Meta's next growth driver - AI

Hi everyone,

I wanted to share some of my recent thoughts about Meta and its business development for quite some time now. The recent developments around their earnings results have only fast-forwarded the topic I wanted to discuss in a more comprehensive article.

In this article, I will touch on three core topics:

The development of Meta's core apps and the potential there

What does AI mean for Meta (short-term, mid-term, and long-term)?

For the last segment, I will give an overview of Meta's current valuation and share some of my closing thoughts.

Let's dive right in.

Development of Meta's core apps

In its recent earnings report, Meta reported a 27% YoY revenue growth to $36.4B, a 91% YoY increase in operational income to $13.8B, and a 117% increase in net income to $12.37B. The user metrics look impressive as well. Despite already having more than $3B daily active users on their platforms, the number grew by 7% YoY to 3.24B users. This quarter, they also marked a stronger average price per ad growth than the previous quarter, with 6% YoY growth.

Given the stock price reaction, the two things that disappointed some investors are their forecast for CapEx increases because of AI infrastructure costs and, to some degree, their Q2 revenue guidance.

If we look at the Q2 revenue guidance, they put out a range of $36.5-$38.3B, which implies 18% YoY growth at the midpoint and 22% YoY revenue growth at the top end. The most important thing that they called out in the guide was an overlapping period of last year when they had really strong growth from Chinese advertisers. To put these numbers into perspective, here are what Meta's biggest competitors have reported (Amazon not included as it hasn't reported yet):

Google – 15% revenue growth for the quarter, no guidance for Q2

Snapchat - 21% revenue growth YoY, guidance of 15-18% YoY

LinkedIn – 10% revenue growth YoY, no guidance for Q2

We can see that Meta has topped all of its competitors in the current quarter growth with 27% YoY growth. Regarding guidance, they have also topped Snapchat, while LinkedIn and Google do not give guidance (but my bet is their numbers would show a similar to worse picture to Meta). So, from a guidance standpoint, Meta said they continue to see strong advertiser demand, and I don't have any worries about it. Not many companies are growing top line +20% in this environment.

Reels, recommendation engines, and AI targetings still driving results

Reels continue to progress well, as we already talked about in my previous posts, and they are starting to take market share from TikTok and others. From this earnings report, the takeaway is that they are not done yet in terms of monetization.

»So we're excited about the opportunities to continue making these ads more performant. And even though ads -- the Reels ad load, sorry, has increased over the last year, it remains lower on a per time basis than both Feed and Stories.«

(Susan Li, CFO)

The ad load compared to Feed and Stories remains lower in Reels, and while given the surface, the long-term ad load will probably be lower than a surface like Feed, management still noted that they are not done in terms of improvements of Reels monetization.

» Right now, about 30% of the posts on Facebook feed are delivered by our AI recommendation system. That's up 2x over the last couple of years. And for the first time ever, more than 50% of the content people see on Instagram is now AI recommended.«

(Mark Zuckerberg, CEO)

Video and Reels are also increasing engagement rates, which over time result in more revenue:

»We expect to continue that work going forward, while surfaces with relatively lower levels of monetization, like video and messaging, will serve as additional growth opportunities.«

»we see further opportunity to increase the relevance and personalization of recommendations as we advance our models.«

(Susan Li, CFO)

Another thing that I liked that was said on the call was that conversions grew at a faster rate than impressions over the course of the quarter. This is a good signal that CPM should continue to increase as advertisers increase their budgets because of better campaign performance results.

Targeting also remains the bring spot with Advantage+ still not fully rolled out and Meta seeing a lot of opportunities for continued adoption and providing value to advertisers:

»So on the single-step automation, Advantage+ Audience, for example, has seen significant growth in adoption since we made it the default audience creation experience for most advertisers in Q4, and that enables advertisers to increase campaign performance by just using audience inputs as a suggestion rather than a hard constraint. And based on tests that we ran, campaigns using Advantage+ Audience targeting saw, on average, a 28% decrease in cost per click or per objective compared to using our regular targeting.

