Uber analysis - Transportation super app

This is an analysis of Uber. I looked into the three pillars of Uber’s business model today and provide some investment insights into why this is one of my portfolio companies.

To understand what Uber is today, it is interesting to see what Uber was in its beginnings. Uber first started in the luxury segment. It was a luxury limousine service. The price for their services was 20%-50% higher than a normal taxi. Since then, they developed into a mobility and delivery super house.

Today Uber’s three main business areas are the following:

- Mobility. This is their “classic” ride-hailing segment.

- Delivery. This started as Uber Eats but since then includes the likes of Postmates, Cornershop, Drizly, etc.

- Freight. This is the smallest of the three segments but nonetheless still very important. Taking care of Shipping and Hauling.

Mobility unit

Performance of Mobility and the COVID effect

Uber’s mobility unit consists of services like ride-hailing and other mobility services. It is one of the biggest mobility providers in the world. Their market approach is very straightforward. They want to be the number 1 or 2 provider of mobility in terms of the market share in a specific region. And they have done that successfully so far:

They have an over 65% market share in US&CA, LatAM, Europe, ANZ, MEA, and around 50% market share in India.

The key for them to have a big market share in mobility is because this is how you achieve profitability in this market, with the economy of scale.

Uber has, over the last few years, experiences great growth in its Mobility business segment. In 2 years (from 2017 to 2019), the number of trips per quarter nearly doubled from 1B in Q4 2017 to almost 2B in Q4 2019.

But then COVID came and hit this business segment hard.

Mobility Gross Bookings were down to as much as -73% in Q2 2020 compared to Q2 2019. But the segment has recovered each quarter, and with the vaccinee rollout, it is performing better every week. We can see this recovery from their recent data from the Q4 earnings report. They reported that from two of their largest mobility markets, Brazil and Australia, bookings in January were down only 10-20% YoY.

Even more interesting, if you breakdown down the use-case of trips for January 2021, social and workday bookings showed almost fully recovered levels while Airport trips were still the obvious laggard.

Performance compared to peers and industry.

Uber was a big disruption to the taxi industry, and now together with their biggest rival Lyft, they own a big chunk of the market in specific areas. Even in a city like New York, where the taxi was powerful, the position has changed a lot in the last 4 years.

Looking at this chart, it is astonishing what Uber and Lyft were able to achieve in the last 4 years.

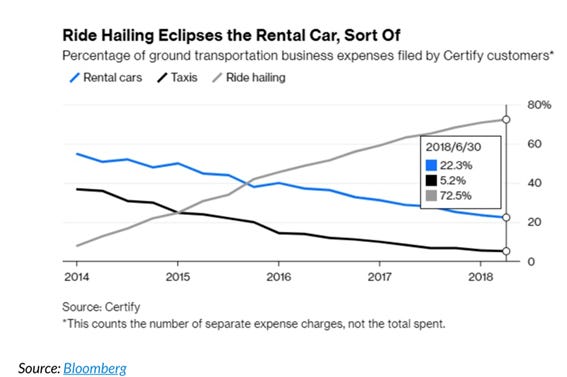

But the disruption didn’t happen only to the taxi business but also to the car rental business. This chart shows the dynamic of it:

On the peer analysis, the easiest to compare Uber and Lyft is looking at the US market, where they both operate for some time.

We can see that both have increased their market share over the last few years but that Lyft was growing faster in the observed period. At the same time, we can see that the market share ratio between the two has stabilized in the last 2 years and that Lyft isn’t taking more market share from Uber.

Delivery business segment

Delivery is the second business segment of Uber and has received massive traction and acceleration from the COVID19 pandemic.

