OpenAI has started to form a "moat"

Hi all,

I decided to share some of my thinking around OpenAI. We are now at a critical point where OpenAI is starting to take off and seriously take over the consumer AI race. My thinking has changed in the last few months from the previous thinking, where every model will be commoditized and no LLM provider will actually have a moat. At this point, I believe that OpenAI has started to form the first signs of a moat in the consumer part.

Before we begin, I would also invite you to listen to a conversation I recently had with Rahul Bhushan, Managing Director at ARK Invest. We discussed AI, Robotics, and Robotaxis, as well as OpenAI, which holds the third-largest position in their ARK Venture Fund.

Now let’s start…

Adoption

I think anyone who follows the AI space knows about OpenAI and, more specifically, about ChatGPT. Even outside of investors and tech enthusiasts, the verb ChatGPT has gone viral, similar to how the verb Google started. What is even more surprising is that despite ChatGPT being out there for more than 2 years already, just recently, at the end of March, it came to another acceleration point in terms of adoption when the Ghibli photo trend emerged on ChatGPT:

The number of MAUs doubled from 400 million to 800 million in a matter of a few weeks. Looking at the adoption curves of other highly adopted technology platforms, such as TikTok, Facebook, Instagram; ChatGPT, is on a slope of its own.

Another factor to consider is that it is not just a “I must try it moment”. Looking at the number of minutes a user spends on ChatGPT, the minutes are constantly growing and have now reached the 29-minute daily mark.

Remember that at the start of ChatGPT and LLMs, many critics said that people tried it, had fun, and then didn't use it again. This trend shows that that is not the case and that with each enhanced model version and UX improvement, the stickiness factor becomes bigger.

The adoption surge of ChatGPT in the last few months can also be seen in data from Similarweb, which shows app store downloads over the last 28 days for ChatGPT compared to some of the popular apps, such as TikTok, Instagram, Facebook, and X.

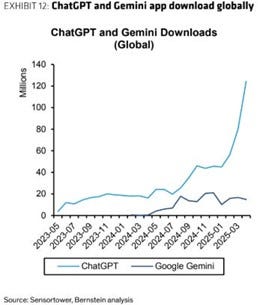

The same trend can be seen from SensorTower and Bernstein data:

The data from Revalera, which I often share, showing the number of job openings mentioning ChatGPT as a needed skill, continues to rise at an astonishing pace:

»We didn’t have any defensibility strategy for a long time.« OpenAI CEO Sam Altman

With the rapid adoption of ChatGPT, despite what many see as its less-than-perfect performance models (on Polymarket, Google's Gemini has been the best-rated model for some time now), OpenAI has now, in my opinion, created the first signs of its consumer moat and brand power.

And now we are entering a key year…

The following 12 months are key in the AI race. We are approaching a point where memory, model personalization, and AI agents are starting to take shape. The thing about memory and personalization is that once consumers start putting their data in, it will create a vendor lock-in, as in the future, once that memory about you and data becomes bigger, it will be a big hassle for you as a consumer to move that data to another agent or LLM provider. It is similar to the network effects of early Facebook. With ChatGPT's rapid adoption in the last months and now memory as a vendor lock in the race for others to compete becomes harder, even if down the line they develop and provide more capable models, for consumers it is not like with enterprises where the best performance model at the most affordable price will win. For consumers, it's about convenience and brand.

The urgency of the next 12 months and the rapid surge of adoption from ChatGPT haven't gone unnoticed by its competitors. There is a reason why Mark Zuckerberg from Meta has become increasingly aggressive in the last few weeks, with Meta investing $14.3 billion for a 49% stake in Scale AI. As part of the deal, Scale AI's CEO, Alexandr Wang, is joining Meta to work on their AI efforts. The Scale AI investment is an »aquihire« of talent from Scale AI to help boost Meta's AI efforts with Llama, which have lagged behind their competitors. Zuck is going deeper than just Scale AI, with now personally assembling a group of 50 top AI experts to join Meta in leading its AI efforts. As reported, he is now reviewing various research papers published by AI research labs, including OpenAI, DeepMind, and Anthropic, to determine who has actually developed and discovered this technology within the labs and is attempting to poach them with substantial compensation offers, such as $100M. Just yesterday, it was reported that Zuck had already poached four key OpenAI employees, with three forming OpenAI's Zurich office.

Zuck is being extremely aggressive because Llama has hit hurdles and now lags behind its peers, but also because he understands that with memory, personalization, and agents, the window to catch up in the LLM race is the next 12 months, as these new features will take effect and vendor lock-in will occur. My prediction is that within the next 12 months, we will have at most five companies working on the frontier LLM models: OpenAI, Anthropic, Google, xAI, and Meta.

OpenAI's hardware ambitions

OpenAI also now has serious hardware ambitions. In late May of this year, they acquired Jony Ive's startup, a famous former Apple designer, for nearly $6.5 billion, who will now lead OpenAI's hardware efforts. What is now almost a consensus opinion among big tech leaders is that AI will unlock the next computing platform, one that is not tied to the smartphone.

And if you listen to those conversations, everyone is calling for a similar device. A device that will be more like a companion system and will be less dependent on a screen. Proactive assistant who will run even when you don't ask it.

»The interface almost melts away.” OpenAI CEO Sam Altman

A device that will be primarily navigated through speech and visuals. Meta and Google view it more as AR glasses, while, according to rumors, OpenAI initially sees it as more of an iPod Shuffle-like device that you wear around your neck. My bet is that AR smartglasses will be the form factor that wins and reaches mass adoption, especially if simple holograms are added to the glasses, allowing them to replace some of the screen.