On the end-to-end automation products like Advantage+ Shopping and Advantage+ App Campaigns, we're also seeing very strong growth. Mark mentioned the combined revenue flowing through those two has more than doubled since last year. And we think there's still significant runway to broaden adoption, so we're trying to enable more conversion types for Advantage+ Shopping.«

(Susan Li, CFO)

Even though just yesterday, The Verge came out with a report that some advertisers are having problems with Advantage+ Shopping tools (citing Reddit forums, etc.), on the contrary, everyone I talked to and almost every expert interview advertiser applauds Advantage+ as one of the key things that drivers more ad dollars towards Meta and is producing great results. The weird thing about this recent Verge report just a few days after Meta's earnings is that less than 14 days ago, they came out with an article showcasing that some advertisers are starting to move budgets from TikTok to Meta because of Advantage+. While being a big fan of their work at Verge I can’t help shaking off the feeling of this recent article being a more sentiment-driven narrative.

WhatsApp - the biggest Meta Gem

I believe WhatsApp is one of Meta's key assets for the next 10 years. This recent earnings report focused more on providing color and strategy for Meta's AI ambitions, so we didn't get much information on WhatsApp. Nonetheless, here are some of the things that we heard.

WhatsApp momentum in the US continues:

»I want to call out WhatsApp specifically, where the number of daily actives and message sends in the US keeps gaining momentum and I think we're on a good path there.«

(Mark Zuckerberg, CEO)

Just to remind everyone, WhatsApp makes revenue in two main ways:

Business Messaging

Click-to-Message Ads

From the current earnings report, WhatsApp Business Messaging revenue is increasing at a strong clip of over 85% YoY and is already a +1.5B annual revenue segment.

We didn't get more insights into click-to-WhatsApp ads, but in the last months, I have been doing a lot of research on WhatsApp and its potential going forward, and I have some interesting findings to share. I have posted some of the findings in my alternative data articles from the past quarter, but here is the most exciting insight I gathered that has yet to be shared in other articles.

This is an interview by a Former high ranking WhatsApp employee, and the most important things from his interviews were the following:

»The $10 billion on Messenger is based on eight years of that product in business. It is mostly coming from high Messenger countries like Philippines and Vietnam and not North America.«

»There's 100 countries or 150 countries where WhatsApp is dominant. I'm not even talking about North America here. I'm just saying the current global international revenue opportunity for click-to-WhatsApp ads is so much larger than Messenger, based on a few countries where Messenger created $10 billion«

»Businesses in North America are still on call centers. They're still on email. They're still on web chat. They have not pivoted to business messaging. Whereas businesses in Brazil, India, Germany are all pivoting to communicating over messaging apps because there's a dominant player messaging app in that country…. North America has not adopted business messaging generally. Therefore, they have not adopted Click-to-Messenger. If I had to guess what the percentage of the $10 billion from click-to-Messenger ads came out of North America, I would say less than 10%.«

source: Alphasense

The key is that the expert said that he believes that the $10B in click-to-message ads that Meta does is mainly from a small number of countries like the Philippines and Vietnam, which are high adopters of Meta's Messenger, which is further in the cycle than WhatsApp. He thinks that only 10% of the $10B comes from North America, which is shocking information to me, as Messenger is several times smaller than WhatsApp as a dominant app in a country, and to generate that kind of revenue with only a small contribution of that from the U.S. region is mindblowing.

Given all the research I did on WhatsApp, I think the opportunities for Meta on click-to-WhatsApp ads are enormous; if you add the business messaging, which will receive a big boost from AI agents, WhatsApp as an asset that dominated 100 countries could become the most critical business for Meta in the next 10 years. In that regard, when I see WhatsApp gaining momentum as a consumer app in the U.S., it makes me even more excited as we all know how much advertising revenue the U.S. market brings in the total world spend and that the »fight« is fought with Apple's iMessage for the dominant position.

What does AI mean for Meta?

On the earnings call, Mark announced that Meta would undergo a big multi-year investment cycle in AI and AI infrastructure going forward. This caused many investors to feel Deja Vu, as just a few years ago, many investors disliked Meta for its commitment to investing heavily in VR/AR and the metaverse. This dislike spiraled into a negative sentiment, which caused a plunge in the stock price.

