Meta firing on all cylinders?

Welcome to UncoverAlpha newsletter. The newsletter is primarily focused on deep dives and insights into great companies in the tech and growth sector. The newsletter is free, so if you haven’t, you can Subscribe on the following link.

This article is sponsored by Stream.

I use their platform regularly, and it is one of my main tools for analyzing a company also from a qualitative standpoint. The insights shared by ex-employees, big customers, and competitors about a company are very valuable in addressing the industry trends and path of where a company is going. You will see many of them in this article as well.

Stream by AlphaSense helps investment research teams access unique, high-quality expert insights faster and more cost-effectively than most traditional expert networks.

With Stream, you’ll have instant access to:

20,000+ on-demand transcripts of interviews between experienced buy-side analysts and company experts provide first-hand perspectives on the companies and sectors that matter to you.

The fastest-growing library in the industry, you're bound to find what you need, when you need it!

Insight from experts with 500+ hours of industry interview experience.

If you want to try the platform out, you can use the link below

If you are interested in sponsoring the next article, you can DM and reach me on Twitter @RihardJarc

Hi everyone,

It’s been a while since I last wrote about Meta. My last article was in December last year. I decided to update and share some of the recent developments in the company with you all and how I look at the company now, a few months later. Now in this article, I won’t write about the business breakdown and overview; if you are interested in that, you can check out my previous article on Meta.

In this one, I decided to focus on a few most important things for long-term investors. One is the traction of Reels. The second one is WhatsApp which is finally becoming a high priority for Meta to monetize. And the last thing I will cover in this article is the effect of Generative AI on Meta’s business and what I think about the valuation after that 200% rise in the stock price since my last article.

Let’s dive in

Reels traction in 2023

Since last year Meta has gone head-on at TikTok with its competitor offering Reels. It's clear that after 2021 Reels has become the number one priority for Meta, and rightfully so. The shift of people wanting to see short video content has become a real trend and is one of the main drivers of engagement on any social media platform.

Now how has traction been so far this year with Reels? I am breaking this down into two formats. One is based on research reports and other media outlets' reporting. The other is based on interviews with industry insiders, former employees, and customers of ad industry companies. Here is the timeline for the most important reports regarding the analyst reports that came out for Reels data estimates:

From these reports, this was what stood out, and I find valuable for investors:

BofA Global Research:

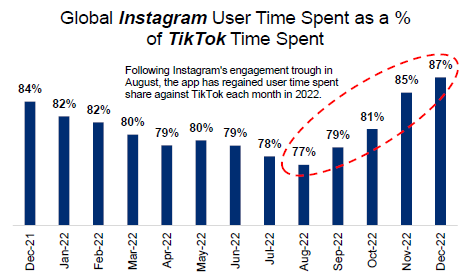

BofA was one of the first reports that showed user growth in the US at TikTok starting to plateau. Instagram User Time spend rose compared to that on TikTok, indicating that the more engaging short-term video format Reels is becoming bigger and bigger underneath Instagram.

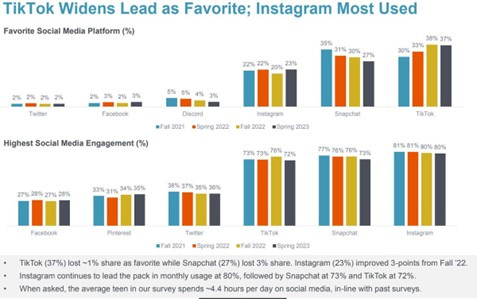

The Piper Survey later in April showed Instagram was still the most used platform, also with the Gen Z generation, and gained some share compared to the Fall of 2022. On the other hand, TikTok shows signs of stabilizing growth and even decreasing a few percentage points.

Then came the App Figures report in May, which showed a similar picture of TikTok cooling down in the US in the first few months of 2023.

