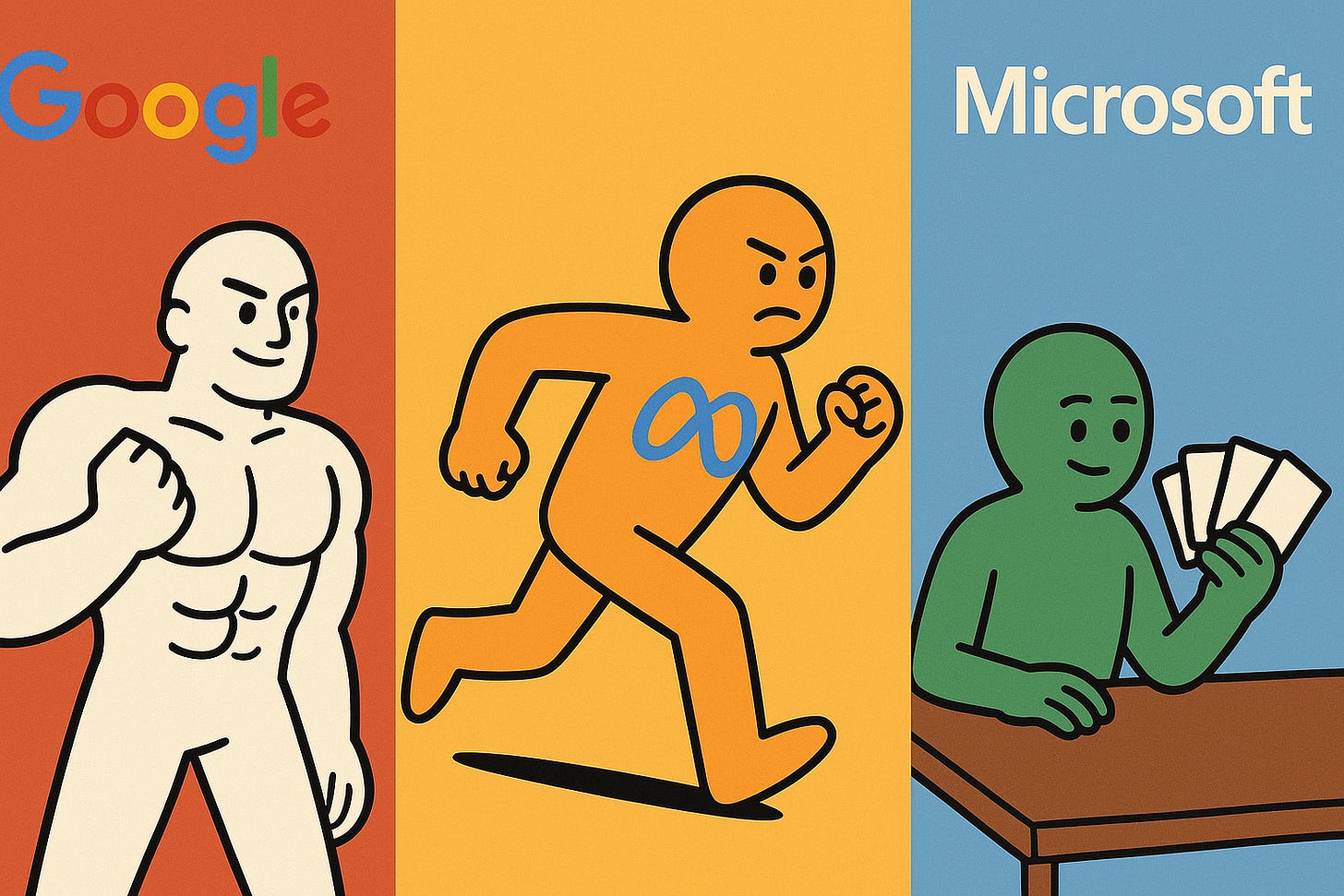

Q3 earnings: Google's AI muscle, Meta Goes All in, Microsoft shows its cards

Hey everyone,

I wanted to share my thoughts and the key highlights from yesterday’s earnings calls from Google, Microsoft, and Meta, because I believe we got some very important signals for these companies and the industry at large.

