The AI nuclear renaissance - SMRs role

Hi all,

Today's article is a deep dive into nuclear energy and, specifically, the small modular reactor (SMR) industry, especially in relation to AI data center power needs. Given that the topic of SMRs is very important to me because it is very connected to the AI industry and its limitations, I wanted to share my comprehensive research on the industry. I found out that it is tough to find any research papers that cover this topic comprehensively in one place, so here is mine.

In this article, I will cover the following topics:

Why Nuclear?

AI data centers energy needs

What are SMRs?

Companies in the SMR industry. Are they interesting from an investor standpoint? (NuScale, Oklo & others)

AI Big Tech & SMR partnerships

Let's get into it.

Why nuclear?

Nuclear energy is getting a new renaissance. One of the main reasons for that is the increased need for electricity. An additional fuel to the fire is the emergence of energy-hungry AI solutions, which are hosted and run in data centers. The most significant appeal of nuclear power is the net-zero emission targets many companies and governments seek. On top of that, nuclear power is one of the most reliable and stable energy sources.

The global nuclear power market is about 10% of global electricity (about $350-$400B annually) and around 32% of zero-carbon electricity generation.

As of 2023, nuclear energy accounted for about 18.6% of total electricity generation in the United States. The International Energy Agency (IEA) highlights that global nuclear power output must more than double by 2050 to meet net-zero emission targets. Most of the U.S.’s nuclear power plants are over 50 years old and nearing the end of their operational lives. While their lifespans have been extended to support the grid, they will need to be replaced in the coming decades. Meanwhile, rising electricity demand, fueled by industrial expansion and technological advancements, adds further urgency to addressing this challenge.

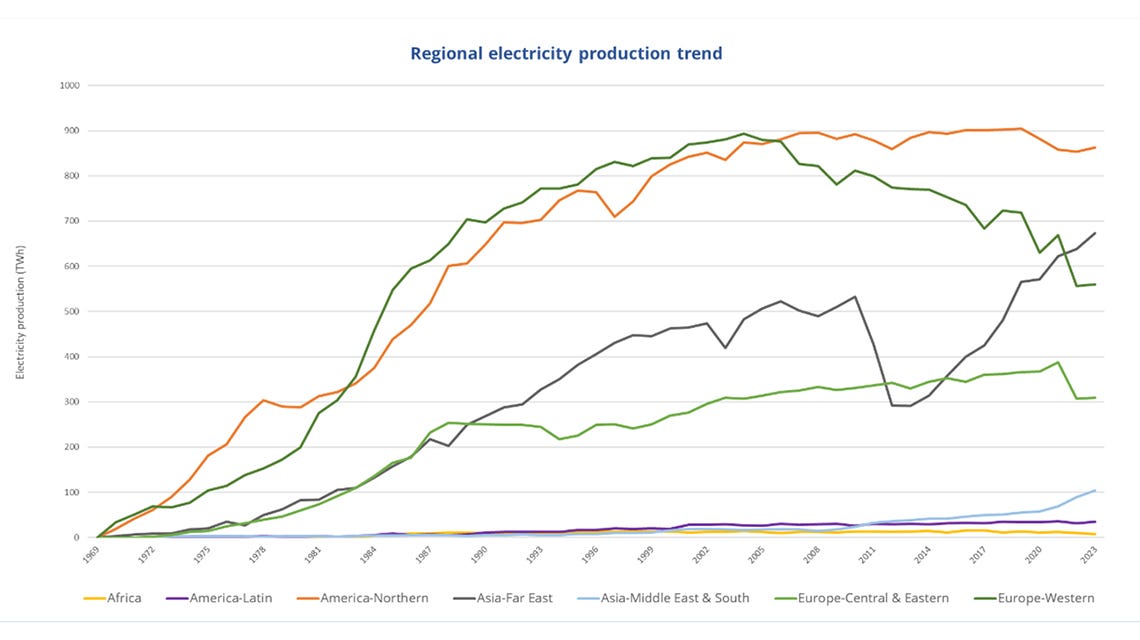

Nuclear power capacity has remained at a consistent level over the past decade. Over 79 percent of capacity growth occurred in Asia. China is still the fastest-expanding nuclear power producer in the world, with 56 nuclear power reactors in operation and an additional 27 reactors currently under construction.