At the end of May, we got one of the most insightful reports made by RBC:

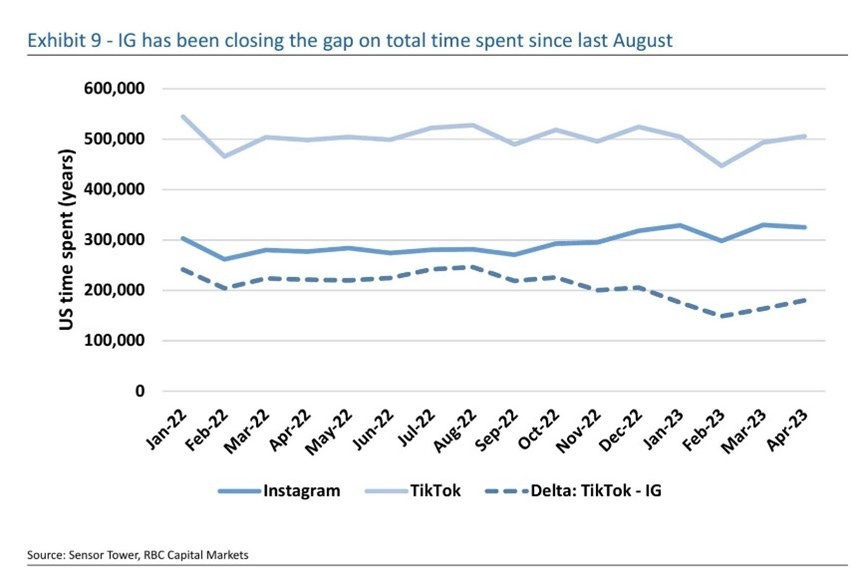

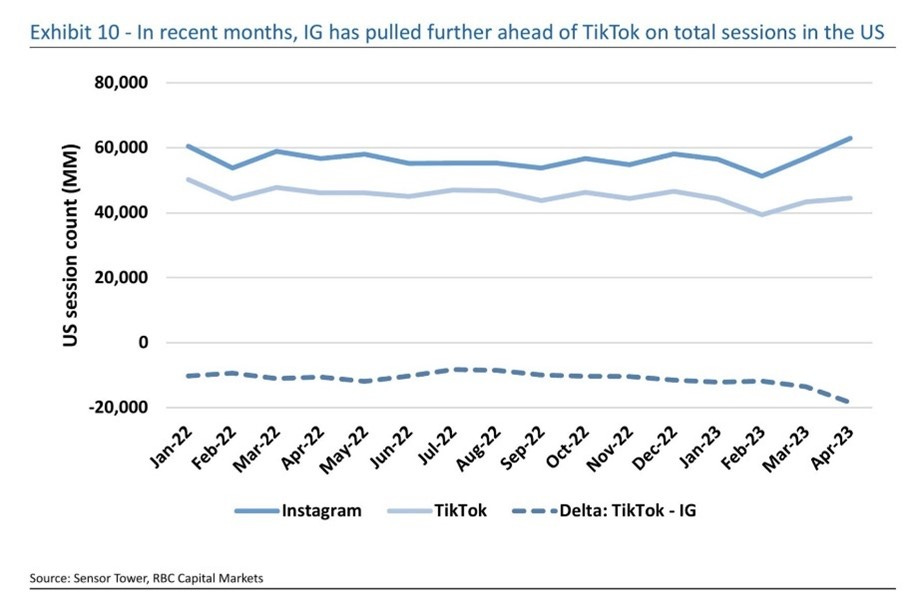

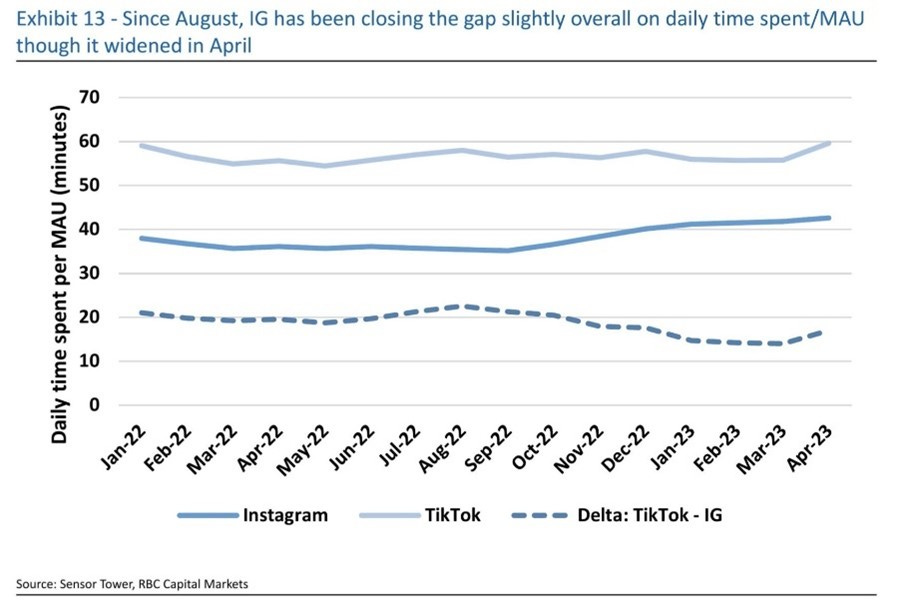

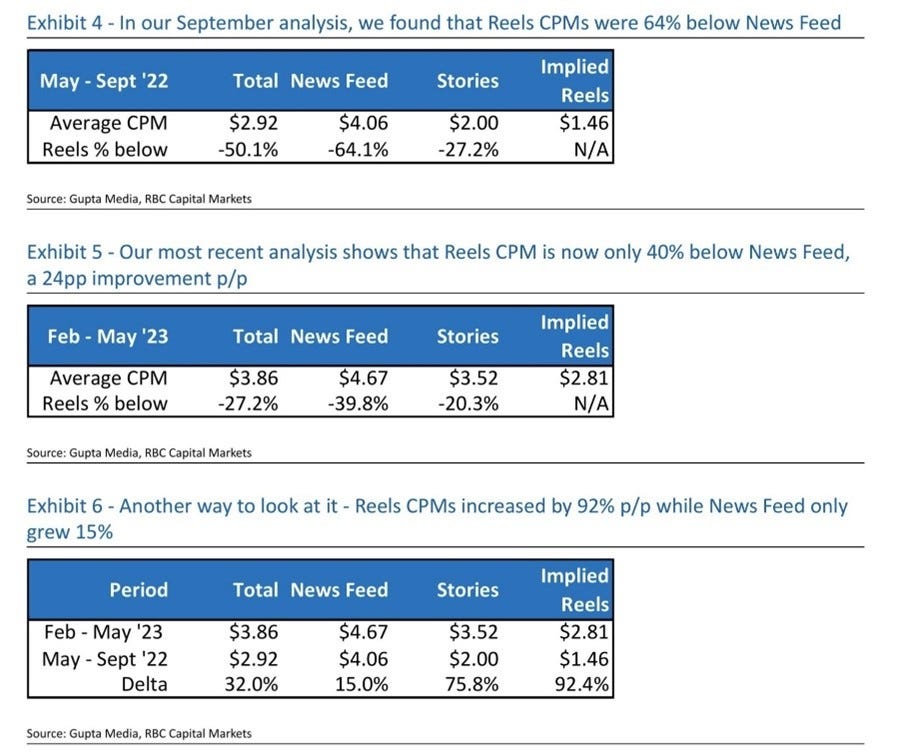

The report showed that the gap between Instagram and TikTok is narrowing monthly. On top of it, I found the CPM part insightful as well, showing that Reels CPM increased by 92% from Feb- May 23 vs what they were in May-Sept 2022.

And then, in June, we also had the Morgan Stanley report showing 74% of Instagram users use Reels, up from 69% in September 2022 and 62% in March 2022. At the same time, TikTok is "flattening."