Google earnings

The key findings from the call I would summarize in the following:

Google Search is much better than expected, and the future of AI Search monetization is getting clearer

GCP continues to impress and win over deals

Google is executing on AI

Search

Google Search delivered impressive results, generating $56.6B in revenue, up 14.6% YoY.

Sundar explained:

»AI is driving an expansionary moment for Search. As people learn what they can do with our new AI experiences, they’re increasingly coming back to Search more.«

Google already talked about in Q2 earnings that overall queries and commercial queries continue to grow YoY on Search, yesterday they added even more color and said:

»During the Q2 call, we shared that overall queries and commercial queries continue to grow year-over-year. This growth rate increased in Q3, largely driven by our AI investments in Search, most notably AI Overviews and AI Mode.«

So, especially AI overviews are prompting people to search more, which is enhancing the Search experience and giving us first glimpses of what future AI search will look like. Google also said that AI mode is resonating well with users and that it now has 75M DAUs.

Ad clicks in the quarter were up 7% YoY, and CPCs were up 7% YoY.

A very interesting segment of the call was when Google discussed the monetization of AI Search.

»And as I’ve shared before, for AI Overviews, even at our current baseline of ads below and within the AI’s response, overall, we see the monetization at approximately the same rate.«

But the bigger AHA moment for me on the call was when Google hinted at a path where AI Search can also make traditionally non-monetizable search queries monetizable:

»You could also argue that on queries, that historically have not been well monetized. We think there is a potential opportunity here where you can obviously imagine that we can build this out with smart AI integration.«

»there’s an opportunity to actually take, let’s say, queries that are not fully commercial but could have an adjacent commercial relationship to basically expand this into more attractive ads offerings without -- while really creating a really interesting user experience at the same time.«

This is a very important piece for investors as only about 20% of traditional Search queries are commercial, so if AI Search can unlock that pie further while the monetization rate of AI overviews is similar to tradtional Search the TAM in terms of ads for the AI Search part could be even bigger than the traditional Search TAM, which most investors don’t expect right now.

GCP

As expected, and as I shared in my last article, which explained what alt data and my expectations were for GCP, AWS, and Azure, GCP delivered a really strong quarter.

Google Cloud revenue was $15.2B, up 34% YoY, but within Google Cloud, GCP continued to grow at a rate that was much higher than Cloud’s overall revenue-growth rate, as mentioned by management. My guess is that, based on this comment and other data that I am seeing, we are talking about a +40% YoY growth rate in GCP.

The impressive stat was also Google Cloud’s backlog, given that they don’t have a prime customer such as OAI, and the usage of Anthropic is split between AWS and GCP:

»Google Cloud’s backlog increased 46% sequentially (quarter over quarter) and 82% year-over-year, reaching $155 billion at the end of the third quarter.«

As I already shared and now confirmed by management, GCP is winning big with new clients:

»The number of new GCP customers increased by nearly 34% year-over-year. Two, we are signing larger deals. We have signed more deals over $1 billion through Q3 this year than we did in the previous 2 years combined.«

The diversifications of clients also seem very healthy, especially as I am more and more concerned about the concentration of the industry to two clients:

»Over the past 12 months, nearly 150 Google Cloud customers each processed approximately 1 trillion tokens with our models for a wide range of applications.«

AI execution

A big, important data point was that the Gemini app now has over 650M MAUs, and that queries increased by 3x from Q2 of this year. Just to put it in context, ChatGPT probably has around 1B MAUs, so Gemini has made significant gains in the last quarter.

