent since the launch of their best seller so far, Oculus Quest 2, on 13 October 2020, as market share has rocketed since.

According to shipment estimates in the last quarter (4Q 2021), Meta’s VR headset market share stood at 80%. However, we must acknowledge that the real challenges are still in front of Meta, with Sony’s PlayStation VR set to launch in late 2022 and Apple joining the VR headset party this or the next year. Nonetheless, the Quest 2 is a remarkable product for a very affordable price and the first VR headset that achieved mainstream numbers. Estimates are that Meta has sold so far around 14.8 million units of Quest 2 (in around 20 months). For comparison, PlayStation 5 has officially sold 20 million units, and Xbox Series X & S is set to be together at over 14 million. So, Quest 2 really went mainstream. But again, this is just an estimate. Meta didn’t give the exact number of Quest 2 sold so far. Meta has much more hardware products in the plan to be released in the next five years. It is rumored that Meta is planning to release its high-end VR headset called Project Cambria this year. The headset would be pricier (around $799 vs. $299/$399 for Quest 2), but it would also be more powerful and more suited to people working in VR than just playing games or socializing.

But it is not just VR hardware; Meta has bigger plans. A product that has the real potential to go mainstream and also reach non-gaming use-cases are AR glasses. A highly anticipated product launch is called Nazare smartglasses. Nazare is supposed to be the first authentic AR smart glasses by Meta. They are rumored to be launched in 2024. Meta took a smart route when it came to AR smart glasses. Their main goal is to make the AR glasses look like ordinary ones and make them as light as possible so they are not bothering people when wearing them. Meta made a key strategic move that will be very important in the future: they paired and made a strategic alliance with the premium leading eyewear brand Luxottica (also the owner of the notorious Ray-Ban glasses). Meta knows well that for AR smart glasses to go mainstream, they must look & feel like regular glasses. I would even go further and say they must look “cool.” And with the partnership of Luxottica, they can achieve that cool factor. When it comes to units sold, AR has an even bigger potential because its use-cases are much broader, and the time users will wear them in a day is much longer compared to VR headsets.

And now we come to the key feature/product of the Meta hardware stack that I see. And that is the AR Wristband made by CTRL Labs (which Meta bought for between $500M and $1B in 2019). And this is the product that makes AR glasses from being just a fun product to being able to change the smartphone era in the coming years.

The wristband uses electromyography (EMG) to translate subtle neural signals into actions — like typing, swiping, or playing games. The bands also offer haptic feedback, creating a more responsive system than basic hand tracking options. This essentially means that you can click and write on a virtual keyboard anywhere. Even better, the wristband can learn what common mistakes you make when writing and correct them themselves. But with reading neural signals from your wrist, the real “magic” is that eventually, you could perform the same typing-style gestures by thinking about moving your hands instead of actually moving them. For those not familiar with the device, I suggest you check out this short video and keep in mind that while it still looks clumsy, Meta will probably package this product into a cool-looking smartwatch that a lot of people got used to wearing by now.

There are also other competitors building similar products. A recent example is Snapchat which acquired the company NextMind, which has a product that you attach to your head and reads brain signals. Maybe it’s just me but while I am all for the future, wearing a device that reads neural signals from my wrist seems far less intrusive than a device strapped on my head reading “my brain.”

Platform revenue from service take rate.

This segment is already known to many as it is similar to the take rate that Apple and Google take on their App and Google Play Stores. So far, Meta has taken the same approach and takes a 30% cut from sales on the Oculus Store, which is the app store for the Oculus VR headsets. Going further, Meta also introduced their virtual reality collaboration space and game called Horizon Worlds, where creators can, similar to Roblox, make worlds and sell digital items. Here Meta also confirmed that it would take a 25% cut from sales. While Horizon Worlds is still in its early stage since it was launched only a few months ago on the 9th of December 2021, it already has a not-so-insignificant number of monthly active users. In February, Meta stated that Horizon Worlds and Horizon Venues had 300.000 MAU. They also started onboarding some famous brands to build their experiences on the platform. The fast-food chain Wendy’s, the Mini brand from BMW, and the guitar company Fender to name a few.

With platform revenue, we can expect a similar dynamic to play out as it happened with the launch of smartphones. At first, hardware was the biggest and primary driver of revenue growth for a company like Apple. Still, after a few years, the platform revenue is the one that is responsible for most of the growth and future profit opportunities. I expect similar for Meta, so the platform part to be a key driver of long-term profitability growth. At the same time, it is important to understand that the concept of the metaverse means that more items, products, and services will be bought and sold online, so the platform revenue part should be much bigger than what we are used to with smartphones.

Other competitive advantage benefits

There are many advantages of owning the next computing platform, but here are some “low hanging fruit” ones for Meta.