Looking at what industry insiders, customers, and former employees have said in this period is also very telling. I picked a few of the most interesting ones:

Former manager at Snap Inc. 02/20/2023:

I think even when Instagram came in, it was mostly, like you said, it was older, not the teens populations using it, but now with the Reels and other things, even the younger groups are using it.

Senior Director at an Influencer Marketing Agency 03/27/2023:

That's currently Instagram Reels and YouTube Shorts are performing very well for organic reach…Now, what we're seeing is because TikTok is becoming a bit more paid-to-play and the organic reach has started to slow down on TikTok a bit, it means that we are seeing Instagram Reels, people are using a little bit more. They're spending a bit more time on there. YouTube Shorts as well.

Former Senior Director at Meta (1 level from C-suite) 03/30/2023:

Is distribution a part of this? I think this was, if you've already got a lot of consumers on your platform, it's very easy to move them over to Reels.

That's why I think you're seeing Meta and Snap and YouTube do pretty well here because they can quickly get this in front of users and have them try it. I think they've quickly realize it's actually pretty close to what TikTok's doing. Maybe I don't need to go to TikTok. You're not really seeing a lot of new entrants who are doing this. Basically, TikTok grew so fast and now you're only seeing big players jump into this, which makes sense.

Former Researcher at Meta 06/05/2023:

I would say that Reels has had a very explosive growth. I think if you just look at the growth rate, that shows us it's inside the payoff dividends. Once they figure out the monetization problem effectively, I think it's going to be a very winning platform.

CEO of an ad agency on a portfolio of 190 clients 06/12/2023:

“Reels really trending up well. In Q1 of last year, Reels with 2.2% of ad spend with Meta. In Q1 of this year, it was 10.3%. Obviously, 5X nearly year-on-year. In fact, in May, it was 12.2%, so really trending up well.

Q1 last year, we had 10 advertisers on Reels. In Q1 of this year, it was 83 so massive difference. In Q1 of last year, the ad load on Reels was 7%. In Q1 this year, it was 20%. In Q1 of last year, performance was only 2% of ad spending Reels. In Q1 of this year, it was 44%.

In May, it keeps going up. To give a sense, in May, CPM was $12.63. That was actually up 20% year-on-year. Number of advertisers was 100 out of 190, way over half now.

In Q1 of last year, we spent, let me get the right line item here, $4.7 million on TikTok and $1.6 million on Reels. In Q1 of this year, we spent $5.1 million on TikTok. It's only up by 10% year-on-year. We spent $8.0 million on Reels. Reels was up 5X. TikTok was only up 10% and Reels is now 60% bigger than TikTok.

In Q1 of last year, we had 30 advertisers on TikTok. In Q1 of this, you had 32, only up two.”

Partner at a Media agency (Inventus Media) 06/16/2023:

I think that what's happening with Reels is that now that they have now got an awful lot more content, both user-generated and content creator-created, that is now giving a critical mass and starting to get a much more positive level of people consuming content on the platform. I think that's the main thing. I think the other thing is that the ability to target.

What's interesting is you've created a marketplace for short-form content. It was driven a little bit by TikTok but obviously, Facebook has such superiority in targeting that that superiority of targeting has allowed them to deliver audiences, which in actual fact, they're more efficiently delivered than they can be through TikTok. As a result, believe it or not, they have a lower cost-per-click than TikTok.

Now, again, that may not hold in perpetuity but certainly, at the moment, it's meant that an advertiser who's tried TikTok but going, "But I don't really know if I'm getting any results from this," with Reels, they're more likely to have confidence in the backend analytics.

I think you can't not look at TikTok and know that some advertisers are saying, "You know what? We don't want too much drama in this. Maybe we just press on this for a second." Again, I think that's a very small part from that perspective, but it's just one more thing that slows growth.”

All of the above interviews were found on Stream. I highly recommend checking them out.