Gemini adoption is also present with enterprises, not just end-users:

»Our first-party models, like Gemini, now process 7 billion tokens per minute via direct API used by our customers.«

On an important question of models advancing at a slower pace, Sundar acknowledged that, but at the same time, hinted that this is the reason why Gemini 3.0 is coming out a few months later than expected:

»I’m incredibly impressed by the pace at which the teams are executing and the pace at which we are improving these models. But it also is true at the same time that each of the prior model you’re trying to get better over is now getting more and more capable. So I think both the pace is increasing, but sometimes we are taking the time to put out a notably improved model, so I think -- and that may take slightly longer.«

And yes, we got confirmation, Gemini 3.0 is coming out THIS year.

Google Summary

All in all, a great quarter by Google, showing not only that GCP is taking the most market share right now and is uniquely positioned with its TPU offering, but also Google Search showing what the future is going to look like, and that future might be even better than the past, which is a big message.

Microsoft earnings

With Microsoft, my main focus is on what's most important: Azure. We got a strong Azure number with Azure growing 40% and 39% in constant currency, but the questions and concerns were focused on customer concentration and the relationship with OpenAI.

And we got some really great insights on that topic and how Satya and Microsoft are thinking about this going forward.

First of all, as you might expect just from having OAI as a client, forward bookings are off the charts:

»Commercial bookings increased 112% and 111% in constant currency and were significantly ahead of expectations, driven by Azure commitments from OpenAI as well as continued growth in the number of $100 million-plus contracts for both Azure and M365. These results do not include any impact from the incremental $250 billion Azure commitments from OpenAI announced yesterday. Commercial remaining performance obligation increased to $392 billion and was up 51% year-over-year.«

But the question is not just what your bookings are, but whether the most important client, OAI, can pay for those orders, and what if Microsoft overbuilds because of that one client?

Microsoft gave us an answer to that and how they are viewing things.

Throughout the call, management was very careful to send the following message: Yes, we will expand and build new data centers at a high pace over the next 2 years, but we are doing so based on even short-term demand we have, so 2 years.

So they are saying that Microsoft is not taking much risk because it is matching its buildout to short-term demand, since the ability of OAI to fulfill short-term orders is much easier to see than the long-term projections.

It was also clear from the call that Microsoft's biggest risk is the short life expectancy of GPUs. In a way, they actually hinted that they see them as 2-year duration assets. Here is an important segment on that from their CFO:

»Let me talk a little bit about maybe connecting a couple of the dots because with $400 billion of RPO, that’s sort of short-dated as we talked about, our needs to continue to build out the infrastructure is very high. And that’s for booked business today. That is not any new booked business we started trying to accomplish on October 1, right?

And so the way to think about that, and you saw it this quarter in particular, and as we talked about ‘26, the remainder, number one, we’re pivoting toward -- increasingly, we talked about this short-lived assets, both GPUs and CPUs, Again, we talk about all these workloads are burning both in terms of app building. Now when that happens, short-lived assets generally are done to match sort of the duration of the contracts or the duration of your expectation of those contracts. And so I sometimes think when people think about risk, they’re not realizing that most of the lifetimes of these and the lifetime of the contracts are very similar.

And so when you think about having revenue and the bookings and coming on the balance sheet, the depreciation of short-lived assets, they’re actually quite matched, Mark. And as you know, we’ve spent the past few years not actually being short GPUs and CPUs per se, we were short the space or the power is the language we used to put them in. So we spent a lot of time building out that infrastructure. Now we’re continuing to do that also using leases. Those are very long-lived assets, as we’ve talked about 15 to 20 years.

And over that period of time, do I have confidence that we’ll need to use all of that, it is very high.

And so when I think about sort of balancing those things, seeing the pivot to GPU, CPU short-lived, seeing the pivot in terms of how those are being utilized, we are -- and I said this now, we’ve been short now for many quarters. I thought we were going to catch up, we are not. Demand is increasing. It is not increasing in just one place. It is increasing across many places.

We’re seeing usage increases in products. We are seeing new products launch that are getting increasing usage, and increasing usage very quickly. When people see real value, they actually commit real usage.