- Meta feels the full power and control of Apple on the smartphone end with its control of the hardware ecosystem. If this time, Meta owns the whole platform experience (also with hardware), then this is no longer an issue, and the full control is in the hands of Meta.

- Given that an AR experience blends the virtual with the real world, it means that people are going to be using smart glasses even more than they are using their smartphones. This means even more room for Meta to position their apps for people to use and sell ads. You can argue that the “space” to put on ads is even bigger with AR glasses. In addition, with geo-location, you can also start targeting ads according to micro geo location (say, a local pub or barber can target people in their immediate area).

The spend

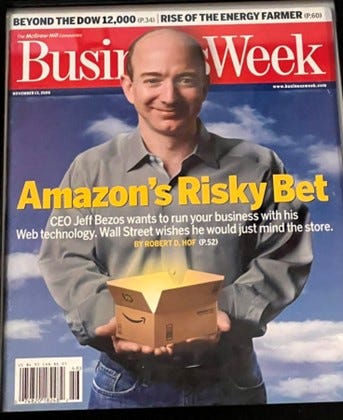

Now let’s address the elephant in the room, the SPEND. How much will it cost Meta in the next years to build it? Last year Meta announced that they were going to spend approx. $10B each year on the Metaverse. That means costs, from building the VR/AR hardware to building the ecosystem and software stack on the new computing platform. While that might sound super aggressive, you must remember that just last year, Meta raked in almost $40B in profits. Because the macro environment has changed a lot since last year, the market is worried that a recession and slowdown in core business could mean that profits get even more eaten up by the Metaverse spending. That is why Meta addressed this issue on their last earnings call when they explained that the $10B is not a fixed number and that they would move the number so that it makes sense. The profit from their core business stays the same and continues to grow in the next years while they invest in the Metaverse concept. This is important for Meta shareholders as it clearly shows that Mark is not in his own world where he will just burn endless amounts of cash to make the metaverse a mainstream reality. He knows that he needs to grow the core business, including profitability and that the success in the core business will put them in a position to invest for the future. Even with this constraint in their mind, there is no doubt that there is probably not a company on earth right now that could spend this amount of money on the Metaverse concept. The big reason for this is that Meta is still run by the founder (Mark) and that he controls the company with his super votes. Apple and Microsoft shareholders would almost surely not approve of an investment of this size in this concept. And while you might think that that is reasonable, you have to acknowledge that Wall Street and the investor bases are often too short-sighted and only want to see more returns in the next quarter or six months. Unknowingly so, they tend to lower the long-term returns that could be achieved if the companies would invest in ground-breaking new technologies and changes. For me, a reminder that will always be there is this cover of Forbes magazine back in 2006.

Wall Street was afraid of Amazon’s new build AWS unit and didn’t want Amazon focusing on it but purely playing it “safe” in the e-commerce space. Fast forward 16 years later, probably around 70% of Amazon’s current market cap is derived from the value of their AWS business and not other segments like e-commerce.

I think the key take when it comes to spending on the Metaverse is that Meta is not willing to stop its profitability growth in its core social media empire, which is good but at the same time, they are also laser-focused on the future and are investing and building the next generation of their services, which again if you are a long-term investor you want this. Endless cash hoarding, buybacks, and other financial engineering give you good results in the short term, but in the end, businesses die because they do not adapt and evolve.

The main risks Meta must watch out for

When it comes to risks, there are a few things Meta must watch out for:

- Reels must become a competitive product to TikTok. The key thing here is keeping engagement high on the platform and with it keeping the older audiences on Meta’s products (millennials and upwards). If Reels fails as a product, that can become a big problem for Meta.

- Not losing users (especially not on Instagram and WhatsApp). Instagram and WhatsApp are probably the two most important digital assets for Meta right now, and it’s key for both to keep adding users and expanding the platform.

- Keep India. As we already mentioned, India is an essential market for Meta with its population size and future potential. Protecting Instagram and WhatsApp's dominance in that market is vital for the future growth of Meta.

- Control the metaverse spend, so it doesn’t cause profit deceleration in normal macro conditions.

- Timing of the launch of AR smart glasses is key. It’s the product that can change the landscape, and timing means a lot. The product needs to be ready and the market needs to be prepared for the new product.

- Relationship with advertisers. An advantage they have so far is the view of advertisers of Meta as the go-to place for business effectiveness. The iOS privacy change impact needs to be resolved by the end of this year with other effective ad products so that Meta’s reputation as an effective performance platform stays unhinged.

- Relationship with prominent influencers. The risk here is that TikTok is now shifting and becoming more aggressive with targeting and onboarding big influencers. So far, Instagram is still their dominant platform. Meta needs to keep it that way because as users age, content from big influencers and sports/movie celebrities becomes more interesting.

