Monthly alternative data report: OpenAI, Google, Meta, Nvidia, Amazon, Microsoft Anthropic

Hi everyone,

I decided to post an article summarizing some of the most valuable insights from various alternative data providers, and research reports that I found over the last month, along with my comments on them. The report covers technology segments: AI, semiconductors, ad tech, and the cloud industry. Many of you have expressed interest in such a report, so I will publish this type of report on a monthly basis. This article will be shorter than some of my other ones, but I am sure you will still find it very useful. If you found it insightful, please share it with people you think might find it interesting.

Before we begin, I would like to invite you all to a webinar I am hosting this week on June 11th. I will be discussing AI, Robotics, and robotaxis, joined by Rahul Bhushan, Managing Director at ARK Invest. It is going to be a very interesting discussion, also packed with different insights. Even if you don't have time to join the live webinar, you can still register via this link. You will receive the webinar recordings via email to listen to at your convenience.

Now let's start.

The topics I found most interesting with valuable insights are:

1. The LLM race is starting to form its first winners

2. Google and its Search disruption (the latest data we have)

3. The chip sector – Nvidia vs ASICs, where we stand

4. Cloud providers: who is growing the fastest?

5. AI is making Meta a much better company – results

6. Amazon data on robotics and China exposure

7. AI consumer devices are the next big leg

The LLM race is starting to form its first winners

The market is splitting into two directions: one is consumer LLMs, and the other is enterprise LLMs. It has also become evident that different things matter to those two groups.

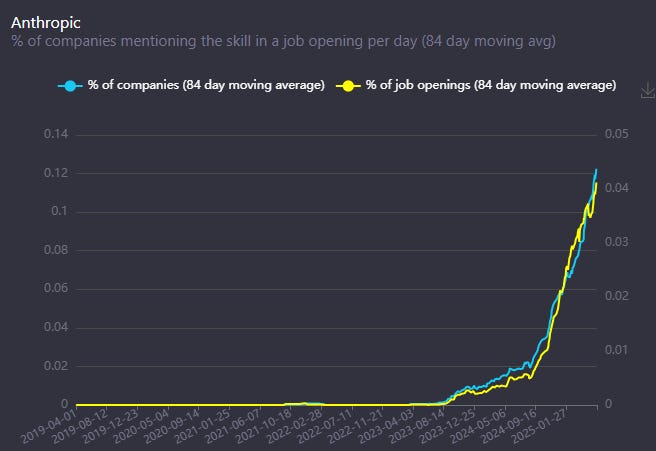

For enterprises, the performance and costs of AI models are the primary drivers of adoption. While OpenAI still holds a substantial market share here, Google's Gemini, based on betting markets like Polymarket, is the number one model right now when it comes to performance. Looking also at the number of job openings mentioning Anthropic as a needed skill, we can also see that Anthropic, the company that Amazon is heavily invested in, is gaining a lot of momentum, especially with coding-based use-cases:

In the consumer world, the factors that matter most to consumers are different from those that matter to enterprises. It has become apparent that brand and UX have become increasingly important, as regular users can hardly distinguish between the accuracy levels of these models. On top of it, with memory becoming an essential part of these models, memory will, in my view, become another »moat« driver for the industry and a vendor lock-in for many users. When it comes to brand power, OpenAI, with its ChatGPT brand, has only expanded its power with consumers as ChatGPT has become a mainstream verb. We also received news yesterday that OpenAI has reached $10B in recurring annual revenue, which is another record breaker and demonstrates how ChatGPT has gone mainstream.