And I sometimes think this is where this cycle needs to be thought through completely is that when you see these kind of demand signals and we know we’re behind, we do need to spend. But we’re spending with a different amount of confidence in usage patterns and in bookings, and I feel very good about that. I have said we are now likely to be short capacity to serve the most important things we need to do, which is Azure, our first-party applications. We need to invest in product R&D and we’re doing end-of-life replacements in the fleet. So we’re going to spend to make sure that happens.

It’s about modernization. It’s about high quality. It’s about service delivery, and it’s about meeting demand.«

And Satya added to this with this comment, confirming the worry about the usefulness of the life of GPUs, when you get much more capable GPUs every year:

»The second thing that we’re also doing is continually modernizing the fleet. It’s not like we buy one version of, say, NVIDIA and load up for all the gigawatts we have. Each year, you buy, you write the Moore’s Law, you continuously modernize and depreciate it. And that means you also use software to grow efficiency.«

Satya also communicated between the lines that they want to customize any of their data centers for OpenAI, as they want to hedge:

»But it’s great to have the hit first-party apps in the beginning because you can build scale that then if it’s a fungible and that’s where the key is. You don’t want to build for a digital native in -- as if you’re just doing hosting for them. You want to build. That’s where -- I think some of the decision-making of ours is probably getting better understood. What do we say yes to, what do we say no to.«

On Azure’s 40% growth, we also got information that a lot of that growth actually comes from OAI:

»Results were ahead of expectations, driven by better-than-expected growth in our core infrastructure business, primarily from our largest customers.«

An important information Microsoft laid out in the call was also how they will expand capacity in the next 2 years and what this means for revenue for Azure:

»We will increase our total AI capacity by over 80% this year and roughly double our total data center footprint over the next 2 years, reflecting the demand signals we see.«

The last comment I would highlight was Satya’s comment, saying in the end, Microsoft’s success is not OpenAI but their own model, which I found was quite interesting:

»And then we have to fund our own R&D and model capability because in the long run, that’s what’s going to differentiate us.«

Microsoft Summary

It was a great quarter for Microsoft and Azure based on the numbers, but there is growing concern about the concentration on one client. It would be interesting to see what Azure growth would be like, ex, OAI.

Meta earnings

I can summarize the earnings exactly as I laid out in this post a few days ago. The core business of the family of apps is on fire, but Zuck has his eyes set on AI and wants to have an OpenAI inside of Meta. What this brings, at least in the short term, is heavy pressure on Meta’s profits and FCFs as OpenAI’s business model is a heavy cash burn one.

The core family of apps

Let’s first look at the core business. Revenue was $51.2B up 26% YoY.

»Across Facebook, Instagram and Threads, our AI recommendation systems are delivering higher quality and more relevant content, which led to 5% more time spent on Facebook in Q3 and 10% on Threads.«

AI is having a profound effect on Meta across both ad targeting and engagement trends.

Reels now has an annual run rate of over $50 billion.

»And now the annual run rate going through our completely end-to-end AI-powered ad tools has passed $60 billion.«

The big WOW moment for me on the call, when it comes to the core, was:

»In the U.S., overall time spent on Facebook and Instagram grew double digits year-over-year, driven by continued video strength as well as healthy growth in non-video time on Facebook.«

Time spent on both Facebook and Instagram is accelerating in Q3!

You also had the continuation of the great growth trend of both direct subscriptions and WhatsApp messaging, as well as click-to-WhatsApp ads:

»Family of Apps other revenue was $690 million, up 59%, driven by WhatsApp paid messaging revenue growth as well as meta verified subscriptions«

»We’re seeing strong growth across our portfolio of solutions, including with click-to-WhatsApp ads, which grew revenue 60% year-over-year in Q3.«

We also got word that Meta’s Ray-Ban Display glasses are sold out.