To summarize the findings, I would say the following. Meta’s Reels are gaining significant traction. You can see it from the number of users engaging with this format and advertisers putting more ad dollars into this product. Engagement on Meta’s platforms is rising because of Reels, and the gap between Instagram and TikTok is decreasing monthly. Reels have real momentum. What also seems to be the case is that Q2 appears to be a much stronger quarter for Reels vs. Q1. If this trend continues in Q3 and Q4 (which I expect), I anticipate Reels should be on pace to catch TikTok very soon and probably even overtake it at some point in the future.

I also noticed that the recent negative press that TikTok is getting from a potential US ban is reducing the appetite of advertisers willing to advertise on TikTok as well as creators trying to “hedge” the platform they are on and devote time to Reels, so they don’t lose all their audience if TikTok becomes banned at some point. Meta is also performing well with Reels regarding ad efficiency, which should not be a surprise; they are probably the number one company in ad/monetization tools and efficiency.

Again, you can take it with as much grain of salt as you want (coming from a Meta shareholder). Still, the trend is clear Reels is gaining market share, and Meta has figured out how to make this product successful both for increasing engagement and monetizing it.

Will WhatsApp finally become Meta’s ATM?

Moving to WhatsApp. Given the push for efficiency and profit, Meta is finally taking significant steps toward monetizing WhatsApp to its full potential. Meta bought WhatsApp almost 10 years ago and has left the app fully unmonetized for most of its time. But in that time, WhatsApp became, from an active user perspective, one of Meta’s most valuable assets. It is estimated that WhatsApp today has somewhere between 2B-2.5B monthly active users.

Most of those users are from emerging markets. Although surprisingly, Zuckerberg mentioned on their last earnings call that North America is now their fastest-growing region on WhatsApp.

Meta has had their fair share of troubles when monetizing emerging market users, but the switch seems to be turned on finally, and Meta is making big leaps every month to make WhatsApp a cash machine for the company.

WhatsApp Business was launched in 2018. It is an app made for small business owners to interact more efficiently with customers on WhatsApp (automate, sort, respond to messages, etc.)

Recent reports last month showed it has achieved high growth rates in this period. Meta reported that WhatsApp Business crossed 200 million users, up from 50 million in 2020. Meta also launched a suite of products for easier creation of ads and personalized messages on WhatsApp Business. The focus is clear and should start to reap meaningful results for Meta. In Q3 last year, Meta reported that click-to-WhatsApp ads only had a $1.5B annual run rate, but the positive thing is they were growing 80% YoY.

This long-lasting struggle to monetize WhatsApp is confirmed by a recent interview with a Former Meta Head responsible for building strategy, leading a cross-functional team, and spearheading marketing:

“WhatsApp has been with Facebook, I believe, more than five years for sure, and it's completely under-monetized. When I was there, many of the people working there felt the same way. Part of the reason is, yes, they were afraid of how to introduce monetization. I think the challenges are around, is it an advertising monetization or is it other form of monetization? I think that's the challenge of figuring out the right approach.”

He also explained that he sees the WhatsApp users “ready” for monetization as a lot of commerce is already happening on the platform:

“ I definitely think Meta should be going faster toward monetization of WhatsApp. A lot of commerce already happens on WhatsApp. As we know, in many developing countries or even large countries in LATAM, in Africa, and Asia, much commerce is already happening there, "Scan this QR code to buy this product and we'll message you.

I think we're at the stage where consumers or monthly active users of WhatsApp, they're already comfortable with commerce happening on that platform. I don't understand the fear around monetizing. I think they should be jumping in, especially because again, their competitor brands, the challenger brands are doing it, and already commerce is happening on these platforms naturally.”

Returning to the recent announcement of Meta, they are also planning to launch another paid feature that lets merchants automate sending personalized messages to their customers. The company didn’t share the pricing details, as WhatsApp said it will start testing the feature “soon.”

Another encouraging sign is that WhatsApp has finally made the payment process more seamless in some countries. In April this year, they now enabled users from Brazil to pay merchants via the app. Businesses can link service providers like Mercado Pago, Cielo, and others to their accounts and start using them. A similar end-to-end shopping experience within WhatsApp was also launched in India with Reliance Jio. A similar offering has also been launched 2 months ago in Singapore with a partnership with Stripe.