ChatGPT has consistently been one of the top download apps on iOS since the start of the year. A research report from SensorTower & Bernstein also shows the significant gap that has formed between ChatGPT and Google's Gemini:

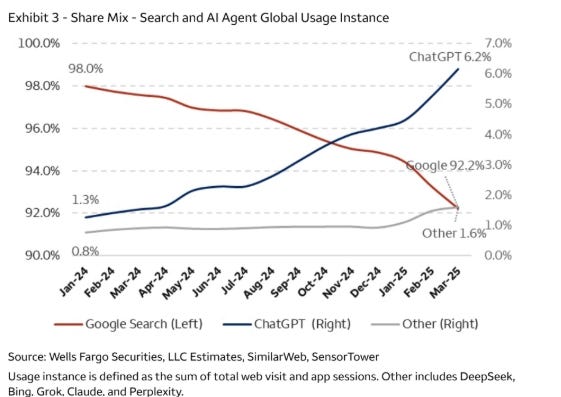

This chart from SensorTower, SimilarWeb, and Wells Fargo shows a similar picture, with ChatGPT gaining significant momentum also in usage:

Google and its Search disruption (the latest data we have)

We have also recently received some new data on Google and its Search disruption. I wrote two pieces on this topic, and my viewpoint remains the same: Search is being disrupted, but the pace of that disruption might be slower than many think. We received some interesting news when Apple's SVP of Services, Eddie Cue, said in court testimony that the search volume in Safari declined for the first time in April. Of course, the default search provider on Safari is Google, so that suggests that Google searches are declining. The next day, we got a statement from Google debunking that claim:

»We continue to see overall query growth in Search. That includes an increase in total queries coming from Apple’s devices and platforms. More generally, as we enhance Search with new features, people are seeing that Google Search is more useful for more of their queries—and they’re accessing it for new things and in new ways, whether from browsers or the Google app, using their voice or Google Lens.«

Many investors were questioning who to believe, but both statements might be true. Looking at Statcounter browser data for April, their data suggest that Google Chrome gained share year-over-year (YoY) from Safari, with Chrome's share up 89 basis points (bp) YoY while Safari declined 86 bp. Therefore, a decline in Safari's market share could be one reason for the drop in search queries for Safari and not necessarily a all around decline in Google searches.

I believe that the usage of Google Search is dropping, but at the same time, the number of queries because of Google's AI overviews and GenAI search might not fall much or fall at all, as users do more searches with LLMs.

Goldman shared additional data from comScore. Their data showed that indexed users and indexed total site views have been flat-to-up since November 2022 (when ChatGPT was introduced). Additionally, data from BrightEdge indicates that search impressions are up 49% year-over-year (YoY) as of May 2025, including a 7x increase in queries of 8+ words (indicating that AI Overviews is leading to volatility in click volume but is positive for query volume).

Regarding Google's Search disruption topic, we also received an interesting note from Bernstein, stating that the 90% share of the Search engine market is actually a 65%-70% market share of the total queries market, with other alternatives including ChatGPT, Amazon, Meta AI, and others.

The chip sector – Nvidia vs ASICs, where we stand

I read some interesting expert interviews on the topic of Nvidia and its long-term market share versus custom ASICs. The two interviews that stand out are one from a current Microsoft employee working in the AI chip field and a current Meta employee also working in that field.

The key highlights from the Microsoft employee interview were that Microsoft already uses some ASICs instead of GPUs for training some of their template models. He also mentioned that ASICs are 2x more cost-effective in training than Nvidia's H100. He also thinks that for human interactions and when humans train models extensively, GPUs are and will be preferred because of their flexibility. In his assessment of the breakdown of GPU/ASIC, he sees the current AI workloads as 90% GPUs and 10% ASICs. In two years, he expects the split to be 80/20. For inference, he also sees numerous benefits of GPUs over ASICs, which is why he predicts a 2-year split of 80/20 in favor of GPUs.

The other interview with the current Meta employee was also very insightful. He also mentioned that Meta uses ASICs for training when distilling their models into smaller ones. Moving from Llama 4 to Llama 5, he expects that 75% of the compute needs will be met via GPUs and 25% via ASICs, as there are many architectural changes expected in the move to Llama 5, where GPUs are again preferred. He also mentioned cost savings but said ASICs are 3-4x more cost-optimized than GPUs. Interestingly, he noted in AI inference that the ratio of GPUs to ASICs is expected to be 60% GPUs and 40% ASICs over the next 2 years, but sees ASICs taking the lead in the next 5-6 years.