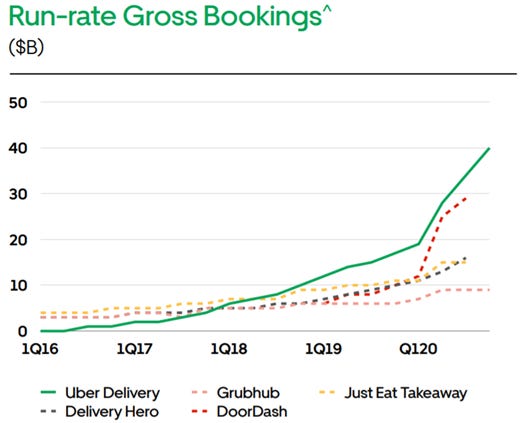

Uber delivery has grown from almost a zero gross booking business in Q1 2016 to a +$40 billion gross booking business. What is more impressive to see is that even though the market was very competitive already when Uber entered it, it rose to one of the market leaders (organic and through M&A) in the last years together with DoorDash they now dominate the market.

Freight

The Uber Freight business segment is the least known because it is not so B2C orientated as the other two segments. But it still is an important part of their offering and compliments their transport portfolio. It is also a business segment that is growing strong and has a $1.3B exit run rate in 2020 with 37% YoY growth. They have 71.000 carriers that have joined their digital fleet.

The industry as a whole in the Freight segment is also delivering good 13% CAGR from 2000-2018 and, with technology advancing, should continue to provide great results:

The Super – App

Because of all the different business segments, Uber has, in my view, become a super app for transport. And it has the perfect setup to continue executing and building business segments around this super transport app. They can now leverage their user base on the Mobility and Delivery side and have synergies between these users. With that, they can lower their CAC (client acquisition costs) and boost their profitability. They also recently launched Uber membership, a subscription service that helps users benefit and use the different varieties of their services while getting discounts and other perks. The end goal for them is that users use the whole portfolio of their product and become hooked on one transport platform.

The numbers for Uber memberships are rising fast. In 2020 they launched it in 16 countries, and they already have more than 5 million members. While most of these members are in the US, the opportunity for further expansion on this segment is high with new countries rolling in 2021 and with more users willing to use the app for both Delivery and also Mobility. The management also noted this at the Truist Securities Technology, Internet & Services Conference:

““Yes, we haven't, but what we have said is the U.S. is a majority of that 5 million. A good majority of that is the U.S., primarily because that's where we've had it for the longest. And all the international markets we expanded to were in Q4. So you should imagine that, that's a small contribution at this point.”

This cross-platform selling has already started to show results, as they noted in their last Q4:

“We also disclosed that close to 10% of our Uber Eats first trips came through the Uber rider app in Q4. Over time, I think it brings down our user acquisition cost, which gives us a P&L advantage.”

And the platform of Uber is not small in any regard.

In 2020 even with the pandemic, they had 93 million monthly active platform customers.

While Uber doesn’t break down the numbers of monthly active platform customers for each business segment based on the gross bookings for each segment this is my calculation of the user segment breakdown:

When the world returns to a somewhat normal state after the pandemic, I estimate that Uber could reach 120M monthly active platform users out of that 84M on the Mobility and 36M on the Delivery side. This estimation considers that the Mobility unit MAU are back to 2019 levels, but I think they may even be higher at the end of 2021 (more in the segment “why I invested”) and that the Delivery segment MAU stabilizes at this levels. To put that in perspective, that number would be over a third of the MAU of a social media platform like Twitter.

Why I invested?

The platform and the market potential

Where Uber is going in the last few years and where I think their biggest potential lies is in their technology and their app. I like to invest in companies that build a platform with active users and how the companies can cross-sell services and products and expand their TAM. And I think Uber is at a perfect stop to do so in being the transportation leader via mobility and delivery in the future.

They are one of those companies that has the biggest TAM’s out there. Their earnings reports estimated the Mobility TAM at +$5T, Delivery at +$5T, and Freight at $3.8T. Mobility and Deliver are one of the world's biggest markets, and if they continue to execute well, I don’t see their growth stopping anytime soon.

Perfect hedge – dual segment business

Another big advantage I see in Uber’s business is that their Mobility and Delivery business segments are a perfect hedge in the covid world. Right now, we are seeing vaccine rollouts and things slowly getting back to normal. Still, nobody knows how long it will take or, god forbid, if we could get another bump in the road to recovery with the different covid strains and the vaccine effectiveness. But with Uber, the business has a dual segment business where you can expect growth in any scenario. Thus, the cash flow from one part of the business can help the other one survive through a rough environment.