Meta is finally serious and has a clear path of monetizing WhatsApp in both advertising and commerce. What gives me even more confidence is that chat surfaces like WhatsApp are perfect for Generative AI tools.

Generative AI what does it bring to Meta?

While I already discussed the effects of Generative AI on social media in my previous article, it is still important to mention that it has enormous positive outcomes for a company like Meta.

The key two areas apart from the apparent increase of workforce productivity that most digital companies will have for Meta are the following:

The first is the ability to make personalized, tailor-fit, one-on-one ads at scale.

AI assistants for businesses & creators

The ability to make personalized tailor-fit ads for every user affects Meta the most because it enhances all their products from Facebook to Instagram to WhatsApp. It also means that digital advertising becomes that much more effective. On top of it, it gives Meta the most considerable edge out of all the social media and ad tech companies. That edge is data. Meta has the most proprietary data on the most extensive user base in the world and can therefore tailor fit ads in terms of content, visuals, etc., with the generative AI. And yes, I didn’t forget about Google. Still, tailor-fitting ad content is better for non-intent platforms like Meta than the ones where users are already driven by intent and have been that much more effective already before (like Google Search). This new approach means Meta’s ads can become so much more effective and drive the price of CPM much higher. To quantify what this means in terms of the ROI effectiveness of ads, it is hard to say for now, but after reading some estimates from industry experts, the low forecast would be in at least a 10%-20% improvement, but possibly a lot more.

The other part worth mentioning is that Meta is already putting a lot of generative AI tools out there for companies on their platform. At some point, companies won’t need ad agencies to help them with the creative side of ads because you will leave all that out to Meta’s algorithms. Your only job as a business advertiser on Meta will be to specify your goals and leave the rest to the algos. Again, by skipping the middleman in the process, businesses will have more cash left in their marketing budgets to reallocate toward ad buying instead of the operational costs of people or ad agencies. The CEO of one ad agency explains well how ad budgets are formed and could change in the near future:

The third bucket is OpEx savings. I think this is probably the easiest to quantify. This bucket is when AI does stuff for you, do you need as many people? Can you save on OpEx and then put the money into media instead? Now, I talk to 20+ senior marketers a month.

For about the last year, since it's been clear that AI and generative AI are going to be a big thing, I've been asking the same question to almost all of them, which is "When you spend money on a campaign, let's say it's $1 million, whatever, what percentage goes on people versus media?" People being either in-house team or your agencies, media being money to go to Google or Facebook or TV or radio or whatever.

It's a big range I see. The most normal for large advertisers is 20%-30% goes on people and 70%-80% goes on media. It's fine. For small advertisers, it's more like 40%-50% goes on people and 50%-60% goes on media. The reason being the ratio of how much time it takes to run a campaign versus how much you spend on an ad is different. Let's take 70/30 of the current split. That's probably reasonable, at least in the U.S.

Say, over the next three to five years, I would be pretty confident in saying that the OpEx required to design and run a campaign, including creative campaign management, reporting, analytics, etc., can probably be halved. That's a 15% saving on your total campaign budget. The logical thing to do is to put that into media so your 70% spent on media becomes 85%. That's a 20% increase in media, which over, say, five years would be something like what, a 3% figure for five years. That's massive.

What you get from this is two massive tailwinds for a company like Meta in existing advertisers increasing ad budgets because of OpEx savings and, on the other hand, rising CPM prices because the tailored ads become much more effective and draw more advertising dollars from other alternatives.

The second thing I mentioned that should be a big changer for Meta is the introduction of AI assistants powered by generative AI. These assistants can be used by businesses and creators (influencers). For businesses, it gives them another level of commerce experience. Users can talk with these assistants, get all the data they need regarding the business or products/services the company sells, and make the whole order process more seamless with fewer friction points. That is a big step for a business because it improves the commerce user experience and eliminates the costs associated with having humans run your customer service or even call/chat centers.

