TSMC - the leading edge semiconductor monopoly

I want to share some findings about Taiwan Semiconductor (TSMC). It should be on the radar of all investors following the AI space and technology enthusiasts.

I have recently done more research on the company and have spoken to different people about TSMC. I also recorded some of those conversations, like the one I had with Dan Nystedt. Dan has lived in Taipei, Taiwan, for over 2 decades, following semiconductors, including TSMC. You can see the full interview with him here.

Now, to my TSMC findings.

Breakdown of TSMC business

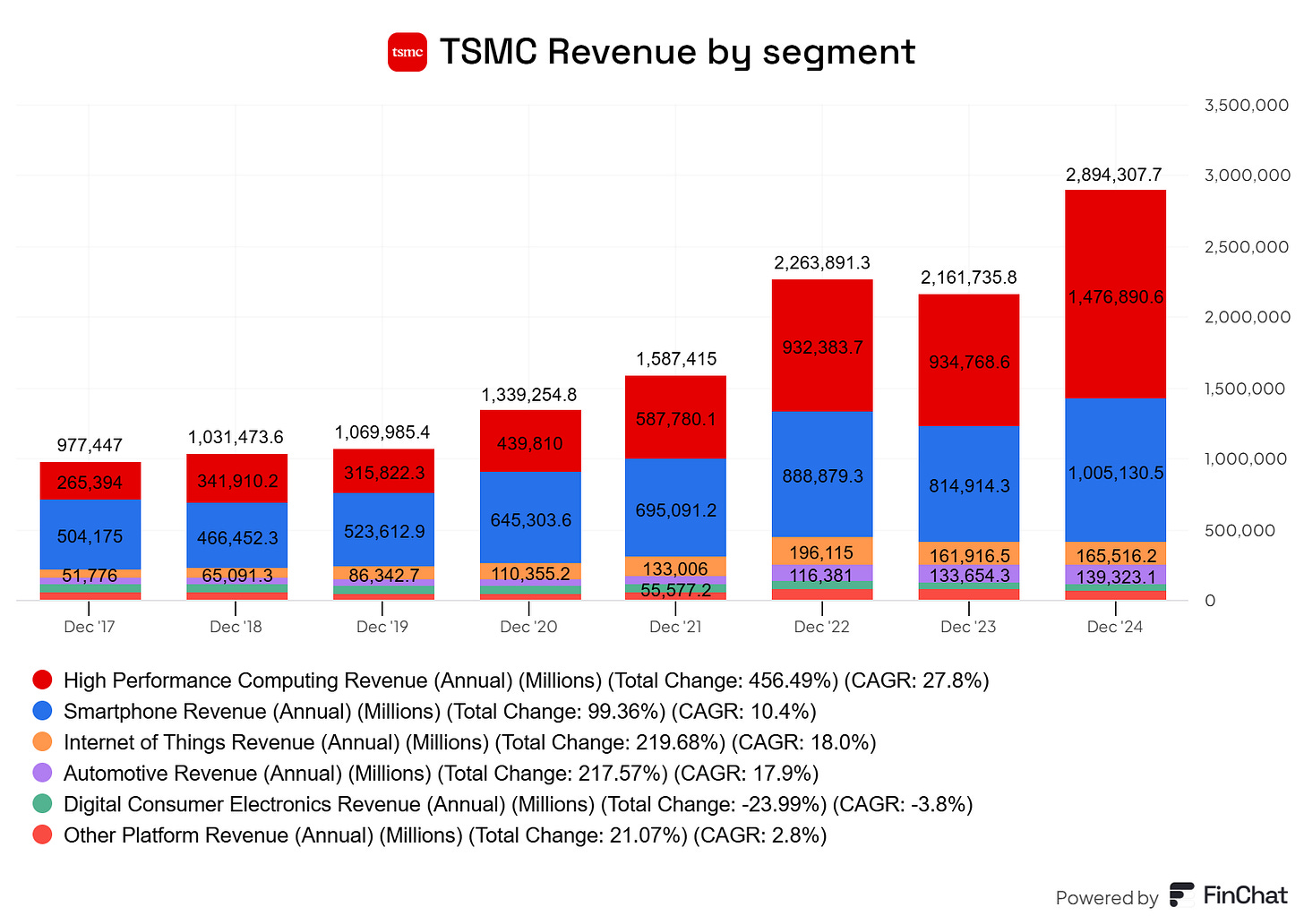

TSMC is the world's leading foundry. It has been for quite some time now, especially on leading-edge nodes. Looking at TSMC, the revenue breakdown of their segments is the following:

We can see that there are four essential business segments. First is the High Performance Computing revenue (HPC). HPC's revenue platform includes PCs, tablets, game consoles, servers, base stations, and more. This is the segment where the recent AI server demand is. Then we have Smartphone, IoT, Automotive, Digital Consumer Electronics, and Other Platform revenue.