To me, the investor reaction shows how shortsighted many investors are. It also shows that Wall Street largely lacks a fundamental understanding of how businesses work, evolve, and invest to become even more powerful companies. We all know how Amazon's AWS was viewed from Wall Street at the beginning.

In addition, it shouldn't surprise anyone that most companies will have to increase costs in the coming years to improve their products and serve many of the AI enhancements and new features. Most of the additional revenues and profits from using these features will come at a later stage when scale and cost efficiency are reached. On Meta specific, more than 3 billion daily users are using their service, so naturally, with a bigger user base, your infrastructure costs to serve these experiences are, in absolute terms, much bigger.

With GenAI and Meta, it is essential to understand Meta's natural position and what that means for its AI efforts. Meta is a rare company with all the necessary components to form a successful AI-dominant company.

Those components are:

Compute resources (infrastructure),

Engineering talent,

Data,

Distribution.

I would go even further and say that they are the number one company in the world in the data component, as they have huge clusters of individual-based and interest-based data gathered through multiple surfaces (PCs, mobile) with a long history.

The difference on this earnings call that I noticed was that Meta realized that it doesn't just want to enhance its existing products but also wants to go further and open itself to new business segments. The realization came to my view because of their natural position and because to have an edge, even with product enhancements in your existing product portfolio, you have to have one of the best AI solutions. I think a big risk would be if Meta did not invest in their own AI and had to resort to using someone else LLM (OpenAI, Google, etc.). Given how significant and high usage GenAI will be on social media and messaging platforms, that could have resulted in a long-term significantly lowered margin profile for a company like Meta, which would be the worst outcome for shareholders.

Investing in AI for Meta is also vastly different from investing in AR/VR. Firstly, regarding AR/VR, Meta didn't have any natural position of strength but had to build out the whole segment from zero (by acquiring Oculus). The second thing investors should focus on is that AI is necessary for every social platform company as it is the next evolution of these platforms. So, it's not like Meta has a choice if it wants to keep its market position. The third thing is that AI will drive short-, mid-, and long-term returns compared to AR/VR efforts, where most are in the long-term bracket.

Before diving deeper into the short, mid, and long-term benefits of AI for Meta, I made this visual summarisation:

Short term effects

Regarding AI's short-term effects on Meta, I categorize them into three segments: AI-recommended content, targeting, and ad creative savings.

Meta has been using AI-recommended content with Reels for quite some time. The most significant push towards that was caused by the emergence of TikTok and the realization that social media is transitioning from consuming content from your social graph to content from people you don't know. That resulted in having to serve a user content from a pool of 200 people he is connected as a friend to serving content from a pool of +3 billion people and rank that content with a powerful algorithm.

Meta is now transitioning to pushing more AI recommendation algorithms to surfaces other than Reels. This will increase the stickiness of the whole product portfolio and watch time and engagement rates.

»One of the things I would say is, historically, each of our recommendation products including Reels, in-feed recommendations, et cetera, has had their own AI model.

And recently, we've been developing a new model architecture with the aim for it to power multiple recommendations products.

We started partially validating this model last year by using it to power Facebook Reels. And we saw meaningful performance gains, 8% to 10% increases in watch time, as a result of deploying this.

This year, we're actually planning to extend the singular model architecture to recommend content across not just Facebook Reels, but also Facebook's video tab as well.«

(Susan Li, CFO)

In terms of AI targeting, we are talking about products such as Advantage+. I continue to believe targeting will become better and better as GenAI will serve more hyper-personalized creative and because now, with users using Meta AI inside their apps, Meta will have even more high-quality data that it can feed to the AI algorithm with » search-like queries« inside of their ecosystem.

The third part of the short-term tailwinds is cost savings for advertisers with AI ad creatives. With Meta offering more and more genAI tools to create ad creatives like pictures, videos, and text, companies need to spend less on people, social marketing agencies, and others. Many people don't know that a big part of a campaign's budget goes toward people or a social media agency. A digital expert quantifies this very well:

»The most normal for large advertisers is 20%-30% goes on people, and 70%-80% goes on media. It's fine. For small advertisers, it's more like 40%-50% goes on people and 50%-60% goes on media«

source: Alphasense

With GenAI taking a large portion of that load, advertisers can now save money on their campaigns. When surveyed, a significant portion of those cost savings would go to increasing the ad budget on the campaign, which again translated to more revenue for Meta.