Listen to Mark Zuckerberg’s latest interview with Lex Friedman. You can see that he is thinking in a similar direction and that we can expect reasonably soon to see these improvements in Meta’s products.

Valuation

Finally, let’s look at the valuation. Since I posted my last article 7 months ago, the stock has increased by more than 200%. It was trading at an LTM P/E of 11.4x and a forward P/E of 13.8x with a bulked cost structure.

Since then, the company has lowered its OpEx guide significantly.

Meta’s new OpEX guide given on the last earnings call for 2023 is $86-$90B, including $3-5B restructuring cost-related charges. Therefore, the continued operation OpEx guide is in the $83-$85B range. Since we haven’t yet entered a severe recession and, on the contrary, Meta is seeing revenue stabilization on a YoY basis, possibly even growth, we are looking at a full-year revenue estimate of $117B-$123B. That would translate to a net profit of around $34B-$38B. With that in mind, we are currently talking about a 20-22x forward P/E ratio. When you add the potential of monetization of WhatsApp & Generative AI, both could revive revenue growth for Meta in the two years to a 10%-20% rate annual rate. With an improved cost structure, we are talking about a forward P/E for 2024 in the 16-20x range with revenue growth in the 10-20% range. But the kicker here is I could be severely underestimating the impact of WhatsApp monetization and Generative AI part as if they both come to fruition could mean much more significant revenue growth but even more so profit growth since Mark has learned his lesson of overhiring in the pandemic era and is focused on making the company efficient and cost-effective while at the same time growing it.

And what we haven’t even touched on in this article is the potential profits that will come from Meta’s B2C offerings from products like Meta Verified etc. Those products with a +90% gross margin could scale fairly quickly and bring a more diversified, stable & profitable revenue stream for Meta than just advertisement revenue. Again, in all those valuation parts, we still leave the whole Reality Labs unity at a 0$ value, even though Apple has validated the market with its entry.

We can't get past the fact that Meta just launched Threads, their Twitter competitor. And while at first, I was skeptical of the success it could achieve, given the recent developments at Twitter and the way Meta is approaching this with connecting to IG's user base, the success of it taking a significant share of users from Twitter is now much higher than I would have expected a few months ago. The launch timing is almost perfect, a few days after Elon Musk decided to limit the number of tweets a user can see, which most of the community doesn't like. Threads has achieved 10M downloads in the first 7 hours of its launch, one of the most impressive stat I have seen. If anything, apps like TikTok, BeReal, etc. have taught us that word travels fast in this heavily social media-connected world, so apps can snowball if set right.

In closing remarks, in the last six months, Mark has turned Meta from a company that had to defend and protect its market to a company that is going full offense. Once again, he proves to be one of the most capable leaders and CEOs in our era, and I am happy to be a long-term shareholder.

As always, If you liked the article and found it informative, I would really appreciate sharing it. It can be online or by word of mouth. I am thankful for it either way! :)

Disclaimer:

I own META stock.

Nothing contained in this website and newsletter should be understood as investment or financial advice. All investment strategies and investments involve the risk of loss. Past performance does not guarantee future results. Everything written and expressed in this newsletter is only the writer's opinion and should not be considered investment advice. Before investing in anything, know your risk profile and if needed, consult a professional. Nothing on this site should ever be considered advice, research, or an invitation to buy or sell any securities.

Good analysis. I think, WhatsApp for Business and WhatsApp in general is underrated. It’s not part of anyone’s models for the future I think. Lots of potential. Also, AI Models will make engagement higher which we can already see. People focus on the metaverse and of course it’s a big thing for FB as they spend so much on it. But the predictable growth path is still FoA and especially WhatsApp. I see VR as a high risk high reward venture.

Very nicely crafted/organized Rihard!

I’m also a long time investor in Meta and appreciate you distilling down the 3 go-forward growth elements. 1) Reels 2) WhatsApp and 3) Generative AI.

Your supporting process and rationale was outstanding. Thanks!

Steven