We can see that in the era of 2017-2022, smartphone revenue was the leading segment, with iPhone sales growing fast. Still, since 2022 and the ChatGPT moment, the HPC revenue, mainly driven by AI server demand, has become the most significant business segment of TSMC.

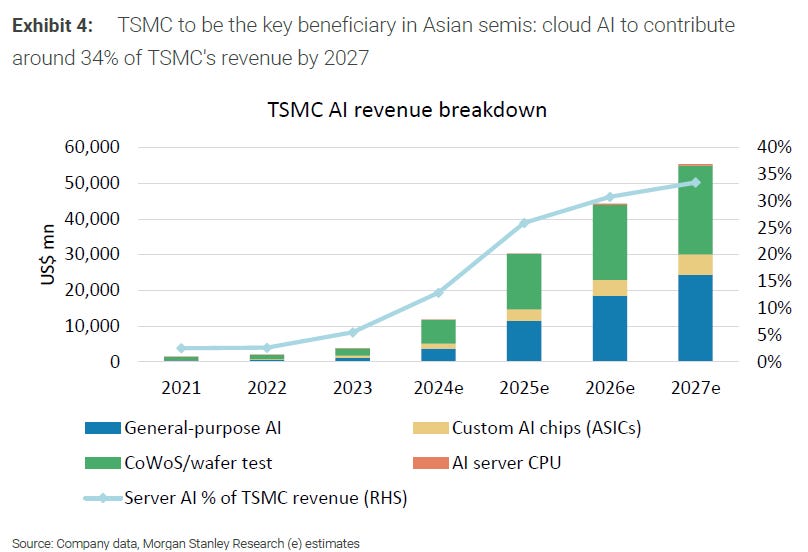

Zooming in on the AI demand, leading-edge AI is only a portion of its revenue so far, but is expected to grow substantially. In a recent report, Morgan Stanley expects cloud AI to contribute around 34% of TSMC's revenue by 2027:

While smartphone revenue hasn't grown substantially in the last few years, if we get a big AI smartphone replacement cycle, the revenue there will also start growing. On top of that, while currently small in total size, the automotive business segment is also very attractive since the rise of EVs, especially AVs, means many more chips in cars are needed, which again benefits TSMCs.

What is TSMC's advantage, and why does it dominate the leading-edge market?

I summarized TSMC’s main advantages in the following points:

Manufacturing excellence

Customer focus

Talented workforce

Network effects

Manufacturing excellence

First of all, one of the most important things to highlight when it comes to manufacturing excellence is that TSMC is a semiconductor company that only focuses on manufacturing semiconductors. Most of you probably know that the legendary Morris Chang founded Taiwan Semiconductor. He was the one who, looking backward, pioneered the business models where a semiconductor company is only focused on manufacturing (fabs) and not on design. Before, you had the most dominant player, Intel, doing both manufacturing and design.

The problem with doing both is that you become a generalist, not a specialist. As TSMC started, they could devote 100% of their focus to optimizing and perfecting the manufacturing process because they were a specialist. Another essential aspect is that most fab customers are semiconductor design companies. So the fact that, for example, Intel was manufacturing for those customers but simultaneously competing with their other business unit inside the company gave customers a sour taste. This was another reason why most of the customers really liked that TSMC only focused on manufacturing and not design.

Another thing that TSMC does well is that because they are so focused on manufacturing only, they have perfected the manufacturing process of their older nodes (so not the leading-edge nodes). Despite not being 7nm or down, many of the older nodes and fabs still make a lot of money for TSMC as they have scale and a good yield because of their focus and excellence.