However, a new device is on the horizon, which will mark another significant milestone for the tech industry. Here is Altman explaining the vision for the device in a YC talk he did just a few days ago:

source: YouTube

Similarly, the view of vision and speech is also shared by Satya Nadella, the CEO of Microsoft, on a recent podcast:

source: YouTube

OpenAI's hardware ambitions also reveal that they do not view themselves as an LLM provider but rather as a Big Tech company. They aim to offer a software stack with LLMs and AI assistants, own the device, and, with Stargate, have their own infrastructure (similar to Google or Meta) rather than being dependent on any Big Tech company. It will be interesting to see how this ambition collides with Apple's partnership with OpenAI, but what is clear is that this ambition is already causing some friction with OpenAI's relationship with its largest investor, Microsoft.

Microsoft and OpenAI's relationship

In 2019, when Microsoft first invested in OpenAI, the relationship was great, as Microsoft was basically a compute sponsor for OpenAI, and OpenAI was a »bet« like company. Since then, things have changed significantly, and despite Microsoft still being a major shareholder of OpenAI, the two companies have experienced some tension. There are a few reasons for the tension, but the way I see it is the following:

Compute capacity. Initially, Microsoft was very satisfied with having OpenAI as a customer, which accounted for the most Azure AI compute in 2023. Today, Microsoft aims to ensure that the compute is available to other companies, as it seeks to capture the entire cloud business of these companies and prevent them from migrating to AWS or GCP. With $70B of already committed CapEx from Microsoft, Satya also doesn't want to push the Microsoft CapEx number into territory where it would significantly affect Microsoft's net income and shareholder patience. His recent comments, emphasizing that the industry ensures AI delivers real-world results rather than just benchmark statistics, suggest that he is more cautious about future AI investments and doesn't align entirely with the OpenAI mission of achieving AGI.

On the other hand, OpenAI's computing needs have grown significantly, and they have become dissatisfied with Microsoft's failure to provide sufficient computing resources for them. So, they both agreed that OpenAI would launch Stargate, its own massive data center, with the help of Oracle and SoftBank.

OpenAI change of entity. As OpenAI accepts new investors like SoftBank, it must transition its capped profit structure into an entity where profits are not capped, allowing the company to conduct an IPO eventually. As part of this, they must negotiate the new ownership stakes and structure with their existing shareholder, with Microsoft being a 49% owner of the capped profit entity. As you might expect, OpenAI wants to renegotiate its previous terms with Microsoft, including both Microsoft's equity stake and its revenue share agreement, as well as cloud and OpenAI API distribution exclusivity and IP rights. Given the importance of OpenAI at this stage and in the future, this negotiation is likely the most significant in Microsoft's history. Likewise, for OpenAI to continue raising substantial amounts of capital and grow, it needs a stable structure and shareholder base.

OpenAI ambitions. The last point of tension, in my view, comes from OpenAI's ambitions. OpenAI doesn't view itself as a "feature" of a Big Tech company and doesn't view it as a subsidiary or dependent of Microsoft. With their product goals, they often also intersect with those of Microsoft. Recently, the path was crossed with OpenAI's $3B acquisition of Windsurf, which is a competitor to Microsoft GitHub Copilot (one of the most important parts of Microsoft's AI product portfolio). Another important path of tension is that LLMs and just-in-time software will likely replace many SaaS solutions. That includes software like Microsoft Office products. The future software might look like an underlying database, an API, and the inference being the LLM. This is not a secret anymore, as even Satya mentioned this option multiple times on recent podcasts:

“Business applications are essentially CRUD databases with a bunch of business logic. The business logic is all going to these agents and they’re going to update multiple databases, and all the logic will be in the AI tier so to speak.”

He also mentioned this in an interview with the Economic Times:

“A lot of the business logic will move to a new tier, which then will be a multi-agent tier that needs to be orchestrated. It's going to be an agent that will orchestrate across multiple SaaS applications. Just like I can build a spreadsheet, I will build thousands, hundreds of agents that are working to help me streamline my own work”

For Microsoft »controling« this potential disruption is very important, and with OpenAI's ambitions and fast pace that seems like a heavy task to do.

Conclusion

OpenAI has established strong brand power, which now gives it an edge in the consumer LLM market. The next 12 months are crucial as they can leverage brand power in conjunction with agents, memory, and personalization to lock in users. Big Tech should be really focused on OpenAI as their ambitions, brand power, and access to capital are on par with theirs and could pose a threat to almost every one of them in the future.

As always, I hope you found this post insightful. I would appreciate it if you could share it with people you know who might find it interesting. I also invite you to become a paid subscriber, as paid subscribers get additional articles covering both big tech companies in more detail, as well as mid-cap and small-cap companies that I find interesting.

Thank you!

Disclaimer:

I own Meta (META), Google (GOOGL), Amazon (AMZN), Microsoft (MSFT) stock.

Nothing contained in this website and newsletter should be understood as investment or financial advice. All investment strategies and investments involve the risk of loss. Past performance does not guarantee future results. Everything written and expressed in this newsletter is only the writer's opinion and should not be considered investment advice. Before investing in anything, know your risk profile and if needed, consult a professional. Nothing on this site should ever be considered advice, research, or an invitation to buy or sell any securities.