It's also worth noting that GenAI in ad creative benefits small and medium advertisers the most. The reason is also the effectiveness of the campaigns. Before, smaller advertisers didn't put that much resources into making the best ad creative as they didn't have time or resources because of their small budgets. Bigger advertisers, on the other hand, had large agencies full of designers and design experts at their disposal. So, SME advertisers will start closing the gap towards the big ones, with Meta being one of the biggest platforms for SME advertisers in the world, which is a significant tailwind by itself.

In the short term, we also have to acknowledge the headwinds that will come from AI. The headwinds are not only the increased CapEx spend but also potential headwinds to revenue. If users start using Meta AI and similar products more, it will take time from other more monetized surfaces such as Feed, Stories, and Reels. It is a very similar playbook that played out with Reels, where when the product was in »scale-up mode« (which Meta AI is right now), it created headwinds to revenue in the short term (2022). In 2023 and this year, the higher monetization of Reels is causing tailwinds.

Mid-term effects

AI agents for businesses and creators are the biggest opportunities overall for Meta regarding GenAI. On the earnings call, Mark explained well how he envisions that working:

»The thing that I actually think is probably the biggest clear opportunity is all the work around business messaging. That's in addition to the stuff that we're already doing, just generally to increase engagement and ads quality in the apps.

But the business messaging thing, I mean, whether it's a creator or one of the 100-plus million businesses on our platform, we basically want to make it very easy for all of these folks to set up an AI to engage with their community.

For a business, that's going to be, to be able to do sales and commerce and customer support. And I think it will be similar for creators, although there will be more of a kind of just fun and engaging part there, but a lot of creators are on the platform because they see this as a business too, whether they're trying to sell concert tickets or products or whatever it is that their business goal is.

And a lot of these folks either aren't advertising as much as they could or, in business, the business messaging parts, I think, are still relatively under-monetized compared to where they will be. And I think a lot of that is because the cost of engaging with people in messaging is still very high.

But AI should bring that down just dramatically for businesses and creators.«

(Mark Zuckerberg, CEO)

From my perspective, the key thing here is that creators have their own AI agents with which their followers can engage. This opens up Meta to finally monetize content creators, as this economy has mostly passed them with creators striking direct deals with brands and advertisers. I see them monetizing them by adding paid features for their AI agents, more capable AI agents, or possibly even limiting the number of conversations an AI agent can have for free. After that, a subscription type of revenue has to be paid. But the thing that should be expected, at least in the mid-term, is that these AI agents from creators will lift time spent and engagement on Meta's platforms as users will have a more personal feel of the connection with the creator, which again down the line resolves in higher ad revenue.

When it comes to AI agents for businesses, I see it more as leveraging the already established business messaging. Many, including myself, view the biggest hurdle of Business Messaging not being adopted in Western countries as it is adopted in emerging markets because of the high costs of human labor. The other reason often cited was the use of more basic chatbots, which can often result in customer dissatisfaction. LLMs solve both of these problems. Meta will probably make a friendly user interface where companies can then feed/fine-tune their data to Meta AI and have their version of the AI agent interact with potential customers on all of Meta's platforms.

The exciting thing about business messaging revenue is that it is a separate industry from the ad industry. The global call center industry is set to be $500B annually. That is a big enough TAM to significantly increase Meta's revenue if they successfully disrupt and capture that market.

Long-term effects

This segment is the hardest to predict, especially with fast-moving and wide-direction technology like AI. In the recent earnings call, Mark addressed some potential monetization paths, like subscription revenue for more advanced models (similar to OpenAI) and monetized and paid content in Meta AI answers (upgrade of traditional search).

The most important thing, which I have already touched on in this article, is the freedom of not having to depend on one of the other LLM providers, which can save the margin of the core business from being reduced in the long term.

The two other things that could be quite interesting to me are a B2B business model around LLama, similar to a marketplace that OpenAI is building, where you are the underlying technology platform everyone else builds upon. Llama 3 is having a great start. Mark posted a few days ago that Llama 3 has +1.2 million downloads in the first week alone. The end form of this marketplace shapes out to be anyone's guess, but the upside is significant.