People’s habits after COVID

I also think that people after covid will be more open to ride-hailing than public transportation because of the safety concerns and a more comfortable feeling. Uber Andrew Macdonald, Senior Vice President of Mobility and Business Operations also said this in his remarks on the Truist Securities Technology, Internet & Services Conference conference:

“So a city like Sao Paulo, which is one of our largest cities globally -- there's neighborhoods that are way ahead of where they were pre-COVID. And what we're seeing in those neighborhoods is people move from public transit to Uber because they feel safer”

And I also think similar movements will happen with people who will go to airports, preferring ride-hailing than train or bus.

So I think Uber will benefit compared to other transportation ways after covid similar to what I believe Airbnb will benefit compared to big hotel chains.

Cost management – profitability, autonomous driving segment

With Uber, a big concert for me for years has been profitability and cost management. But they have changed my mind lately and shown me that Uber can become profitable and that they are focusing on doing that. Management acknowledges that cost management is one of their priorities. In the long run, they don’t want to be a heavy Capex spending company, but more a technology platform with high margins.

The mobility unit would be already profitable if it weren’t for covid in 2020. Now, because of the covid boost, the delivery business is very close to it. Now I can finally see profitability in the next 2-3 years kicking on the door, and with their economy of scale, I see they made a perfect setup to scale this and grow further.

Another thing that I liked, even though it received a lot of controversies, is the selling of their autonomous driving segment to Aurora. Despite some investors arguing about this move, I don’t want Uber to develop and burn money for autonomous driving. Why?

First of all, the amount of cash burn was a heavy burden on the whole business. Looking at how much this segment burned money from the R&D, it was more than half a billion dollars yearly. I really think Uber should focus more on their brand and the platform and how to keep the users happy and engaged than to focus on stuff like autonomous driving. I think that they will adopt autonomous cars, which should improve their margins even more, but I don’t believe they need to be the company developing this technology to the fullest. For autonomous cars to gain popularity and adoption, the price at which whoever makes and sells the best system won’t be high and won’t be very profitable as they have to get the scale and adoption. So I actually think selling their autonomous segment to Aurora and receiving a significant 26% equity stake in Aurora is the smartest thing they could have done. It also allows them to be independent now and adopt any autonomous car provider out there and use their cars in the future, which is an important aspect as it will affect their business's satisfaction rate – that is, providing mobility to users.

And this is the key thing for me that Andrew Macdonald also noted:

“I think it's unlikely we would want to operate our own fleets. We traditionally don't want to be in the capital-intensive part of the value chain, and that's not our core capability”

And this gives me confidence that Uber’s next 5 years will be one of the “golden years” for the company and for the stock, as they will enhance their revenue growth and scale with profitability and monetization, and the market will reward them for it.

Even if we look at the biggest acquisitions for Uber in the last years, we can see a clear shift from spending M&A on the autonomous vehicle part to spending and making acquisitions to enhance and improve the user experience, offering, and scale the platform.

Financials and valuation

Now let’s look at the financials of Uber.

We can see that their revenue in 2020 dropped almost - 15% because of the covid pandemic and the drop in revenue in the Mobility unit. If Uber weren’t so diversified and had their Delivery and Freight business segment, this drop would be much more substantial. We would be talking about a totally different business, not a platform but just a ride-hailing business.

The most important takeaways from the P&L part of the financials for me is the drop in sales and marketing and the drop in R&D. The sales and marketing is important to see as even though Mobility was a part where it didn’t make much sense to spend on marketing on Delivery they were aggressive and took advantage of the market opportunity. The drop in marketing and sales cost shows that the economy of scale is starting to work on both of their biggest business segments and that CAC is dropping. I further expect the CAC to drop as they will be able to monetize a user inside their super app better on multiple business segments.

Another important read is the drop in R&D expenses. While this is normally a red flag for me when looking at a growth company (I want to see growth companies investing more in the future), I am fully on board with Uber on lowering the R&D. The main drop in R&D is because they no longer invest in their autonomous vehicle segment. As explained already in this article, I think they understood that for AV to get fully mainstream, there will be a lot more money to spend and that even that might not get you the return you were looking for to achieve a good return on the AV investment.