Both interviews were very insightful, as they show ASICs already having some market share with these two major Nvidia clients. Additionally, Meta's employees observed a faster pace of ASIC adoption, which may stem from the fact that Microsoft is earlier in its ASIC development phase than Meta is and thus has less performant ASICs than Meta.

Both interviews were found on AlphaSense.

Cloud providers: who is growing the fastest?

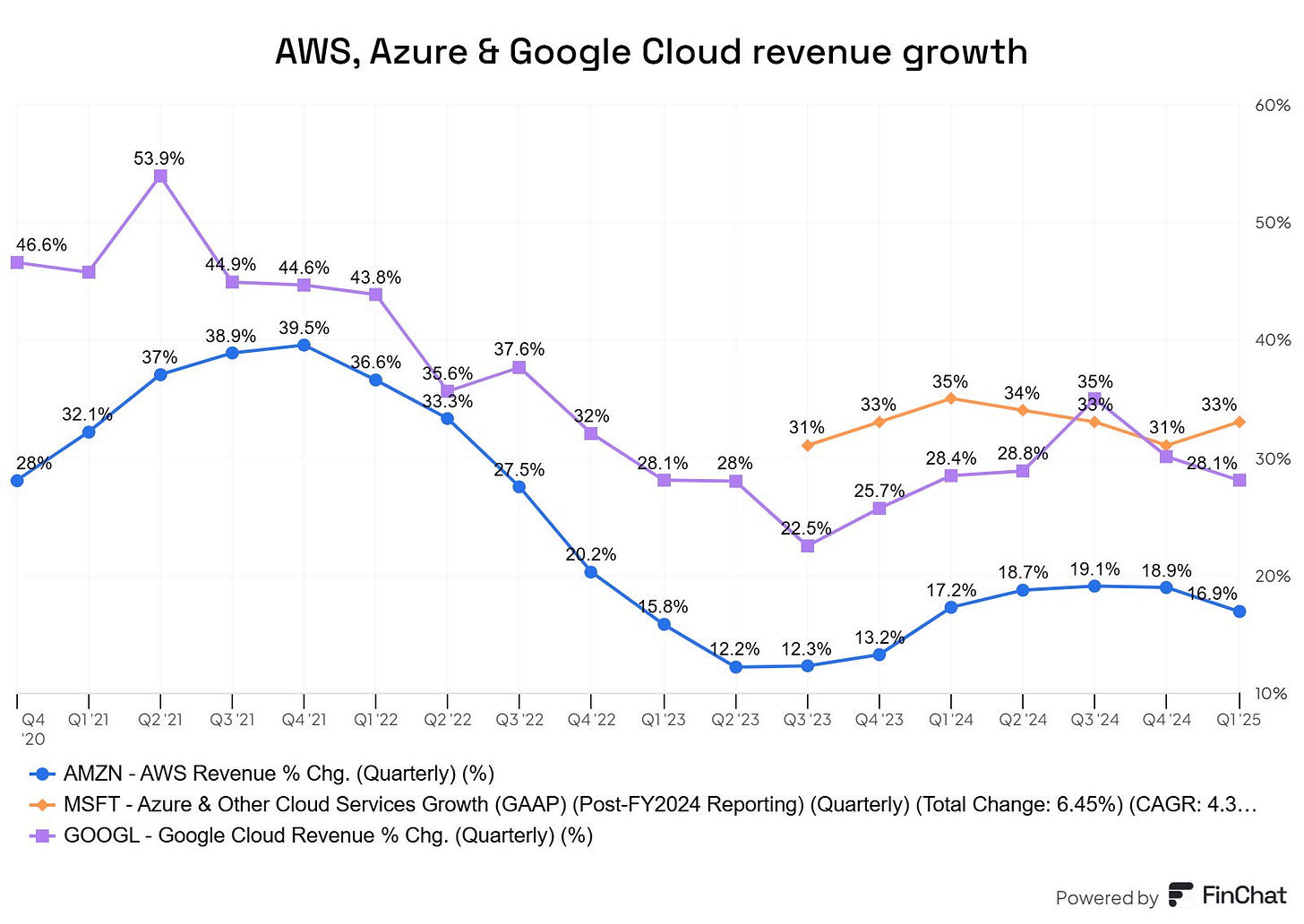

After reviewing earnings results from tech companies, we can compare the progress of all three hyperscalers: Amazon AWS, Google Cloud (note that we don't have exact data on GCP), and Microsoft Azure. An important point of difference this quarter was the acceleration of Azure in contrast to the deceleration of both AWS and Google Cloud.

The difference highlights the importance of OpenAI as a client to Microsoft and how its perceived connection with OpenAI is affecting clients' decisions to use more of Microsoft when considering AI workloads. While Microsoft is trying to diversify away from its reliance on OpenAI, and the relationship between these two companies is becoming more complex, I believe that for Microsoft, maintaining a substantial ownership share in OpenAI and securing its default cloud provider deal going forward is strategically important. The growth of usage of OpenAI and ChatGPT is visible in these Azure numbers.