AI Data centers & energy needs

Data center growth and demand for energy have been a trend for years as the cloud computing industry has kept growing and expanding. The introduction of ChatGPT and the AI boom that we have experienced in the last 2 years have only accelerated as AI workloads and AI chips consume much more energy than traditional data center workloads. This Nuclear Energy expert gives a good example:

» If you provide a simple search in Google, you consume 0.3 W per hour of electricity. If you do the same with ChatGPT or Alexa or Gemini, any AI that we can imagine, this 0.3 W transforms into 2.9 W, so it means 10X the consumption.«

source: Alphasense

Driven by artificial intelligence (AI), cloud computing, and digital transformation, U.S. data centers consumed an estimated 150 TWh of electricity in 2023, equivalent to around 3% of the nation’s power demand. According to Goldman Sachs estimates, data center demand hovered at 340 TWh in 2023 globally, which is about 1.3% of worldwide electricity use. U.S. data center power use is expected to triple between 2023 and 2030 roughly and will require about 47 gigawatts of new generation capacity. Similarly, in September, the International Data Corporation estimated that data center consumption would more than double by 2028 (19.5% CAGR) and that the consumption of AI-specific workloads is expected to grow even faster at 44.7% CAGR.

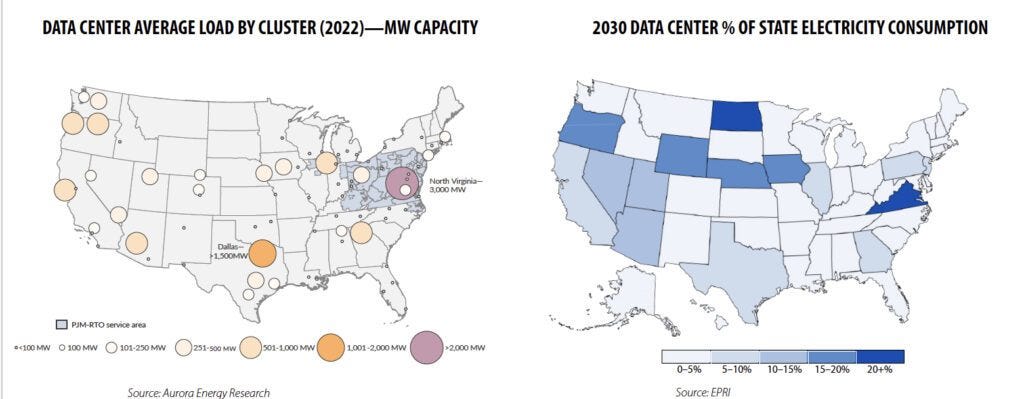

It is also interesting to watch data center load by cluster and data center consumption as a % of state electricity consumption:

Big tech companies operating data centers are exploring nuclear energy because solar and wind cannot consistently provide reliable, round-the-clock power for their operations. Right now, the most used combination of energy fuel for a data center in the U.S. is a mix of both solar and natural gas. However, nuclear energy has become very attractive because companies want to be carbon-neutral and have stable power. An additional benefit of nuclear power is that it can provide more stable long-term contracts that are less sensitive to inflation and supply chain problems.

With the attractiveness of nuclear power, a big trend that has risen in the last few years are small modular reactor (SMR) companies.

What are SMRs?

Traditional nuclear plants are expensive, take decades to build, and have a history of public resistance following disasters like Chernobyl, Three Mile Island, and Fukushima. However, interest in nuclear energy, particularly Small Modular Reactors (SMRs), is growing as they have been heralded as a solution to streamline nuclear power production, offering flexibility, lower upfront costs, and modular deployment. The simplest way to imagine SMR is that it is a smaller version of the traditional nuclear reactor. One of their most significant benefits is that they are modular. They are designed to be built in factories, not on-site. Because they are built in factories, they are easier to assemble and control. From quality checks to a more predictable supply chain and quality of workers. When assembled, they are then shipped to the site of the nuclear plant, where they are stacked together to form the whole plant. In terms of energy output, traditional nuclear plants have outputs between 1,000-1,600 megawatts of electric (MWe) per reactor, while SMRs are around 50-300 MWe per module. Some SMRs are also said to be safer due to passive safety features, which rely on natural processes like convection to prevent meltdowns in emergencies. But they also come with cons. The primary one is that they are much smaller than traditional nuclear plants, so they do not have the cost benefits of economy of scale. Because of that, producing the same amount of energy is more expensive than on a traditional nuclear plant. While the design and build-out of an SMR is still long, they are much faster set up than buying a traditional nuclear plant. There is also support because of their location flexibility; they can be set up in lands where there are retiring coal plants.