The second is having a competitive advantage in the AR market, where LLMs appear to be a key technology in navigating the AR glasses. Other players, such as Apple, may become dependent on third-party providers like OpenAI and Google, which may prove to be costly over the long term. And not to be too confused with the metaverse and everything around that. The latest version of Meta Ray Ban Smartglasses is a big hit, and many of the models are sold out. I expect Meta may achieve high mainstream product adoption in its next generation of Smartglasses if they add the hologram AR feature, as both holograms and an LLM assistant at an affordable price seem like a significant technology hardware upgrade.

Meta HAS to build AI infrastructure.

The point I emphasize is that if Meta wants to retain its strong position in the world, it has to invest in AI infrastructure as it has to adopt AI features both for users and advertisers. Long-term investors should reward such behavior as, arguably, Meta has been a tad late to the short-form video content. While the results of that still look good today, at some point, it was a serious danger to their business. Given the power of AI, I do not doubt that using these features, users will find it amusing, sticky, and addictive over time, and advertisers will achieve a much higher ROAS. If Meta wasn’t the company delivering these experiences to the market, somebody else would.

On top of it, because they serve more than 3 billion people daily, the amount of infrastructure you need to be able to serve these experiences to people is costly. Meta's CFO, Susan, also made a critical comment on the earnings follow-up call after the earnings call:

»The second thing is that, again, we’re building this out in a way where we can repurpose the capacity for other things. So if it turns out that we do not need as much training capacity as we expect, we will have the flexibility to deploy it towards inference capacity, for GenAI usage, or if it turns out that we don't need as much of that as we expect, we will be able to put it towards core AI ranking and recommendation use cases, which right now we are still at a place where capacity that we can put towards those use cases are quite positive ROI for us.«

(Susan Li, CFO)

This last comment should be important for investors worried about this AI investment not yielding returns. The AI infrastructure that Meta is building is flexible in terms of use. In the most pessimistic scenario, if Meta fails at their efforts of developing highly capable GenAI, they just frontloaded infrastructure that they will need anyway in a few years given their scale and, with it, inference costs and recommendation engine costs. I am not one of those skeptics, as I think it is an excellent move by Meta to double down on AI infrastructure. Still with it, I also acknowledge that, as with any prediction of the future, there is a probability of the whole thing not returning the outcomes that I presented today.

