Q4 2025 Channel checks & alternative data: The memory crunch is getting worse & one hyperscaler stands out

Hey everyone,

I am posting my regular channel check & other alternative data report before we start earnings of big tech and semiconductor names.

For this report, I got the most interesting data on cloud providers Google, Microsoft, and Amazon, as well as semiconductor memory providers SK Hynix, Samsung, and Micron.

Let’s dive in.

Memory is in a historic crunch

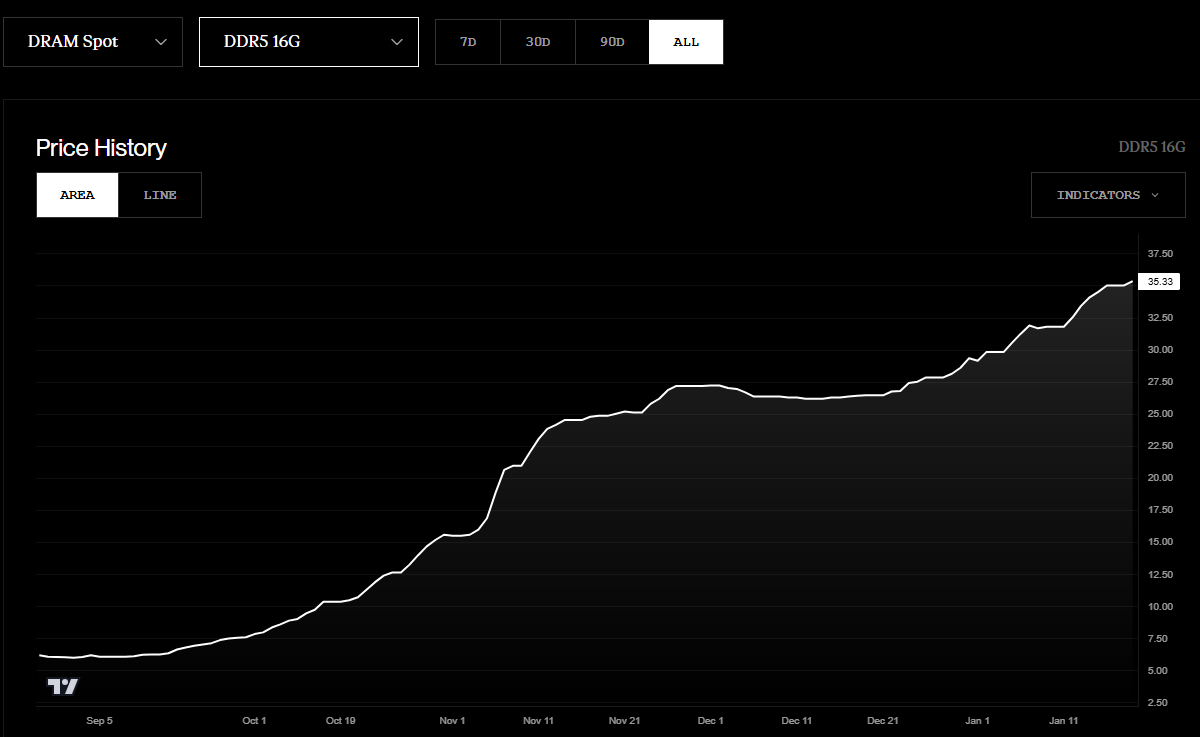

The memory market crunch has spread not only to HBM but also to DRAM and NAND. We can see from this Ornn chart that spot DRAM prices for DDR5 16GB have risen by 366% from the start of Q4 to today. Even since the start of this year, they are up 20.5%.

Flash MLC 64GB is also up more than 15% since the start of Q4, and SLC2G is up 59% in the same period.

When analyzing relevant expert interviews on AlphaSense in bulk for Q4, the findings confirm that industry demand is skyrocketing.

Memory demand growth accelerated substantially in Q4 2025, with consensus growth ranges expanding from 5%-10% in Q3 to 12%-17% in Q4.

High-bandwidth memory demand maintained strong momentum with 65%-80% year-over-year growth and extended lead times of 20-30 weeks, with zero inventory availability, compared to a 14-35% growth range and 12-24 week lead times in the prior quarter.

Lead times for DRAM, according to the analysis of expert interview expanded from 16 to 40 weeks quarter-over-quarter! Many experts also noted that customers are now placing long-term orders, compared with the more short-term demand orders seen just the quarter before.

HBM pricing premiums are reaching 5x over DDR5, even accelerating from the prior quarter.

When looking forward to the guidance comments from these experts, things look even tighter:

Many mention customers panic buying and inventory hoarding due to anticipated supply shortages. Customer orders are shifting to 9-12 month advance commitments with redundant orders across suppliers, compared to standard quarterly planning cycles in the previous quarter.

Lead times deteriorated substantially across memory categories, with DRAM now extending to 52-56 weeks, driven by overwhelming AI data center infrastructure demand and capacity shifts toward advanced memory products.

In terms of pricing, rebate programs largely disappeared in Q4 compared to the prior quarter, when suppliers like SK Hynix and Micron were most aggressive with incentives and rebates, offering 20-25% discounts. Price increases are +30-100% across product categories, accelerating from the prior quarter’s +5-10% general price increases.

All 2026 capacity is sold out to hyperscalers, with suppliers moving to long-term agreements only, compared to prior quarter mentions of full bookings through 2026, because customers are locking in supply early due to fear of shortages and each accelerator requiring multiple HBM stacks.

I am expecting skyrocketing earnings results from all three SK Hynix, Samsung, and Micron, both in terms of revenue but especially in terms of profitability, as customer negotiating power is essentially zero at this point.

Moving now to the cloud industry

Cloud is accelerating, but one cloud provider stands out in Q4…