AI is making Meta a much better company – results

I have written extensively about Meta, so most of you are familiar with my views on the company. It remains one of the primary beneficiaries of the current and future AI wave. We obtained some interesting slides from Meta from their FTC hearing. The ones that I found the most interesting were these three:

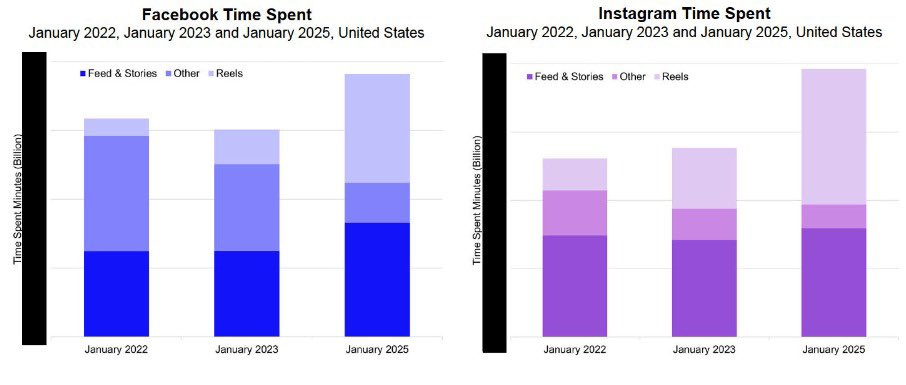

The first one shows that Meta's shift in 2022 towards short-form video (Reels) has been the right decision, as it has significantly increased Time Spent on both Facebook and Instagram. I still vividly remember how some users were upset when Meta made the shift, saying that they wanted to see more friends and family content and not 3rd party content, and how they didn't want video, as Instagram is a »photo app. « Well, it turns out Zuckerberg was right again when he said that they are making these decisions based on usage data they are getting from users, and the data spoke volumes, saying people want more 3rd party content and more video.