As this semiconductor expert said, the key strength for TSMC, because they focus on manufacturing only, is their cost control of the process and the yield ramp-up:

»This is actually, I would say, the strongest strength of TSMC, meaning the yield ramp-up and the cost control. Just mainly makes things manufacturable. If you're talking about Intel, I think, as far as I know, they're also making very good progress in terms of developing this similar technology. The key thing is how fast they can mass produce, meaning high-volume manufacturing. I would say, that's probably the differentiation between these two company.«

For TSMC, their data in combination with AI is also a significant factor, which they don't want to share as they optimize everything in their manufacturing processes. As this Former TSMC employee working on ML optimizations for them said:

»One thing about TSMC is that it's very, very strict about its data. It does not want its data to ever go out because they feel that data is what gives them the competitive advantage over others. It does not allow its data to be processed by other companies.

For example, many times there are vendors like the tool vendors, equipment vendors or other vendor softwares which allows you to process data, but they will not do that. They have built an in-house system to process, analyze everything like their own data. They also use machine learning for a couple of different things. They have it's way to use it for image processing, NLP is another thing, and then the time series data.«

It goes even so far that equipment and software suppliers to TSMC have their servers inside of TSMC with rigorous and limited access:

»One thing is, I know this for sure, that you need to sign an NDA as an OEM. For the data being stored and then sharing, many times it happens that, for example, AMAT will put its server inside the company. Their engineers can only access after coming inside the company. In very rare cases, as far as I understand, they can have remote access, but they even monitor those things, like who is accessing the data and what all other datas that have been accessed.

Even to that, I still remember initially when I joined TSMC, the servers were inside the fab and they were private servers. For example, the server may be of AMAT or maybe someone else's server. What we were doing is we were asking our vendors to give us the data and they will give it via the servers.

In the coming years, they made sure that they don't have to rely on others. They created their own database. They even made it better than the other. They used their own design system and everything so that we can even access those datas super fast.«

Another important thing that multiple experts, including Dan, mentioned is that TSMC, when they put out a roadmap, they deliver. Similar things were said by others:

»Usually, when TSMC announce their milestone, their road map, it's very rare they miss that. It's always on time. Usually, you can find this on their track record. Company like, for example, Intel, I think a lot of times they delay. That's also another difference. That makes things a little bit difficult to project, but usually TSMC, they deliver on time. That has been shown many times. It's all down to the execution.«

For customers, delivering on your roadmap is vital as the client product cycle is highly dependent on you. This brings me to my next point of TSMC’s advantages – customer focus.

Customer focus

Everyone I talk to agrees that TSMC is exceptionally customer-focused and listens to its customers. Now, this often sounds like empty words, so let's dive deeper into what this means.

Early on, TSMC decided to partner with EDA tools and set out design principles, but let the customers use their IP within these principles to combine it into a great product; on the contrary, Intel had its own ecosystem of design and would often want clients to adapt to that. A former TSMC employee on this topic:

»Intel was the smartest kid on the block, "We will show you." The first time they did try to do foundry back in early 2000s, they had everyone trying to use the Intel design tools. You'd spend months getting your engineers pulled up and at the end, they'd say, "Wow, this sucks. We want Cadence. We want Synopsys." Intel had a couple of really big gaffes, hyperthreading instead of multicore. That was the first and foremost that allowed AMD to just kill them.

Samsung and Intel were doing their own thing fighting each other. They were always trying to prove who was the smart kid in the block. TSMC was sitting there going, "Hey, do you know who the smart kid on the block is? Our customers," because every run on TSMC, a shuttle lot has 20, 25 customers on it. That's 20 or 25 design experiments that they're running to refine their DFM guidelines.«

With the marriage of TSMC, EDA tools, and customer design IP, TSMC made customers happy and delivered results:

»Intel had their own and still has pretty much their own ecosystem for design. That's why they've never been able to do foundry. They tell everyone "We'll show you how to design." As it turns out, the world is signing out until really doesn't do that super well. TSMC early on joined up with Cadence, Synopsys, Mentor Graphics and said, "We need our EDA tools to be in a fashion that people can take these disparate blocks, this IP that we have, and combine them with their own IP. If they follow the rules, it's going to work.