Valuation and summary

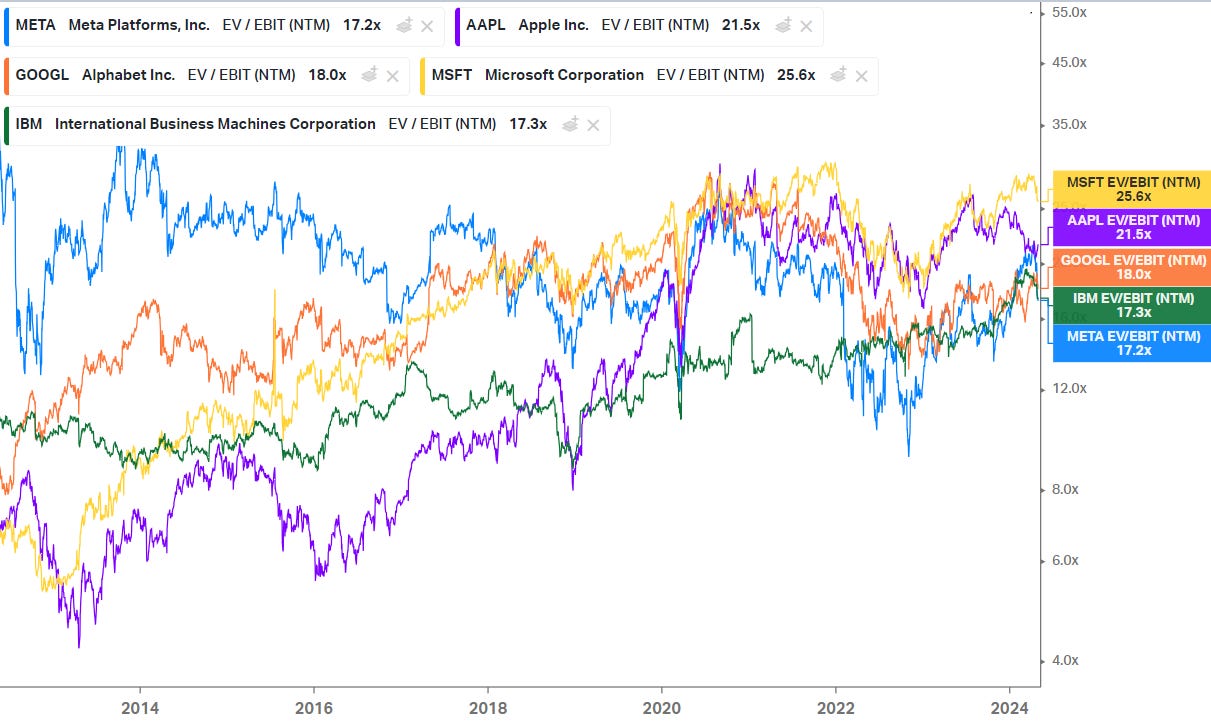

At the time of writing, Meta’s market cap was $1.1 trillion. It's trading at a 21.4x forward P/E and a 17.2x forward EV/EBIT (based on consensus estimates).

Comparing it to its tech peers, Meta, on an EV/EBIT, now trades lower than Google, Apple, Microsoft, and even IBM.

Given that Meta now spends an enormous amount on AI and AR/VR CapEx, I like to look at operating cash flow as it is the best measure of the core strength of a CapEx nonheavy industry. And yes, despite these significant investments, I still view Meta's industry as a CapEx light industry but with bigger investment cycles in big technology shifts. I still believe that Meta either sees results from their AR/VR efforts in 3-5 years or shuts down the project. In terms of their AI investment, I see a minimal chance that this investment doesn't yield results in the worst-case scenario; it serves as front-loading some of the necessary infrastructure for powering the core business. Either way, the market is giving zero value to AR/VR and is also very skeptical about Meta's AI ambitions.