Now, let’s move to the balance sheet:

What is important to check on the balance sheet is their short-term ability to finance themselves. So looking at the current assets, although they dropped significantly in 2020, they still stand at $9.8B while their short-term liabilities stand at $6.8B. So even if market conditions got a lot worse, Uber would not have short-term problems. With that said, given current market conditions, Uber is well capable of getting favorable financing if they needed it.

I also marked a thing that I don’t like. They increased their Goodwill from $167 million to $6.1B. The goodwill represents the value of a brand that a company can put on its balance sheet. Most of the time, in my view, Goodwills are more there to inflate the assets. I acknowledge the power of brands and their weight, especially for companies like Apple, but I don’t like to see this asset too inflated on smaller companies. Uber valuing its brand at $6B seems reasonable to me as their brand is one of the most known brands for transportation in the world. But just to understand that when I check the balance sheet, I normally deduct the Goodwill that a company states.

The main take from the P&L statement and the balance sheet is that they managed to really stabilize their revenue drop in 2020 through diversified business segments and at the same time make a huge step forward to long-term profitability and sustainability. Looking at their balance sheet, they are more than able to finance their operation further in the short run successfully.

Valuation

So if we look at Uber from a valuation point of view, the price has appreciated substantially in the last few months, but we can see that the forward P/S multiple remain stable around the 4-5x Sales.

While it is hard to know what the right multiple for Uber in this point of this should be a peer analysis of two of Uber’s biggest competitors on different business segments Lyft and DoorDash, shows that if Uber is a mix of both these two businesses, its valuation is at a discount compared to both looking at the forward P/S ratio. Even when comparing the Gross profit margin, both Uber and DoorDash have it at 53%, while Lyft is 39%.

*I used the forward P/S ratio as I believe it is a more fair indicator of these businesses when the pandemic is over.

So while it’s hard to pinpoint what the right valuation for Uber should be, based on peer comparison, I don’t find Uber expensive here at $106B.

Conclusion

I think most investors missed the recent shift in business focus that Uber has made. Going from a heavily Capex spending business into a lean technology platform. Building out a super transportation app platform with a high number of users and then using that to lower CAC and cross-sell products with a higher margin is the kind of business that fits into my investment scope and philosophy.

I believe the pandemic has helped Uber boost its Delivery business speeding it up (was expected 3-5 years before the pandemic has been achieved in one year). On the other side, I think the end of the pandemic will help its Mobility business because of changed user habits. Uber is one of those companies that will come out of this pandemic as a much more efficient and lean company ready to scale its technology and platform. They have also started doing things we haven’t touched in this analysis, like Uber ads, etc. With all the above, their TAM is truly one of the biggest on the market.

I will be doing a Q&A session with paying subscribers on the 25th of March regarding this Uber analysis and also sharing some other information that was not included in this analysis, like my view on issues of Uber regarding the employment of drivers, etc. If you are a paid subscriber, please send your question by the 23rd of March, and I will be posting a special follow-up analysis answering the questions that were submitted for paid subscribers. You can ask the question on this post under the comment section or reply to the email that you received regarding this analysis, and I will receive them. If you are not a paying subscriber yet, you can still subscribe now and ask the question and get access to the exclusive Q&A post that will be published on the 25th of March.

If you are not a subscriber yet, you can subscribe to the free version of UncoverAlpha, where I occasionally post my analysis, or subscribe to the paid Substack where you get access to exclusive Q&A sessions after analysis, posts on how I construct my portfolio and what my investment philosophy is and also get access to real-time alerts regarding my portfolio buys or sells and more.

Disclaimer:

I own UBER.

Nothing contained in this website and newsletter should be understood as investment or financial advice. All investment strategies and investments involve the risk of loss. Past performance does not guarantee future results. Everything written and expressed in this newsletter is only the writer's opinion and should not be considered investment advice. Before investing in anything, know your risk profile and if needed, consult a professional. Nothing on this site should ever be considered advice, research, or an invitation to buy or sell any securities.