I remember back in the day, we would have months and months of churn trying to get something to work because the designers were making up the rules. The fab was at the end of the whip. TSMC does not let people violate design rules or design principles such that when they spend hundreds of thousands of dollars, if not millions of dollars on a run, they get silicon that's going to work. That marriage of EDA tools and fab is what really has made TSMC just unstoppable.«

As many share this belief, TSMC also listens to smaller clients as they know well that Nvidia once was a small client but is now the 2nd biggest client, just behind Apple.

Another excellent example of TSMC’s practice of listening and working together with their clients was the recent 3nm node and the transistor technology that TSMC used. With fabs, the transistor technology for the manufacturing of semiconductor chips changes over time. At first, we had the Planar Transistors (which were used widely until the mid-2000s), but it became challenging when scaling down beyond the 45nm and 32nm nodes, so the industry went to FinFET technology (Fin Field-Effect Transistors) starting at the 22nm node. FinFET technology offers better control over current, reduces leakage current (better power efficiency), and allows smaller size and better scalability. FinFET is still used today in 14nm, 10nm, 7nm, and even 5nm.

At 3nm, Samsung decided to go to the next transistor technology, called gate-all-around (GAA). The benefits of GAA are that it gives even better control of the channel compared to FinFET (reducing leakage and improving power efficiency), and it provides smaller transistor sizes with better performance. TSMC decided to stick with FinFET for the 3nm node and not go to gate-all-around technology yet. This turned out to be a great decision as the new technology caused Samsung to have many problems and mistakes.

As Dan in our conversations points out, he seriously doubts that any of Samsung's customers wanted them to go to GAA as they are already used to FinFET and have a high degree of confidence in it, and as it turns out, with TSMC, FinFET is more than good enough for 3nm. He thinks the reason why Samsung wanted to do it was to claim that they went to GAA first. On the other hand, TSMC again listened to their customers and went the other route.

Talented workforce

The next pillar of TSMC's moat is again a theme shared by most industry experts: TSMC has a devoted and talented workforce. It mostly comes down to its geo region and culture.

This semiconductor expert displays the best summary of this point:

»I think one thing is culture, the other thing is the people, talent. I would say, easy one, I would call talent. They have an advantage, by the way. People sometimes overlook the importance. TSMC meaning all the fab R&D, everything is based in Taiwan. Taiwan, actually, if you look at the industry in Taiwan, it's very much focused on hardware development. Everything relate to the hardware. I would say not many software industry. All the best people in Taiwan went to hardware, either TSMC or some design house, majority of them.

If you compare that to United States, it's the opposite. Actually, there's many, many studies these days talking about this talent shortage thing, why this semiconductor was dying in the United States. One reason, of course, is talent shortage and why there's talent shortage is because there are so many options in the United States. There's Google, there's Meta, Apple. Very practical, if you look at the pay difference, there's huge pay difference if you work for software versus hardware. Even today, even now.

If you look at the past 10, 15 years, all the graduate, people graduate from college or from graduate school, look at their major, 90% goes to computer science, less than 10% go to, let's say, electrical engineering, material science. I would say the best people go to the computer science. That's the advantage TSMC has. It's embedded in all those things. I think that's probably the root cause, the root reason why they have a technical advantage. They just get the best people.

If you look at TSMC, now there are actually has tons of people from Japan, from India. That means all Asian talent are being drawn into that company. The culture is another thing. I don't want to go to detail, but there's a different work culture between in Asia versus, for example, in United States. We're talking about a work-life balance, those things.«

Network effects

The last pillar that I identify as key is network effects. With network effects, the key thing that comes up here is that the semiconductor manufactoring process has over the years become so complex and CapEx heavy that, firstly, the barriers to entry in this business from a CapEx perspective are incredibly high as we can see it from this chart of TSMCs CapEx, which I might add is only growing going forward, even with already being at a $30B annual rate:

To add on to that CapEX, all of the leading design companies, even small ones, want to work with TSMC for manufacturing, so oftentimes, TSMC sets them out on a mission to test different design processes and technology, and if they come to a solution, they will then partner with them. This means that TSMC, on top of its own CapEX, is outsourcing some of its R&D budgets to smaller companies wanting to work with them for free.

The second thing is that the vast customer base that TSMCs has, especially on the leading edge, gives them the necessary feedback from clients so that they can make improvements and perfect their processes.

On top of all that, switching from fabs is complicated and costly. Dan mentioned that it costs design companies $800M to make their design fit another fab in the 2nm node.