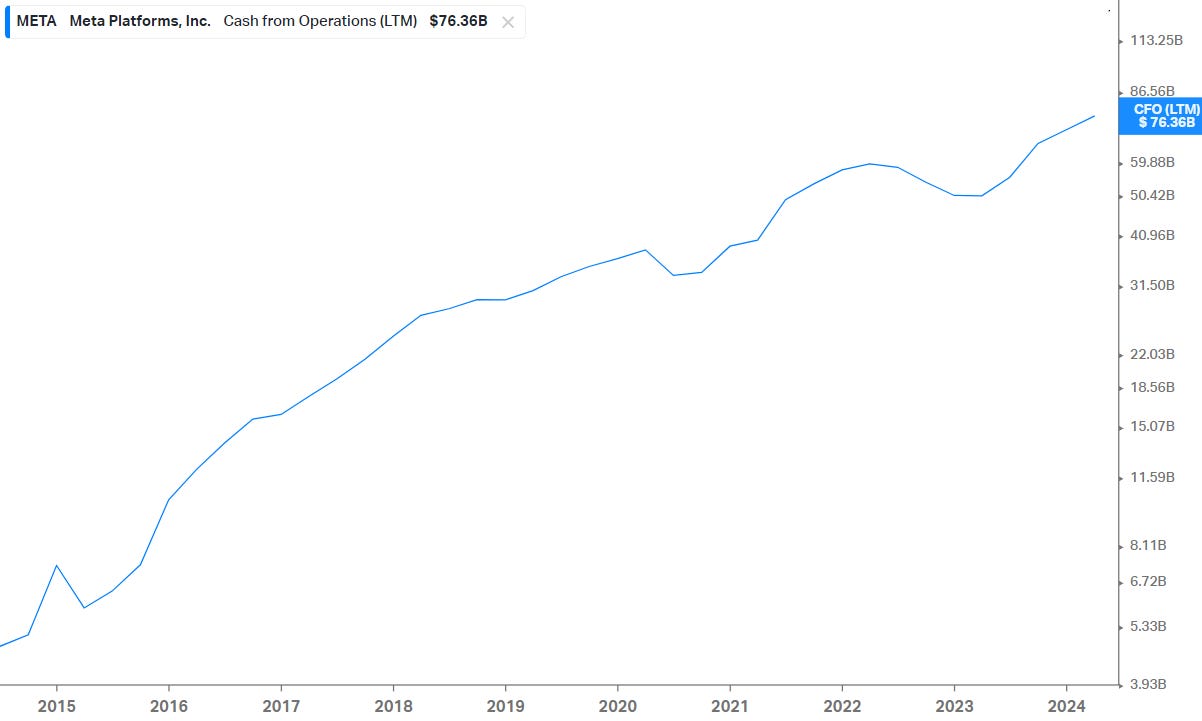

In terms of operating cash flow, Meta generated $76.3B in cash flow for the trailing twelve months.

While operating cash flow dropped from $57B to $50.5B in 2022, it has since increased by over 50% to $76.3B. The company trades at 14.3x operating cash flow and will spend around $40B in CapEx in the coming year. For comparison, Google trades at 20x operational cash flow, and Microsoft trades at 27x OCF.

Google generates $107B in OCF, Apple $116B, and Microsoft $110B. Meta currently generates 68%-71% of the OCF of the above-mentioned companies. However, the stock trades at a market cap of 36%-52% of the above-mentioned companies. I could not make the argument that any of these companies have a CapEx lighter long-term business model than Meta. Both cloud and hardware production are undoubtedly long-term heavier CapEx industries, so it's interesting to see the market pricing Meta the other way around. It's also worth noting that Meta is growing faster than any of the companies mentioned above. The questions around Meta's moat can also be put to bed as it has shown that it is a resilient business even when facing a fierce competitor like TikTok, Apple taking away signal for advertisers, etc. As a former Meta employee said:

»Went to Meta and a few years later, I realized part of the magic sauce at Meta is just because it's $1 billion opportunity doesn't mean that Meta should do it because there's 10 or 20 other billion opportunities available to them because of where they are and who they are, where they sit in the ecosystem…

When you spend a few years there, in my case, after spending my career in start-ups and then working at a big company like Facebook, that's the key piece that I think keeps them successful because they don't really touch small stuff. They only touch big stuff. Yeah, they might fail on things here and there, but when they succeed, they succeed big«

source: AlphaSense

When it comes to Meta, it again comes down to Mark Zuckerberg. If you are a long-term investor, you have to believe that he sees where the puck is going. With significant technology shifts like the one you see today, not all dominant technology companies stay in the same shape. Having the appropriate infrastructure for AI will be just the first but crucial step towards doing so.

I, for one, think he is one of the best CEOs out there and has an excellent track record of steering the company through many technology evolutions and changes over its history. As he put it well on their latest earnings call:

»I think it's worth calling out that we've historically seen a lot of volatility in our stock during this phase of our product playbook ‐‐ where we're investing in scaling a new product but aren't yet monetizing it. We saw this with Reels, Stories, as News Feed transitioned to mobile and more. And I also expect to see a multi‐year investment cycle before we've fully scaled Meta AI, business AIs, and more into the profitable services I expect as well. Historically, investing to build these new scaled experiences in our apps has been a very good long term investment for us and for investors who have stuck with us.«

(Mark Zuckerberg, CEO)

As a disclaimer, I recently added to my Meta position after its earnings results.

Until next time, take care!

As always, If you liked the article and found it informative, I would appreciate sharing it.

Disclaimer:

I own Meta (META) and Microsoft (MSFT) stock.

Nothing contained in this website and newsletter should be understood as investment or financial advice. All investment strategies and investments involve the risk of loss. Past performance does not guarantee future results. Everything written and expressed in this newsletter is only the writer's opinion and should not be considered investment advice. Before investing in anything, know your risk profile and if needed, consult a professional. Nothing on this site should ever be considered advice, research, or an invitation to buy or sell any securities.

Absolutely brilliant article. I absolutely loved the part about Meta having all the four prequesites to become a leading AI company.

I would even say, that there is a fifth! This is having a high ownership and longterm thinking Founder & CEO In Mark Zuckerberg.

I can't believe this excellent article has one comment.

We are all up nicely since the earnings call, thanks.