Over 25 countries, according to the International Atomic Energy Agency (IAEA), are investing in SMRs. In March, Wood Mackenzie estimated the pipeline of SMR projects was worth more than $176 billion and that SMRs could account for as much as 30% of the global nuclear fleet by 2050.

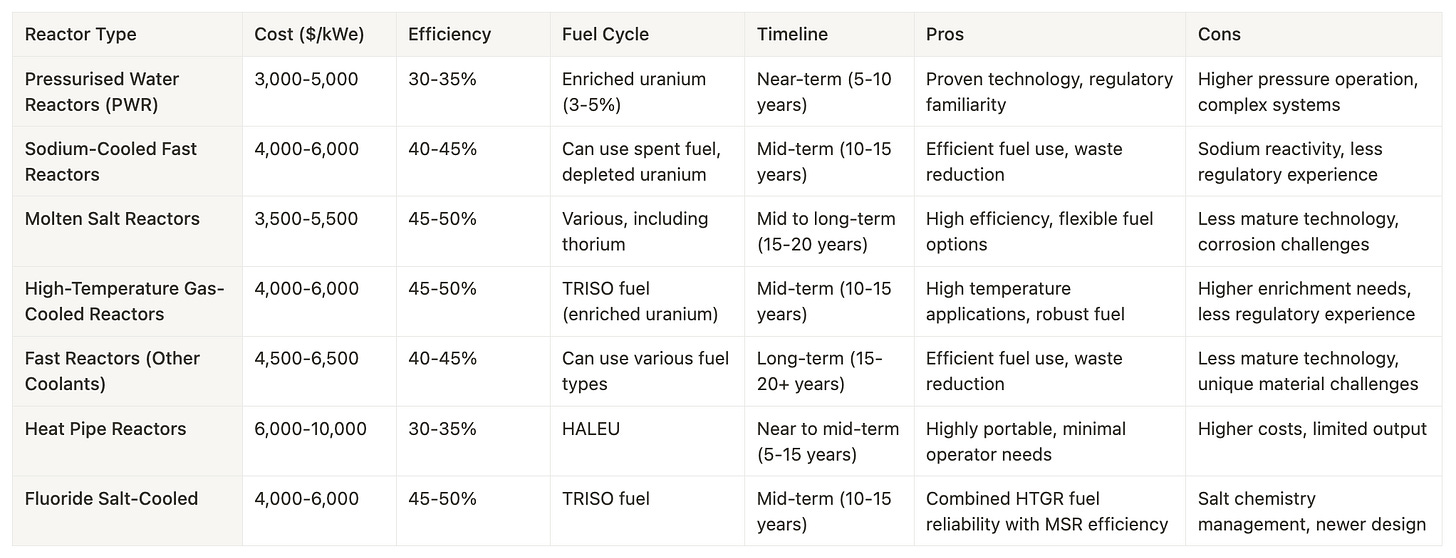

SMRs come in various designs, with each with its pros and cons. Additionally, many of these concepts of SMRs do not yet have a working plant as they are concepts. Here is a good overview of those designs.

As we already mentioned the problem of costs, we can look at the example of NuScale, which has its Pressurised Water Reactor design. Their levelized cost of electricity ranges from $89-135/MWh, while traditional nuclear plants are in the $110-160/MWh. However, looking at the most traditional alternative in data centers, which is combined solar and gas, gas costs $45-70/MWh, and solar plus storage costs $30-60/MWh.

We also already mentioned safety. The most significant safety task with any nuclear plant is keeping the reactor core cool enough if the plant suddenly shuts down and stops making power. If the coolants stop circulating long enough, the fuel will get too hot and meltdown. That creates the risk of leaking radioactive material into the surrounding area. That happened in the Fukushima plant in 2011 when the backup generators responsible for cooling off the plant were wiped out by the Tsunami.

Many SMR designs have passive and self-contained safety systems that claim to be safer. Passive and self-contained safety systems that don't rely on human operators or external power. Many SMR designs claim to be passively cooled without needing external water. To do that, they would use a natural force called convection to cool down the reactor. In theory, the concept works.