These network effects combine into a strong flywheel, allowing the leading company to maintain that edge for a long time.

Risks and challenges

As with any company, there are risks and challenges with TSMC. The primary one, which everyone knows by now, is the geo risk of Taiwan.

Addressing that risk, TSMC is diversifying its fabs outside of Taiwan. It already has operational fabs in the US and Japan. It will also expand to Germany and the US even more, with an additional $100B investment announced just a few weeks ago. The company's first US Phase 1 fab of 4nm is already running at high volume production, as the company is planning to go forward with Phase 2 and Phase 3 with a combined $165B CapEx. The research firm Cowen estimates that these investments in the U.S. will result in 6 chip fabs, 2 AP facilities, and an R&D center. In total, they estimate that they could eventually represent ~170K wspm of leading-edge capacity and ~60K wspm of CoWoS AP supply.

At a recent Morgan Stanley conference, Morgan Stanley hosted TSMC CFO Wendell Huang at a fireside chat. Huang explained that long-term, once all six planned US fabs are complete, these would account for 20-30% of global N2 and below capacity.

While geopolitical risk might be the only reason investors think it makes sense for TSMC to diversify out of Taiwan, there is another one: Taiwan's power.

A semiconductor expert explains that TSMC consumes around 7-10% of the total power of Taiwan:

»Other concern, power. That's probably the huge concern. We have about the power consumption of TSMC. Can Taiwan support that in the longer term? That's actually, I would say, probably more urgent compared to geopolitical issue. I think TSMC, this single company consumed probably like 7% or 8%, if not 10% of total power of Taiwan. Just one company consume close to, I don't know, probably 7%-10% of the power of the whole country, and it grow very, very fast. For me, it's not sustainable at least.«

And that is even higher with the more leading-edge nodes, as one EUV machine consumes 1MW-1.2MW of power.

With the expansion outside of Taiwan, the question is, can they do that effectively (margin), maintain that yield elsewhere, and scale as they scale in Taiwan?

The answer is probably yes.

As this Former GlobalFoundries employee explains, the technology transfer shouldn't be a problem as the process is structured:

»Typically, when we do a technology transitions, it always comes with a better improvement. Go back to your example, I build it in Taiwan, I improve my yield. I transition the process, I transition that improve process to Arizona. When they start-up in Arizona, the performance of the fab should matching the improved performance in Taiwan.

However, there were cases that it could be lower. It wouldn't be lower than what it originally started with. It can be a gap, but it shouldn't be so far away because you are matching your process one to one. The small gap will have to fill up by troubleshooting, comparing. In most cases, when we do a major technology transition, I think they will send an experienced team over to train the local engineers so that they can up to speed to the performance that the company wants. Shouldn't be much problem.«

But as many point out, including Dan in my recent conversation. In Taiwan, TSMC has no problem scaling up because they have a known supply chain for building fabs, known regulations, and a relationship with the government to help them move things fast. When it comes to other places like the US, the speed of building up fabs will also depend on the US government helping out with regulations and removing as much red tape as possible.

The problem with talent is different, as it is much harder to get talented semi-engineers in the US than in Taiwan, and even if you do get them, their salaries will be higher, but TSMC sending some of their Taiwan teams to Arizona is undoubtedly helping. There are already reports that the first phase of the Arizona plant is achieving the same yield as the TSMC fabs in Taiwan, so that is good news.

There is also the aspect of higher costs, not just labor, but other costs like energy, water, etc. TSMC expects a 2-3 margin dilution from overseas fabs over the next 5 years. Still, many experts mention that many TSMC customers are willing to pay more for US-made chips as a »safer source« with possible tariffs on the horizon. The fact that TSMC is the only game in town for leading-edge chips helps them a lot at this point, so I don't expect a greater margin hit than the 2-3% one estimated by TSMC's management.

Regarding tariffs, while this is at the top of the minds of many investors right now, I don't view it as a significant threat. Firstly, we could see TSMC excluded from tariffs as Trump said when TSMC announced an additional $100B investment in the US in the White House:

»US semi customers will make their chips as they don’t want to pay tariffs.”«

Also, according to a Reuters report, “the US may exclude sector-specific tariffs on April 2, reports say, but the situation is fluid.”