CapEx bomb

But then we moved to the portion where Zuck is going all in and ready to burn a ton of cash. The 2026 »soft« guidance was the key for many investors and their fears:

»As we have begun to plan for next year, it’s become clear that our compute needs have continued to expand meaningfully, including versus our own expectations last quarter. We are still working through our capacity plans for next year, but we expect to invest aggressively to meet these needs, both by building our own infrastructure and contracting with third-party cloud providers. We anticipate this will provide further upward pressure on our CapEx and expense plans next year. As a result, our current expectation is that CapEx dollar growth will be notably larger in 2026 than 2025. We also anticipate total expenses will grow at a significantly faster percentage rate a than 2025, with growth primarily driven by infrastructure costs, including incremental cloud expenses and depreciation.«

Zuck added things like:

»We’re also building what we expect to be an industry-leading amount of compute.«

»I think that it’s the right strategy to aggressively frontload building capacity so that way we’re prepared for the most optimistic cases.«

»If it takes longer, then we’ll use the extra compute to accelerate our core business which continues to be able to profitably use much more compute than we’ve been able to throw at it.«

»But any compute that we don’t need for that we feel pretty good that we’re going to be able to absorb a very large amount of that to just convert into more intelligence and better recommendations in our family of apps and ads in a profitable way.«

Meta is saying in the best case scenario, we have the compute and are the next OAI, in the worst case, we are frontloading some of the CapEx that we will need in the future for our core:

»So we’re really trying to plan ahead not only to ensure that we have the capacity we need in 2026, but also to give ourselves the sort of flexibility and option value to have the capacity that we think we could need in ‘27 and ‘28«

This strategy could be risky: a data center investment is fine because it is a long-duration asset, but frontloading too many GPUs could be dangerous, as Microsoft is doing the opposite. It all comes down to the fact that Meta wants to be OpenAI, and when you want to be OpenAI, you also have to have a similar P&L profile in the coming years.

A comment that made me jump was that Mark wants to calm down investors, so he even hinted at the fact that if Meta overbuilds, they are open to becoming a compute provider to others:

»Now I mean, it’s, of course, possible to overshoot that, right? And if we do, I mean, this is what I mentioned in my comments, then we see that there’s just a lot of demand for other new things that we build internally, externally, like almost every week, people come to us from outside the company asking us to stand up an API service or asking if we have different compute that they could get from us and we haven’t done that yet. But obviously, if you got to a point where you ever built, you could have that as an option.«

Meta Summary

For me, this quarter shows just how strong Meta's core business is and how AI is a huge enabler of it. If Zuck hadn’t been ambitious with the LLM model builder, the stock would probably be up this quarter, but the fact is, he has. The reasons are quite obvious: if Meta delivers and is the frontier LLM provider, its long-term margin and growth profiles are much better than if it were not; but in the short term, this means Meta has to risk current profits and cash flow to even have a chance at becoming that.

As already said before for me this outcome was expected and my positon in Meta is minimal as it ever was coming into this quarter, but as investors digest this new short-term reality for Meta over the next 2-3 years where profits and FCF will shrink drastically I will be looking for the chances to build up my position again and make it a core holding of mine.

As always, I hope you found this article valuable. I would appreciate it if you could share it with people you know who might find it interesting. I also invite you to become a paid subscriber, as paid subscribers get additional articles covering both big tech companies in more detail, as well as mid-cap and small-cap companies that I find interesting.

Thank you!

Disclaimer:

I own Meta (META), Google (GOOGL), , Microsoft (MSFT) stock.

Nothing contained in this website and newsletter should be understood as investment or financial advice. All investment strategies and investments involve the risk of loss. Past performance does not guarantee future results. Everything written and expressed in this newsletter is only the writer’s opinion and should not be considered investment advice. Before investing in anything, know your risk profile and if needed, consult a professional. Nothing on this site should ever be considered advice, research, or an invitation to buy or sell any securities.

Excellent analysys, truly showing how AI expands search, something I even noticd looking for new Pilates moves online.

Great analysis