However, as we already talked about before, the main reason why data center providers want nuclear power is because it is a reliable and stable source that runs 24/7 uninterrupted. Cloud providers can be less sensitive to having a source with higher electricity costs as they sell software services with high gross margins, so their flexibility in handling costs is higher than for regular electricity consumers in a country. Solar + SMRs could be an excellent combination for Cloud providers.

To summarize the main pros of SMRs compared to traditional nuclear plants:

Faster and cheaper build-out

Safer (passive safety features)

More flexible when it comes to location (smaller plot required)

However, SMRs still face many hurdles.

The Cons of SMRs

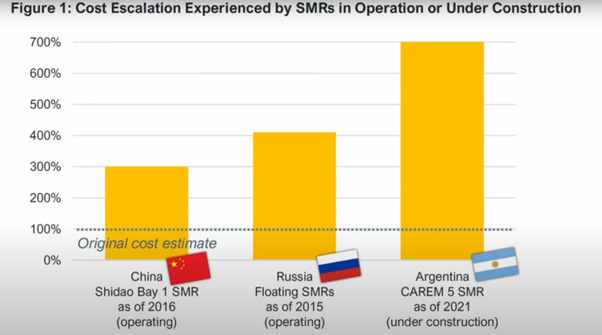

Building smaller reactors reduces economies of scale, making them less profitable. Projects often face staggering cost overruns, sometimes tripling or more of initial estimates, and lengthy delays, with completion timelines stretching well beyond promises and, in the last few years, raising inflation exacerbated these challenges. This pattern is consistent across nations, suggesting systemic issues in cost estimation, inflation, and technological stagnation. For instance, NuScale, a leading SMR developer, canceled its first U.S. project due to high costs and lack of interest. In contrast, state-backed projects in countries like China and Russia have made more progress, leveraging integrated supply chains, controlled costs, and assured revenue streams. But even for them, the costs to build these reactors compared to first estimates are still much bigger:

We must also face reality, which says that only 2 SMRs are operational right now, one of which is in Russia and the other one in China.

Another important topic when assessing nuclear energy is the problem of nuclear waste and its storage. Most SMR designs produce a similar amount of nuclear waste on a unit production basis than traditional nuclear plants, so the problem of storing nuclear waste stays.

So, to summarize the Cons of SMRs compared to traditional nuclear plants:

More expensive to produce energy on a unit basis

Less test proven in the »real world«

Similar in terms of waste production

Companies in the SMR industry. Are they interesting from an investor standpoint?

I made this overview of the companies involved in SMR design and production. Keep in mind I may have left out some, but to me, this is the core of the industry right now.

It represents new SMR startup-like companies like NuScale and Oklo and older and more established companies that have been in the industry for some time, like Westinghouse:

I want to avoid getting into too many technical details about the differences in the designs of these SMRs, as the article's point is to make it understandable from an investor standpoint. The key is that no SMR design has yet proven to be the best or the one where the industry unites around it.

However, I want to share some insights into the two public companies, NuScale and Oklo.