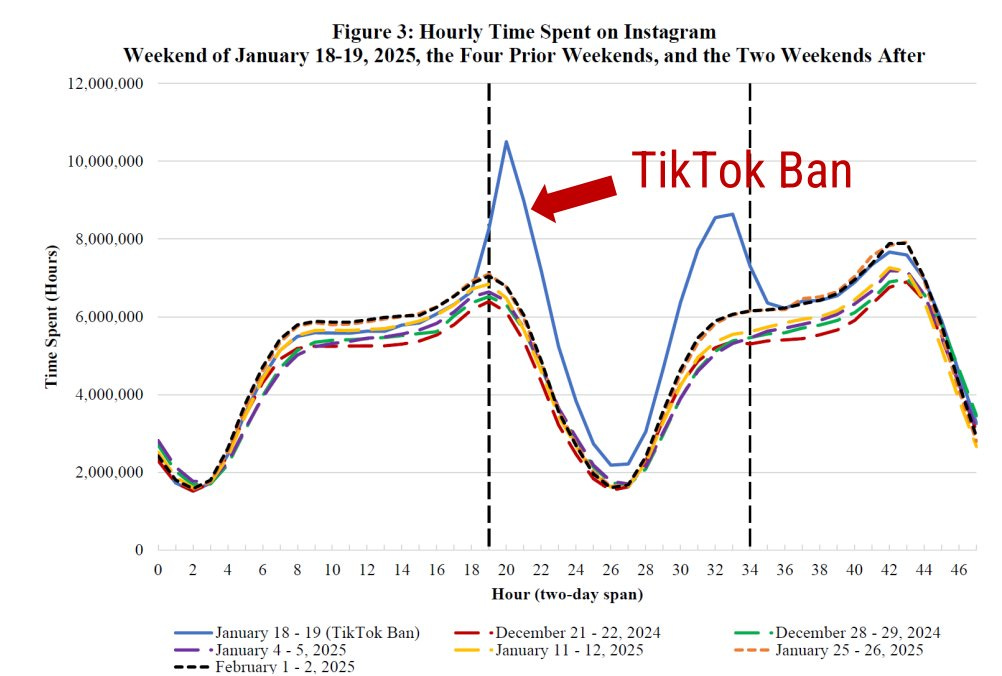

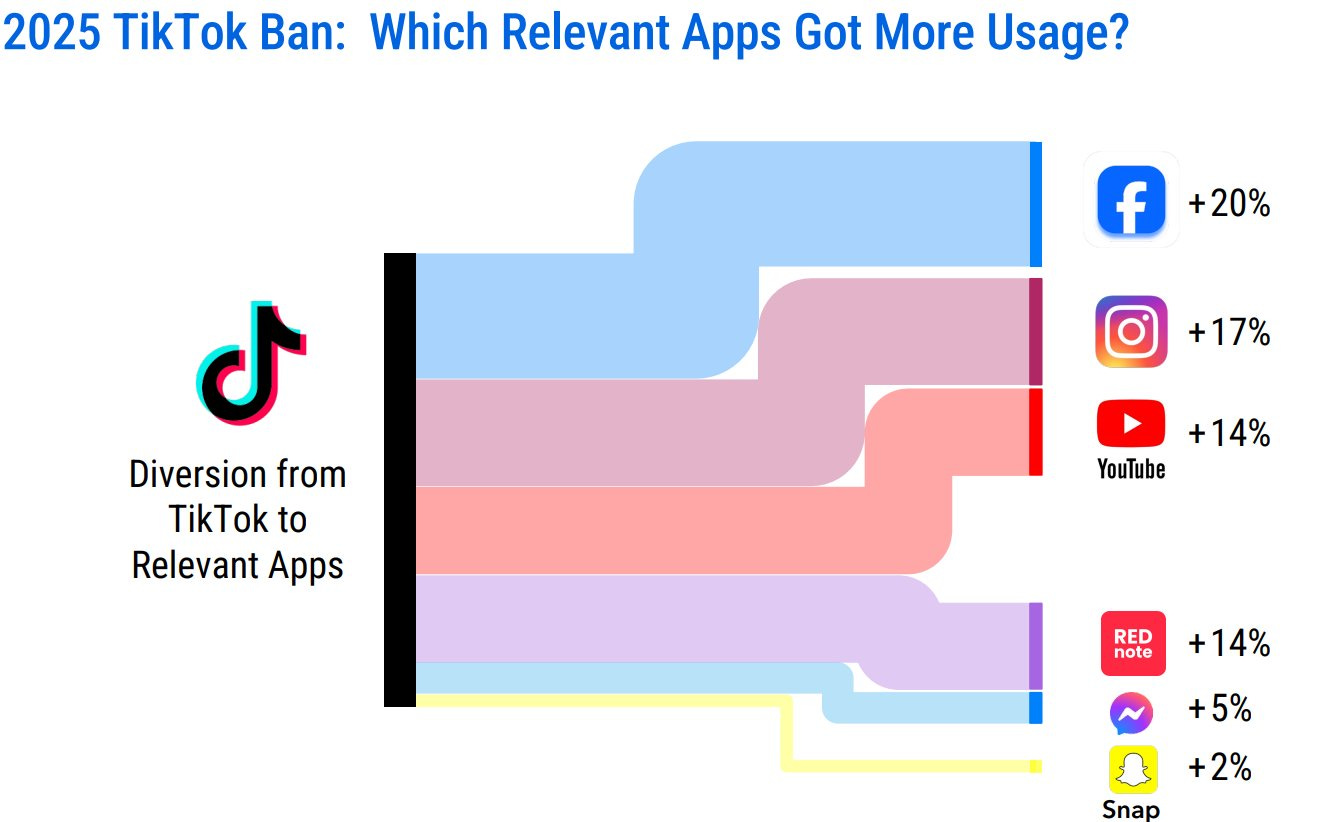

Then, there were two more slides showing how Meta would truly be the purest benefactor if TikTok were banned in the U.S. For the few hours that TikTok went down in the U.S. because of the ban, Meta saw a significant uptick for its apps, especially Facebook and Instagram, which can be seen in these two slides Meta put out:

Amazon data on robotics and China exposure

When it comes to Amazon, we all know that robotics is an area that will bring significant benefits to the company. When it comes to fulfillment and warehouse automation, Amazon still has room to improve, as noted by its management.

Brian Nowak, for Morgan Stanley Research, put out a note estimating that 10% of U.S. units that go through new robotics-enabled warehouses can drive $2B-$3B of annual savings for Amazon by 2030.

We also received a research note from Bernstein and Open Supply Hub, which showed that 31% of suppliers on Amazon are based in China, followed by 21% from the U.S. They also broke down the products being imported the most in the U.S. by category. 89% of Apparel is being imported, 71% of Computer and electronics, and 59% of Electrical equipment. Both of these data points are helpful for investors trying to make sense of the new possible trade regime.

AI consumer devices are the next big leg

As the final point in this report, my conviction that AI consumer devices are the next major battleground has only grown stronger. OpenAI's acquisition of Johny Ive's one-year-old startup, formerly associated with Apple, for $6.5B at the end of May is a significant signal that OpenAI also recognizes this. In addition, Meta, with its Ray-Ban Smartglasses, is