Even if you get tariffs on TSMC chips, most of the tariff burden will be paid by U.S. customers since TSMC is the only game in town, and Intel is nowhere close at this moment.

Valuation

Important note: I used TSMC's market cap for the valuation part as it is trading in the Taiwan Stock Exchange, not the U.S. ADRs. TSMC is trading on the Taiwan stock exchange at a $740B market cap, while U.S. TSMC ADRs are trading at a $857B market cap at a 15.8% premium.

Let's look at some basic metrics for TSMC, like EV/EBITDA and P/E (both forward):

At these levels, I find the valuation not expensive as the company is trading in its average range of pre-COVID EV/EBITDA at 9.29 and the low end of its P/E range at 15.88, being lower only in the 2022 tech selloff and 2020 COVID crash in the last 5 years.

Additionally, TSMC is facing one of the most prominent tailwind cycles for its business, with AI still in its early innings. On top of it, TSMC, from a business perspective, when it comes to AI, is a perfect hedge. When it comes to AI cloud server demand, it serves customers like Nvidia, but at the same time, it is also the manufacturer of custom ASICs for hyperscalers. Even looking at on the edge AI, if smartphones, PCs, or workstations will be a big market for AI, TSMC is again the supplier of that. When we add things like AVs and humanoid robots, again, the only game in town is TSMC.

So you have a company trading at its average or below the 5-year range while facing the most significant growth tailwind in the next 5 years. Even TSMC, while also being very conservative, has given out a 5-year forecast for their revenue: TSMC CFO reiterated TSMC's »close to 20%« revenue CAGR forecast for the next 5 years. He expects cloud AI semis to deliver close to mid-40 % CAGR for the period.

Getting a company that has a 20% revenue CAGR for the next 5 years at 15.88x P/E and 9.29 EV/EBITDA is very interesting to me and to many others.

DeepSeek and all the advancements in model efficiency also help TSMC as they benefit if AI becomes more affordable and, with it, usage explodes higher. Not to mention, we have had a training workload chip cycle so far, but inference is on the rise now. Just in the last few days, we can see OpenAI, Groq, and Google's Gemini all reporting high usage rates on their chatbots, with things like image generation from OpenAI, and all of them are struggling to keep up with demand because of the lack of chips (GPUs or TPUs).

To close it out, I would mention a comment that Dan said in our conversation, which should interest many investors:

» One thing that I think is important for people to understand about the chip industry right now, is it's going through a new cycle, and the industry is getting pricing power. And the reason is because the customer has changed. And I mean that very specifically because the customer, the big customer now is the hyperscalers, the cloud companies, it's big businesses that have deeper pockets and have more money…

I did the calculation, 1996-2016, the compound annual growth rate of the semiconductor industry was 4.8%. And that 4.8% is not that great. Well, and the reason the reason is real simple: the chip industry's main customer became consumers. And so you really wanted to make your chips as cheap as possible because they went into PCs, they went into smartphones, they went to television sets etc.

The previous 20 years, from 1966 to 1996, the compound annual growth rate was 17%. That was when customers were the military and the space program. And so the industry had access to money, big money that it could use to develop itself.

And so what we're going into now, between 2016-2024 the growth rate has already increased to 8.1%. It's ramping up. But now we're hitting the back of the bathtub, so to speak, in terms of how much growth could go back into the chip industry because the customer has changed. The main customer is no longer the consumer. There's no longer a need to make everything as cheap as possible.«

If you'd like to dive deeper into TSMC and the semiconductor industry, you can listen to my recent conversation with Dan Nystedt HERE.

As always, I hope you found this article valuable, I would appreciate it if you could share it with people you know who might find it interesting. I also invite you to become a paid subscriber, as paid subscribers get additional articles covering both big tech companies in more detail, as well as mid-cap and small-cap companies that I find interesting.

Thank you!

Disclaimer:

I own TSMC (TSM) stock.

Nothing contained in this website and newsletter should be understood as investment or financial advice. All investment strategies and investments involve the risk of loss. Past performance does not guarantee future results. Everything written and expressed in this newsletter is only the writer's opinion and should not be considered investment advice. Before investing in anything, know your risk profile and if needed, consult a professional. Nothing on this site should ever be considered advice, research, or an invitation to buy or sell any securities.

Great post!

Excellent post!