- The perception of a dying business/stock. While, to some degree, I agree that management should not be worried about stock price and valuation in Meta’s case, to some degree, they must also keep it in their mind and try to address Wallstreet's worries. The main reason is that for Meta’s highly ambitious efforts and goals, they need to be able to retain and attract top-notch talent. An important way of compensation for talent is stock-based compensation. If you have a falling stock price, the compensation becomes less attractive. PR and perception of a dying business need to be addressed so that it doesn’t become a thing that lasts for a more extended period and could cause Meta to become a less exciting place to work.

Valuation

Now let’s look at Meta, where it stands on the valuation front. The company is currently trading at a $462B market cap. It generated $117.92B in revenue and $39.37B in profit in 2021. Its net profit margin is one of the highest in the industry at 33.4% for 2021.

On EV/EBITDA and P/E, it is trading at its lowest levels to date at 8x EV/EBITDA and 12.93 P/E. In my view, the valuation currently reflects a market stance of a tech business that is dying. The only good example of a tech dying narrative is IBM before their RedHat acquisition.

We can see that IBM has now overtaken Meta when it comes to EV/EBITDA multiple. Still, even in the years when IBM was just a “dying” business from 2015-2018 and where interest rates were as high as they are expected to be today in a FED tightening cycle, IBM’s EV/EBITDA was similar or even higher to what Meta’s valuation is now.

The story is much or less the same on metrics like EV to Free Cash Flow. Meta has traded similar to what Microsoft, Apple, and Google for years and now has gone to the most depressed levels of where IBM traded in its history at Meta’s current 10.51x EV/FCF.

It gets worse. The valuation is so depressed that Meta trades on an EV/EBITDA lower than on historic lows of Tobacco makers Philip Morris and Altria.

Even if we look at the ad industry and expect a recession to be on the doorsteps, the platforms such as Meta and Google seem to be stickier than most people think.

Because Meta was not yet a public company in 2008, we can look at the financials of Google.

Both revenue and net income took a hit in 2008, but it was not as much as some may have expected, and the recovery was very swift. A similar effect can be viewed in 2020 when the pandemic hit, but this time on Meta financials.

As Meta is a performance-first platform and has an auction type of ad model, when a recession or economic shock hits, you first see some advertisers pausing their campaigns and the price per ad dropping. But other advertisers come to fill the void and lift ad prices back as many companies’ business models depend on performance marketing.

It is clear that the market is pricing a doomsday scenario for Meta in which It is expected to deliver negative profit growth for the next years. The next quarters will probably be challenging in terms of revenue growth, as Meta already mentioned. Internal headwinds they are facing (unmonetized Reels, non-iOS leaping period, etc.) as well as external (macro environment, currency headwinds, slowdown of the economy), but the long-term story is positive in my view. They have challenges, as already mentioned in this article, but for every challenge, they already have a solution in place. Whether that is Reels, onsite conversion AI algorithms, or cost control of the Metaverse spend. They also have a founder CEO who has an excellent track record. Still, at the same time, the Metaverse, while it seems like a significant cash burn at the moment, could be one of the greatest opportunities out there and could be a powerful driver of both fundamental as well as stock price growth for Meta in the next 5-10 years. The most significant risk factor in the Metaverse story is timing. Time will tell if it would be better for Meta to keep developing the metaverse concept in the “dark” for a few more years than to announce it now. But even if the whole metaverse concept is not as successful as Meta envisioned at these valuation levels, you are getting the core business at interesting levels.

Conclusion

If you were an owner of a company and couldn’t run it yourself but could pick any CEO to run the company, who would it be? Mark Zuckerberg would be on the top of my list. The guy is smart, decisive, daring, and has the guts to invest and face challenges. Think about it. Meta, formerly Facebook, in all their lifespan, had faced so many challenges. First, it was the transition from website to mobile (analyst called that they would not be able to do it), then came the transition from news feed to photos, then came Snapchat and attacked the concept with its Stories feature, then came Cambridge Analytica. The company and the CEO have a track record of facing tough challenges and successfully beating them. Meta’s problems and threats are very real, but at the same time, but the chances of them overcoming those challenges are high in my view.

If you haven’t yet, feel free to subscribe to this free newsletter & share.

Disclaimer:

I own META stock.

Nothing contained in this website and newsletter should be understood as investment or financial advice. All investment strategies and investments involve the risk of loss. Past performance does not guarantee future results. Everything written and expressed in this newsletter is only the writer's opinion and should not be considered investment advice. Before investing in anything, know your risk profile and if needed, consult a professional. Nothing on this site should ever be considered advice, research, or an invitation to buy or sell any securities.

You had me reading past 3 a.m. :D Excellent work!

Good Job and I agree with you