gaining traction with users and is expected to release a new version of the glasses this year, which should include some holographic features. Yesterday, we had Apple's WWDC event, where they didn't really show much except for their new software redesign called Liquid Glass. It essentially makes your navigation look more transparent as if you are looking through a liquid. While it may not make sense to me to use it on your phone, as it makes the screen less clear, it hints at Apple trying to prepare users for this type of view, as this type of screen and navigation bar is useful for AR glasses. The next battleground for these tech giants will become AI hardware and the new computing platform.

As always, I hope you found this article valuable, I would appreciate it if you could share it with people you know who might find it interesting. I also invite you to become a paid subscriber, as paid subscribers get additional articles covering both big tech companies in more detail, as well as mid-cap and small-cap companies that I find interesting.

Thank you!

Disclaimer:

I own Meta (META), Google (GOOGL), Amazon (AMZN), Microsoft (MSFT), and TSMC (TSM) stock.

Nothing contained in this website and newsletter should be understood as investment or financial advice. All investment strategies and investments involve the risk of loss. Past performance does not guarantee future results. Everything written and expressed in this newsletter is only the writer's opinion and should not be considered investment advice. Before investing in anything, know your risk profile and if needed, consult a professional. Nothing on this site should ever be considered advice, research, or an invitation to buy or sell any securities.