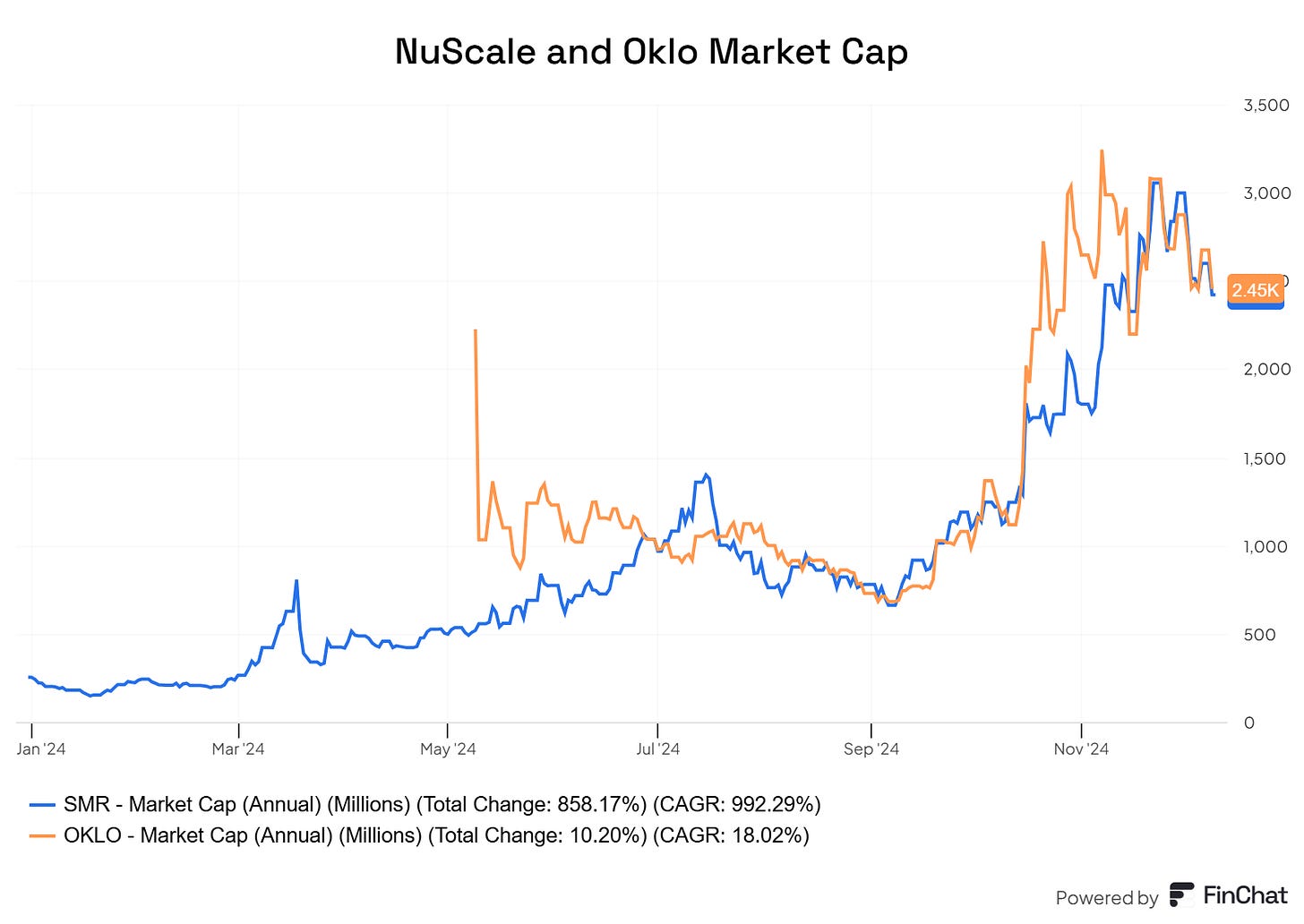

Both have experienced enormous stock price rises since Microsoft announced its partnership to expand the Three Mile Island project, followed by Google and Amazon announcing their nuclear partnerships. But, besides the excitement of investors on Wall Street, both companies have their own set of issues.

NuScale

NuScale's most significant advantage is that currently, they are the only company whose SMR design has received certification from the U.S. Nuclear Regulatory Commission (NRC). This certification, issued in July 2022, marks NuScale's design as the first SMR approved for use in the United States.

NuScale's biggest problem was that their first SMR project, which got regulatory approval called CFPP, was canceled. The project started in 2015 and was later amended in 2018, with a total capacity of 462 MW and an estimated cost of $4.2B. However, the estimates of costs kept rising to $9.3B, where in November 2023, both NuScale and Utah Associated Municipal Power Systems agreed to terminate the project due to insufficient customer interest and escalating costs. To put it simply, the costs were just too high, and in that environment, NuScale couldn't get enough utilities to commit to buying their power.

Another thing to consider with NuScale is that Fluor Corporation owns 60% of the company. Fluor is an engineering and construction firm covering energy and urban solutions. Fluor works closely with NuScale on their projects, with a Former NuScale employee explaining:

»On the Fluor side, there's probably more than 120-200 people in various sundry positions. Fluor did all of the non-ENTRA+ design work for the NuScale plant. That would be the site itself, all underground piping, all auxiliary buildings, construction of the facility itself as far as the concrete floors, etc. There was a lot of design work there.

There was an interface arm. Fluor would design something, and then it would have to be sent to what you would call a qualified nuclear designer, which was Sargent & Lundy, for the interface between the non-nuclear side and the nuclear side. There are a lot of bus ducts and piping, etc., that would go from the non-nuclear side into the nuclear side, so there was a lot of coordination effort between the two.«

Former NuScale employee on Alphasense

Now, while that might be viewed as an advantage for some, in this case, it seems not to be the case. As this same expert elaborates,